Investing in real estate is one of the best ways to build wealth over time. Real estate prices have a remarkable history of increasing over time ─ and that's all money in your pocket.

How do I create a real estate company name?

Pro Tips For Picking Catchy Real Estate Business Names

- Avoid overly specific names that might pigeonhole your business endeavors.

- Look at your mission and values for potential inspiration.

- Research any ideas you have to ensure they are not already trademarked.

Is real estate a profitable business?

In conclusion, there are several types of real estate that can be profitable for investors. The most profitable types of real estate include commercial properties, rental properties, vacation rental properties, development opportunities, and REITs.

How do I start a real estate business plan?

Here are our recommended steps for creating a business plan for real estate agents:

- Write an executive summary.

- Define your mission statement.

- Create a team management summary.

- Know your target client.

- Outline SMART business goals.

- Map out your keys to success.

- Breakeven analysis.

- Understand your market.

Do most millionaires do real estate?

Some of the most successful entrepreneurs in the world have built their wealth through real estate. In fact, it's estimated that 90% of all millionaires invest in some form of real estate. There are several reasons for this, but in today's article, we'll share seven reasons why millionaires invest in real estate.

Are property taxes paid in advance or arrears in Michigan?

You are paying ahead when you pay the treasurer on July 1st until the end of June next year.  So remember you are paying your taxes ahead. The time it runs from.  Many people believe that Michigan property taxes run for six months.

I’ve acquired $100 million worth of real estate over the last 7 years.

— Nick Huber (@sweatystartup) July 27, 2023

What they won’t tell you on social media:

It’s tough.

Deals are messy. People are messy. Sellers aren’t logical. Closing a deal takes patience and it is a fluid, ever-changing process.

There are hundreds…

How are property taxes paid at closing in Florida?

Real property taxes are paid in arrears (meaning at the end of the year) in Florida and are not assessed until November of the year for which they are due. Therefore, when a closing takes place between January and the first week in November, the amount of the current years property taxes are unknown.

Are property taxes prorated at closing in Michigan?

A tax proration is a matter of negotiation between buyer and seller and there is not a uniform tax proration in the State of Michigan. In many counties, including Jackson, the local Board of Realtors will have a method of tax proration printed in the purchase agreement.

Are property taxes public record in California?

To ensure that assessments are equitable, the assessed value of the property and the amount of property tax are public records. Deeds and liens are placed on public record so that anyone can check the ownership of property or the financial status of a person or corporation.

Are property taxes IRS deductible?

If you itemize your deductions, you can deduct the property taxes you pay on your main residence and any other real estate you own. The total amount of deductible state and local income taxes, including property taxes, is limited to $10,000 per year.

What is the secret to a fast sale of a property?

One of the most effective ways to sell your home fast is to price it competitively. If you price it too high, you detract prospective buyers and price out potential bidders. In addition, it may take longer to settle the negotiation process if prospective buyers want your price to come down.

Where do houses sell the fastest?

Nashville was the hottest market, with an average listing time of 14 days. Seattle was the second fastest-moving, averaging 17 days. Omaha and Salt Lake City both averaged 18 days, and Cincinnati, Birmingham, Charlotte, Denver, Las Vegas, Manchester and San Francisco were also among the busiest.

What types of homes sell the fastest?

Homes in Desirable Neighborhoods

Homes located in highly desirable neighborhoods with good schools, low crime rates, and convenient amenities tend to sell faster and at higher prices. These areas attract buyers looking for a better quality of life and long-term investments.

What is a ghost sale in real estate?

The term ghost offers likely was originated by a disgruntled realtor who was aggravated with local investors who would make offers on properties, get a contract on them and then not close when the time came. Often, these investors would cancel the contract under their inspection period clause.

Can I invest $100 dollars in real estate?

REITs enable anyone to begin building an income-producing real estate portfolio. You can start by investing less than $100 into a high-quality REIT like Equity Residential, Realty Income, or Stag Industrial and generate income almost immediately.

