Where Do I Enter Real Estate Taxes on TurboTax: A Step-by-Step Guide

Learn how to enter your real estate taxes on TurboTax with this comprehensive guide. Find out where to input this information to ensure accurate tax filing for US residents.

Are you a US resident wondering where to enter your real estate taxes on TurboTax? Filing taxes can be a daunting task, but with the right guidance, you can navigate through it smoothly. In this article, we will provide you with a step-by-step guide on how to enter your real estate taxes on TurboTax, ensuring you don't miss any crucial information.

# Understanding Real Estate Taxes #

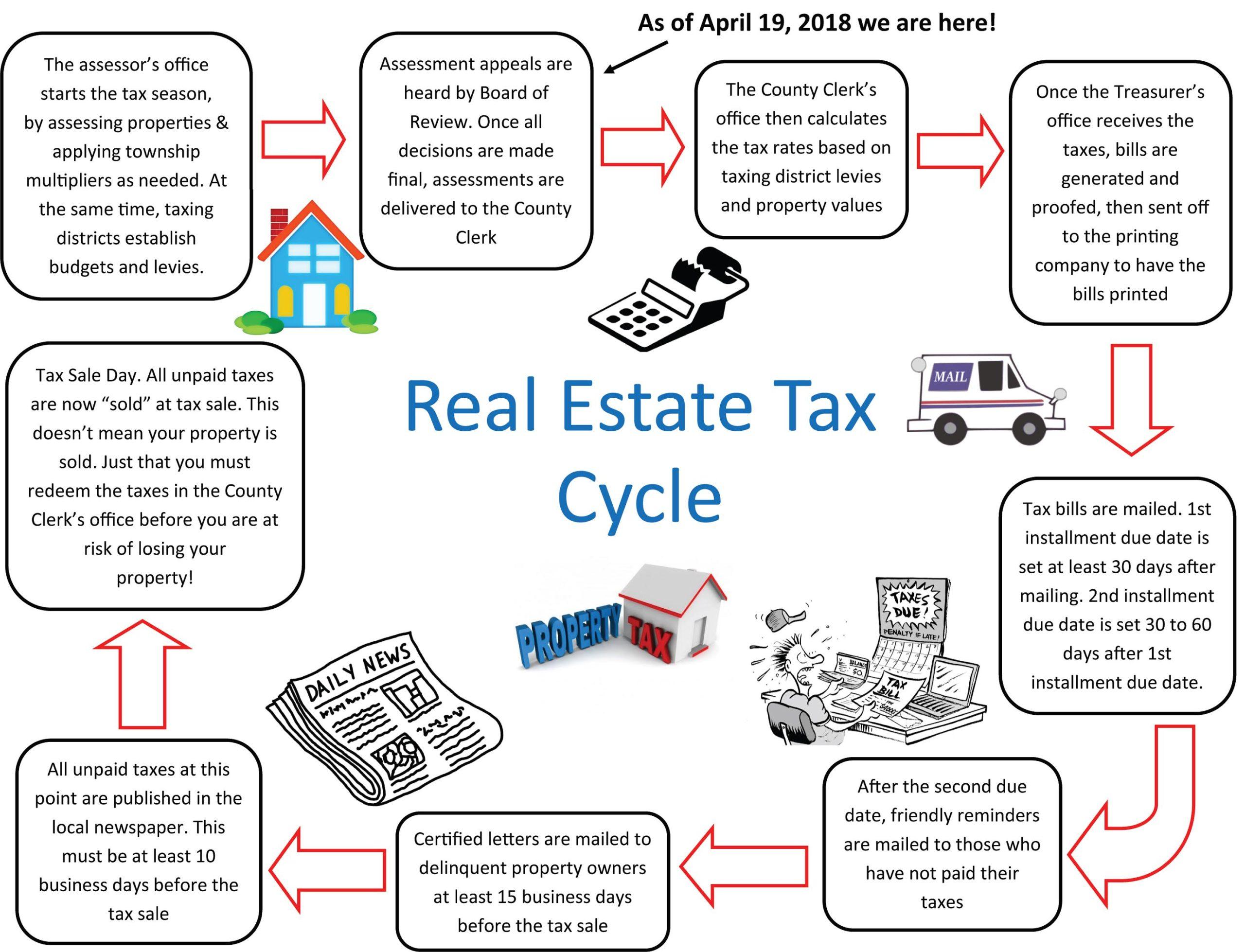

Before we dive into the process of entering real estate taxes on TurboTax, it's essential to understand what real estate taxes are. Real estate taxes are levied by the local government on properties, such as homes, land, and commercial buildings, based on their assessed value.

# Step 1: Logging into TurboTax #

To get started, log into your TurboTax account. If you don't have an account yet, create one by following the simple registration process.

