How do I invest in real estate with others?

Working with partners – You can find investors who are willing to put up the capital while you find the investment and handle the process. Terms of the loans must be negotiated with the silent partners. It's possible to use funds from an IRA or other account to fund a real estate investment.

Can two friends buy an investment property together?

From a financial perspective, when you invest in a property with a friend, the mortgage will be in both names, which means both of your credit reports will be pulled. If one of you has bad credit, you may not qualify for a low interest rate, or qualify for the loan at all.

How do you partner with friends in real estate?

- Determine if a partnership is right for you.

- Review your strengths and weaknesses.

- Find someone who compliments your skills.

- Evaluate the potential of the partnership.

- Establish clearly defined roles and expectations.

- Create the terms of agreement.

- Keep the process simple.

How many people can buy a house together?

There's no legal limit as to how many people can be on a home loan, but getting a bank or mortgage lender to accept a home loan with multiple borrowers might be challenging.

How to protect yourself when buying a house with a partner?

You might want to sign a “tenancy in common agreement,” which is similar to a cohabitation agreement. Such a document sets out who owns what percentage, clarifies the couple's financial obligations, and spells out each person's buying and selling restrictions and duties in the event of a split-up.

Have rich friends / parents to be your first investors or forget real estate and go do entrepreneurship / small biz instead.

— Nick Huber (@sweatystartup) April 16, 2023

Entrepreneurship -> get beat up -> learn how to operate -> get good at managing people -> make money -> invest money in real estate. https://t.co/kPvUSSQQ0K

Is it better to buy a house as a couple or single?

Is it better to be married when buying a house? Marital status doesn't influence whether you qualify for a mortgage, so there is no benefit to being married during the home buying process. However, married couples have more legal protections than unmarried couples in case they separate.

Frequently Asked Questions

How do you split expenses when one partner owns a house?

So, don't split bills, don't split HOA , don't split any item in particular - simply total up how much your life together costs, and you both contribute toward that. The house is in your name, there's no more discussion to be had about who's responsible for those bills.

How much should I charge a friend to live in my house?

It's absolutely fair to ask your friend to pay rent. As for the amount, that's less clear. Ten percent of your monthly housing costs seems reasonable — generous, even, considering she spends more than that much of the month there, by your description.

Is it smart to rent with friends?

Depending on how well you know your friend, having them as a tenant could mean you have a little more flexibility when scheduling inspections or repairs. They may feel more comfortable with you entering the rental home or apartment unit outside of business hours or on the weekend to conduct regular maintenance.

Should you tell people how much your house cost?

Keep in mind that if your friend really wants to know what you paid, there are other ways of finding out, since real estate transaction information becomes public record. But that doesn't mean you need to discuss the cost. “Just because you're asked a question doesn't mean you have to answer it,” says Puhn.

What to know before buying a house with a friend?

- Carefully Choose The Friend You Want To Buy With.

- Have An Open Conversation About Finances.

- Decide What Type Of Property You Want To Buy.

- Discuss The Type Of Ownership You Will Choose.

- Put It All In Writing.

What are the benefits of buying a house with friends?

- Easier to qualify for a mortgage. Getting the best home loan you can is probably one of the more challenging aspects of home buying.

- Splitting monthly expenses. Sharing is caring among friends.

- Home equity gains for all.

- Tax breaks for co-homeowners.

What is it called when you buy a house with someone else?

Published Date: August 7, 2023. You're thinking about becoming a homeowner but aren't sure you can afford to do it on your own. This is where co-ownership of property comes in, enabling you to share ownership interest in a piece of real estate with other buyers.

How do you buy a house from someone you know?

- Get Preapproved.

- Determine The Purchase Price.

- Draw Up A Purchase Agreement.

- Complete A Title Search.

- Consult An Attorney.

- Continue Through Underwriting.

- Close On Your Home.

Can you have 2 properties on 1 mortgage?

How do you buy out a real estate partner?

In that case, you can refinance your mortgage, cash out the equity you've built up, and use it to buy out a partner. Refinancing will also remove the other person's name from the mortgage, eliminating them from the legal responsibility of making payments and removing their rights of ownership.

FAQ

- Can a partnership get a mortgage?

- Yes, definitely. I am considering the same with a business partner on a buy and hold. Spoke to my lender and he said he would just combine our applications and credit worthiness to create a mortgage using our blended qualifications.

- Can married couple have 2 primary residences?

SEPARATE RESIDENCY IS ALLOWED, BUT . . .

It comes as a surprise to many that under California law, married couples have the right to opt for separate residency status. And this arrangement can lead to large tax savings for high-income marriages. But it's not for everybody.

- How to flip a house with other people's money?