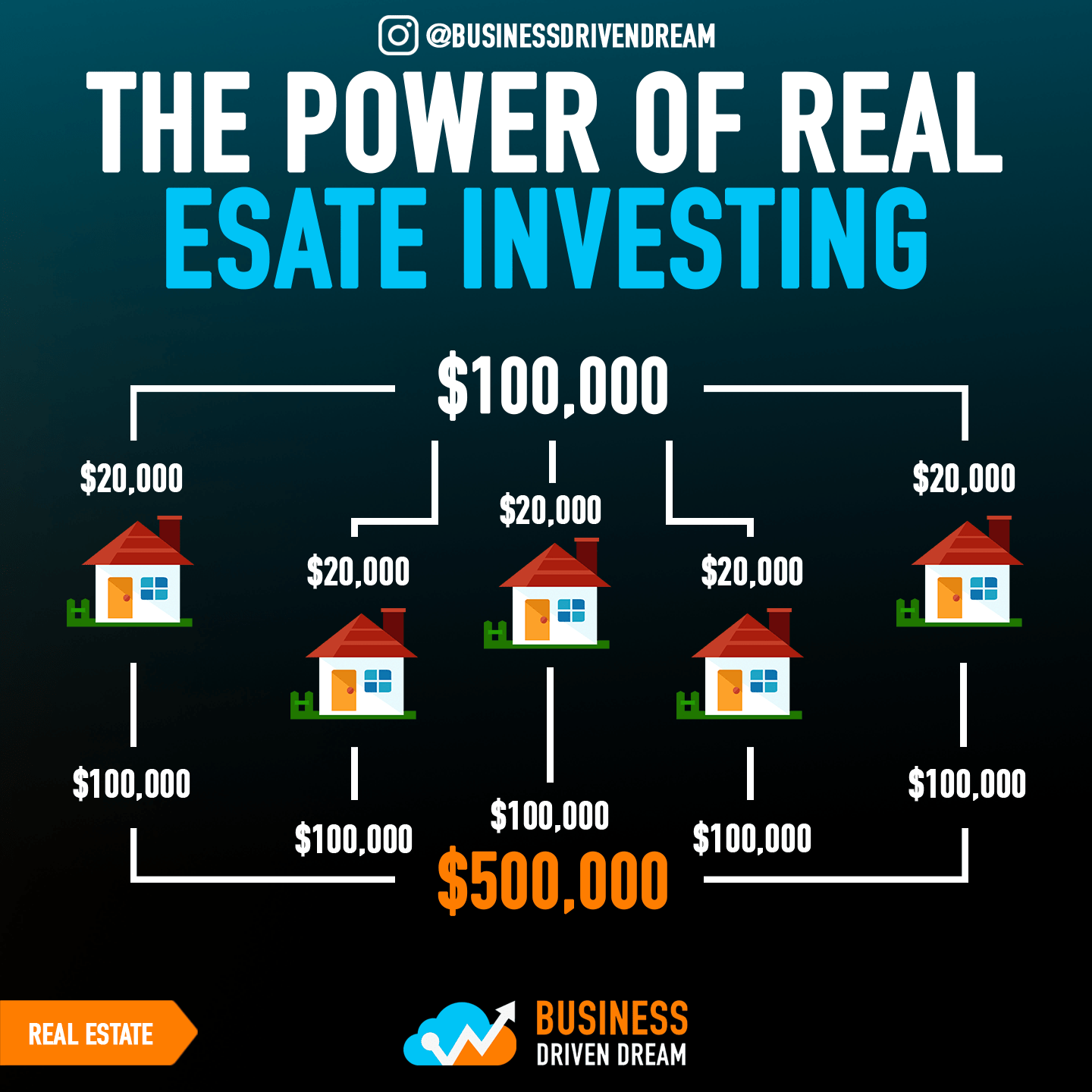

How to invest $100 000 dollars in real estate?

How to Invest $100k in Real Estate

- Residential Property for Long-Term Renters.

- Short-Term Rental Property.

- Flipping a House or Condo.

- Multi-Family Rentals.

- Commercial Property.

- Stocks in Real Estate Companies.

- REITs.

- Joint Ventures.

What is the most profitable type of real estate to invest in?