# Step 2: Selecting the Right Tax Form #

Once logged in, you will need to select the appropriate tax form

�turbotax where to enter real estate taxes

Hey there, fellow blogger! Are you ready to tackle your taxes like a pro? We know it can be quite the adventure, but fear not! We're here to guide you through the virtual maze of forms and numbers, with a little help from our trusty friend, TurboTax.

Now, let's talk about real estate taxes. As a homeowner, you're probably familiar with those pesky bills that arrive in the mail every year. But fear not, because TurboTax has got your back! They make it super easy to enter your real estate taxes and ensure you're getting all the deductions you deserve.

To get started, log in to your TurboTax account and head over to the "Deductions & Credits" section. You'll find this gem on the left-hand side of the screen, just waiting to be clicked. It's like your own personal treasure chest of potential tax savings!

Once you're in the "Deductions & Credits" section, TurboTax will ask you a series of questions to determine which deductions you qualify for. Keep an eye out for the magical phrase, "Real Estate Taxes" – that's your cue to click and dive right in!

Now, don't worry if you're not sure about the exact amount you paid in real

Where do i put my real estate taxs on turbotax

Understanding the Process: Where Do I Put My Real Estate Taxes on TurboTax?

As the tax season approaches, homeowners in the United States diligently gather their financial documents to file their returns accurately. Among the various deductions to consider are real estate taxes, a significant aspect of property ownership. In this expert review, we will guide you through the process of inputting your real estate taxes on TurboTax, ensuring a smooth and hassle-free tax filing experience.

Understanding Real Estate Taxes:

Real estate taxes, also known as property taxes, are levies imposed by local governments on property owners. These taxes play a crucial role in funding public services such as schools, infrastructure development, and emergency services. As a homeowner, it is essential to claim your real estate taxes as deductions to reduce your overall tax liability.

Navigating TurboTax:

TurboTax, a popular tax preparation software, simplifies the process of filing taxes for millions of Americans. To begin entering your real estate taxes, follow these steps:

1. Start by opening your TurboTax account and logging in.

2. Once you've logged in, select the section labeled "Federal Taxes" to access your federal tax return.

3. Next, click on the "Deductions & Credits" section to proceed.

4

How do I deduct real estate taxes on TurboTax?

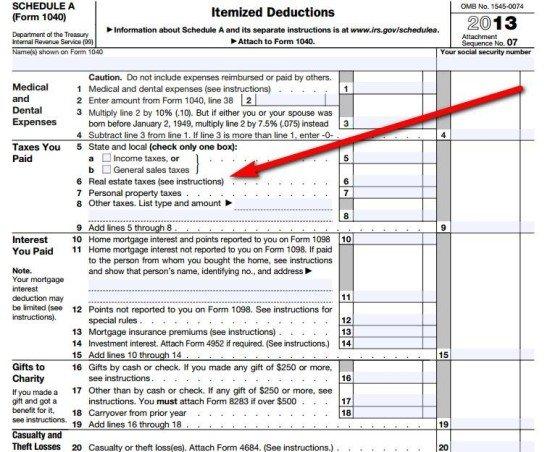

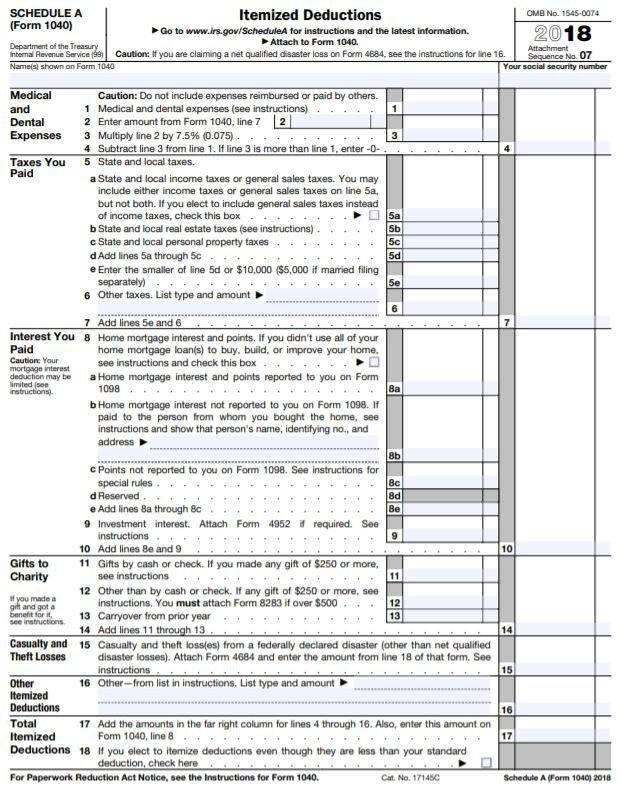

If you pay either type of property tax, claiming the tax deduction is a simple matter of itemizing your deductions on Schedule A of Form 1040.