One possibility is to partner with someone who has money to invest. Close friends, relatives and business associates are often good partner candidates. Partners can finance just the down payment, closing and repairs costs, or can bankroll the entire project.

- How to use someone else's money to buy a house?

Using other people's money means not putting your own cash into a real estate deal. You can do this by borrowing money (debt) or selling a stake in a property (equity). Most investors buy real estate with hard money loans.

- How do you profit from selling a house?

The profits you make from selling your home are called net proceeds. Your net proceeds are determined by your home's sale price minus expenses, such as home improvements, staging costs, agent fees and paying off your remaining mortgage.

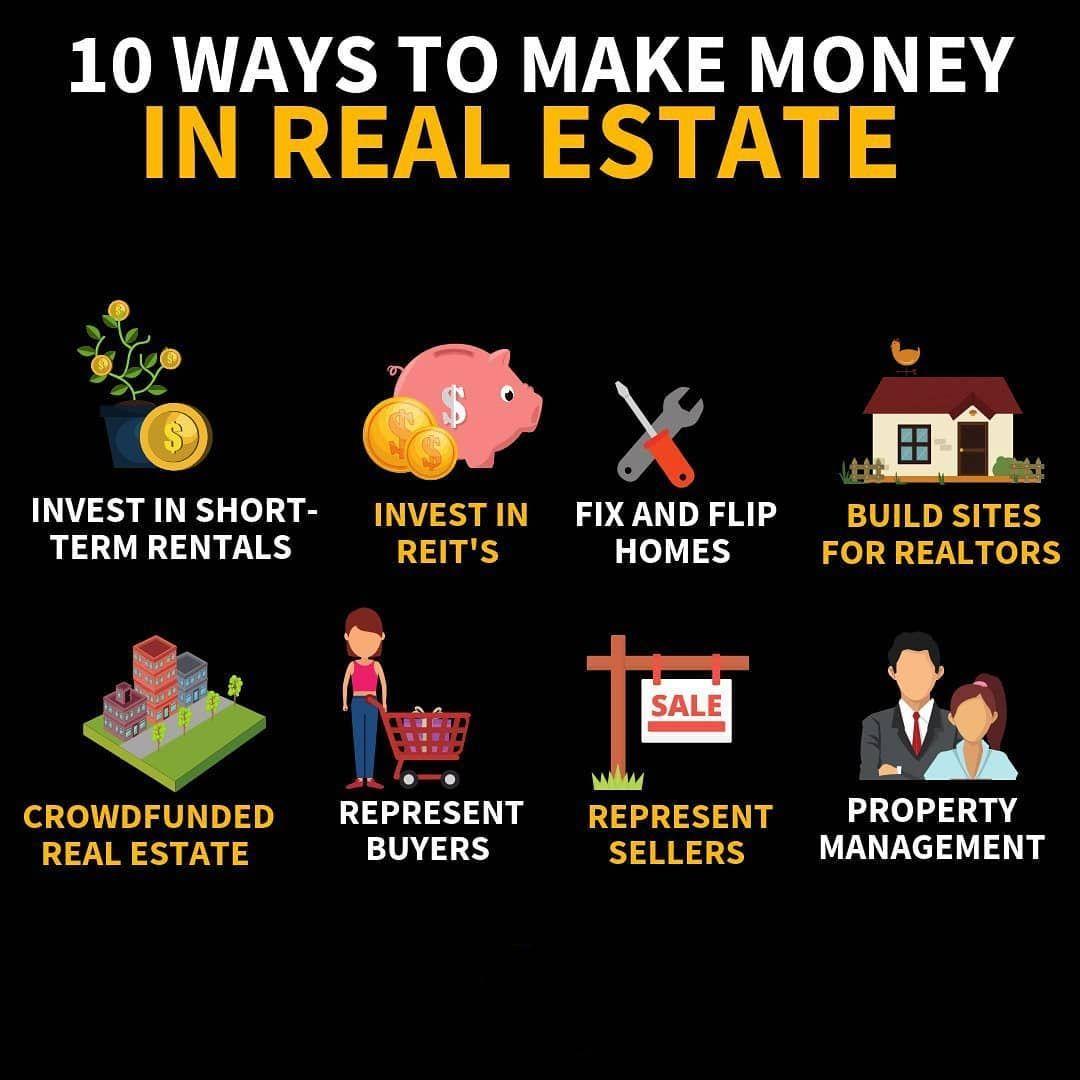

- How to make money in real estate without owning a property?

- In this blog, we will talk about some of the best options for investing in real estate without owning any piece of land.

- 10 Alternative Ways to Invest in Real Estate Without Owning Any Property.

- Airbnb Arbitration.

- Real Estate ETFs.

- Real Estate Mutual Funds.

- Real Estate Investment Trusts.

- Real Estate-Focused Companies.

- Why is property flipping illegal?

Simply put, this type of “flipping” is a crime because it violates California's fraud laws. In fact, it is sometimes referred to as mortgage fraud or loan fraud.

- How do I find partners to invest in real estate?

You can find real estate investors for a partnership in several ways: through bank financing, a real estate investment club, crowdfunding, your current personal or professional network, and online resources such as social media.

- How do I start a real estate investment company with friends?

- Best Practices for Investing in Property with Friends

- Get to Know your Friends Personally and Financially

- Form an LLC and Create an Operating Agreement.

- Be Clear on Roles and Responsibilities

- Define Ownership.

- Pooling your Money.

- 5 Pro Tips for Group Investing in Real Estate.

How to invest in real estate with friends

| How a newbie can start investing in real estate? | Real estate investing for beginners

|

| What do investors look for in a partner? | More than anything, early-stage business investors want to see a return on their investment (ROI). If you can demonstrate that your business will make them money, then you're 90% of the way there. If your company has been up and running for a while, then you need to show excellent financial performance so far. |

| What are the 3 most important factors in real estate? | Home prices and home sales (overall and in your desired market) New construction. Property inventory. Mortgage rates. |

| Is it a good idea to buy property with friends? | The Bottom Line Buying a house with a friend has a lot of benefits. It may be easier to qualify for a mortgage with two incomes and you'll get to share all the monthly expenses, including the mortgage payment, utilities, and maintenance or repair costs. You get to build equity as you pay down the loan. |

| How do I start a real estate business with friends? | Best Practices for Investing in Property with Friends

|

| What are the 4 P's of real estate? | The 4 Ps of Real Estate Marketing

|

| How to buy a house with someone else's money? | Seller financing – Title to the property is transferred to the buyer along with a mortgage or deed of trust and a promissory note that outlines the terms and conditions of the loan the buyer now owes the seller. This strategy may be used instead of providing all the cash needed at closing. |

| How do you buy an investment property with someone? | Best Practices for Investing in Property with Friends

|

| How to use other peoples money to flip houses? | Another option to consider is partnering with other fix and flip investors who have the funds ready and available to purchase properties and flip them. This way, you can also learn and grow, while you partner with them for funding. |

- What does it mean to have an interest in real property?

Anytime you have “interest” in a property, it means you have a right to the property, whether it's through ownership or a security. “Ownership interest” simply means that you have all of the rights that come with owning a property.

- Is it possible to take over someone's mortgage?

- You can take over someone else's mortgage using an assumable mortgage. Assumable mortgages are a great way to get into a home if you're looking to buy or sell, or even just do some property flipping. To finance with an assumable mortgage, you need to contact the current homeowner and make them aware of your intentions.

- How can a group of friends buy a house together?

Two common arrangements for co-ownership include joint tenancy, in which you share ownership equally, and tenancy in common, in which each owner may have a different percentage of ownership. A real estate attorney can advise on what will work best for your situation and draw up the documents needed to make it legal.

- Can my friend and I buy a house together?

Yes. There are many ways to have ownership interest in a property, and these include options that allow any number of people to partner when purchasing a home. As long as all the buyers can afford the mortgage, you and your friend – or friends – will be all clear to go in on a house together.

- What is the rule in case of joint owners?

This generally means that each co-tenant has an equal right to possess or use the entire property, and that the rent or maintenance costs of the property are shared among the co-tenants according to their ownership interest. Each co-tenant also possesses a share in the value of the property as it appreciates.

- What is the best way for multiple people to buy property?

- Formalizing your group by filing an LLC helps reduce conflict among group members. This process reduces conflict because no single group member “owns” the property in question: It is owned by your joint business entity, making everyone an equal partner in the investment.

- How can I make money with property I don't own?

Subleasing. “A more creative way to actually invest in real estate without actually owning property is to lease a property with a one- to two-year lease and then subsequently sublease the property for use as a short-term rental or STR,” Hager said.

- Can you invest in someone else's house?

- The new co-owner-to-be can pay the original owner a lump sum to assume a percentage ownership in the equity (the value of the home, less what the owner owes on it), and the co-owners will share mortgage payments in the same percentage. For example, let's say Jackie has $100,000 of equity in her home.

- How do you do passive income?

- 29 passive income ideas

- Start a dropshipping store.

- Create a print-on-demand store.

- Sell digital products.

- Teach online courses.

- Become a blogger.

- Sell handmade goods.

- Run an affiliate marketing business.

- Sell stock photos online.

- 29 passive income ideas