Can you deduct state and local property taxes?

How does the deduction for state and local taxes work? Taxpayers who itemize deductions on their federal income tax returns can deduct state and local real estate and personal property taxes, as well as either income taxes or general sales taxes.

Does TurboTax automatically deduct state and local taxes?

If you have state income taxes that were withheld from your paycheck or that you paid and state and local sales taxes, TurboTax will automatically select the higher deduction for you, ensuring you keep more money in your pocket.

How do I deduct real estate losses on my taxes?

How to Report Rental Property Losses on Your Taxes. When you sell an investment property at a loss, you'll need to report it on Schedule D of your Form 1040 to claim a deduction. Remember that deductions reduce your taxable income which could mean paying less in taxes or getting back a larger refund.

Frequently Asked Questions

Is local property tax deductible?

Where to input real estate tax in turbotax

Apr 18, 2023 — Select Tax Tools, then Tools, to open the Tool Center; Select Topic Search; Search for personal property taxes (use this exact phrase) and then

Where do I enter 1098 mortgage interest on TurboTax?

And search for 1098. Then click jump to 1098. And follow the instructions to enter your mortgage information a form 1098 without a letter is a mortgage interest statement.

How do I file estate taxes with TurboTax?

You'll need TurboTax Business to file Form 1041, as the personal versions of TurboTax don't support this form. After you install TurboTax Business and begin working on your return, you'll be asked which type of return you need to prepare. Select Trust or Estate return (Form 1041) and proceed.

Where in TurboTax do I enter home improvements?

You add the cost of capital improvements to your cost basis in the house. Your cost basis is the amount you'll subtract from the sales price to determine the amount of your profit when you sell it. A capital improvement is something that adds value to your home, prolongs its life or adapts it to new uses.

FAQ

- Is real estate tax the same as property tax TurboTax?

- Real estate tax is a type of property tax – not all property taxes are real estate taxes. Real estate taxes are assessed on real property like your home, and other property taxes like personal property taxes are assessed on tangible and movable property you own, like vehicles.

- Are estate taxes deductible on 1040?

The deduction for state and local taxes, including real estate taxes, is limited to $10,000 ($5,000 if married filing separately). See the Instructions for Schedule A (Form 1040) for more information.

- What is Box 10 on 1098?

The box may be empty if only one property secures the loan. Box 10 – Other information, such as real estate taxes and insurance paid from escrow will be included in this space. Box 11 – If the lender acquired the mortgage during the calendar year, the acquisition date is entered here.

- How do I enter a home purchase on TurboTax?

Once you are in your tax return, click on the “Federal Taxes” tab ("Personal" tab in TurboTax Home & Business) Next click on “Deductions and Credits” Next click on "jump to full list" or “I'll choose what I work on” Scroll down the screen until to come to the section “Your Home”

How to deduct town and county real estate taxes in turbo tax

| How do I itemize deductions on Turbotax? | Itemizing requirements In order to claim itemized deductions, you must file your income taxes using Form 1040 and list your itemized deductions on Schedule A: Enter your expenses on the appropriate lines of Schedule A. Add them up. Copy the total amount to the second page of your Form 1040. |

| Is real estate tax the same as property tax Turbo Tax? | Real estate tax is a type of property tax – not all property taxes are real estate taxes. Real estate taxes are assessed on real property like your home, and other property taxes like personal property taxes are assessed on tangible and movable property you own, like vehicles. |

| Is TurboTax good with real estate? | If you own investment or rental property, TurboTax will help you with deductions, depreciation, and getting your biggest possible refund. |

| Does Turbo Tax do estate taxes? | After you install TurboTax Business and begin working on your return, you'll be asked which type of return you need to prepare. Select Trust or Estate return (Form 1041) and proceed. |

- Can I use TurboTax if I sold a home?

Just tell us about your home and the sale, and we'll determine what, if any, of the profit is taxable and report it accordingly. Even though you sold your home, if you choose to itemize your deductions, you can deduct many real estate expenses like mortgage interest, insurance, points, property tax, and improvements.

- Where in Turbo tax do I enter home improvements?

You add the cost of capital improvements to your cost basis in the house. Your cost basis is the amount you'll subtract from the sales price to determine the amount of your profit when you sell it. A capital improvement is something that adds value to your home, prolongs its life or adapts it to new uses.

- Where is property depreciation in TurboTax?

You enter the rental property as an Asset to be depreciated in the Rentals and Royalties section of the program. Specifically on the screen for the Rental Summary click the Start or Update button for Assets/Depreciation.

- Can you claim home improvements on TurboTax?

When you make a home improvement, such as installing central air conditioning or replacing the roof, you can't deduct the cost in the year you spend the money. But, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house.