Commercial properties

Commercial properties are considered one of the best types of real estate investments because of their potential for higher cash flow. If you decide to invest in a commercial property, you could enjoy these attractive benefits: Higher-income potential.

Is $1 million enough to invest in real estate?

Buying one or several real estate investment properties with $1 million is a good idea considering that if you do good research and invest in the right markets, you can get up to 9% annual returns. At the same time, while the property appreciates, investors can rent the property out to generate income.

How to grow $1,000 dollars fast?

Here's how to invest $1,000 and start growing your money today.

- Buy an S&P 500 index fund.

- Buy partial shares in 5 stocks.

- Put it in an IRA.

- Get a match in your 401(k)

- Have a robo-advisor invest for you.

- Pay down your credit card or other loan.

- Go super safe with a high-yield savings account.

- Build up a passive business.

How to invest real estate with little money?

5 Ways to Begin Investing In Real Estate with Little or No Money

- Buy a home as a primary residence.

- Buy a duplex, and live in one unit while you rent out the other one.

- Create a Home Equity Line of Credit (HELOC) on your primary residence or another investment property.

- Ask the seller to pay your closing costs.

How to invest $300,000 in real estate?

How to Invest 300k in Real Estate

- Get involved in real estate crowdfunding.

- Invest in a multi-family property in a less costly neighborhood.

- Buy fixer-uppers and remodel them for profit.

- Purchase rental properties that may require no money down.

- Develop relationships with your bank to finance projects.

How to invest in real estate with $1,000 dollars?

The following types of real estate investments don't require much cash, allowing you to get started with just $1,000 to invest.

- Fractional Ownership in Properties.

- Publicly-Traded REITs.

- Real Estate Crowdfunding: Private REITs.

- Real Estate Crowdfunding: Loans.

- Private Notes.

- Real Estate Wholesaling.

- Invest in Land.

- House Hack.

How to invest $5,000 dollars in real estate?

Below are 7 strategies you can use to actively invest in real estate with $5,000.

- Buy an inexpensive primary residence.

- Find a property with seller financing.

- Buy property with a partner.

- Find a hard money lender.

- Borrow money from friends and family.

- Become a wholesaler and bring buyers and sellers together.

What is the penalty for renting an illegal apartment in Massachusetts?

The legislation would subject landlords who keep illegal apartments to up to 21/2 years in jail. Inspectors would be able to seek a criminal complaint in district court against these landlords, and also fine them $15,000.

Do I need a license to rent my house in Tennessee?

Landlord's Responsibilities

Every landlord in Tennessee must obtain a landlord rental license from the local government. It is the landlord's duty to ensure that the rental unit is safe and habitable at all times. This includes complying with all relevant building codes.

What a landlord Cannot do in Kentucky?

The landlord cannot increase the rent, decrease the services provided, or evict a tenant for asking that repairs be made or for notifying Code Enforcement of defects in the property. 3. The right to a rental unit that is habitable and compliant with all building and housing codes (KRS 383.595).

What a landlord Cannot do in Tennessee?

You cannot be evicted without notice. The landlord cannot change the locks or shut off your utilities to make you leave. Most of the time, a landlord needs to go to court before evicting you. If you did something dangerous or threatening, the landlord only needs to give you three (3) days to move out.

What is considered an illegal apartment in Mass?

An illegal unit is a unit which is used for a residential purpose but that is not registered with the local authorities as required by law.

What do I need to know before selling my house?

Close: Make sure you have all your documentation ready.

- Set a timeline for selling your home.

- Hire an agent who knows the market.

- Determine what to upgrade — and what not to.

- Set a realistic price.

- List your house with professional photos.

- Review and negotiate offers.

- Weigh closing costs and tax implications.

How can I make my house look good to sell?

Start With Curb Appeal

Paint the front door and/or shutters a bright color, but make sure it coordinates well with the rest of the home's colors. Replace old house numbers, lighting, the mailbox and welcome mat. Clean up the edging around flowerbeds and lay down fresh mulch.

How do I make my home listing stand out?

How to Make Your Real Estate Listing Stand Out

- Be Honest. While it may seem obvious, one of the best ways to make your home listing stand out and find a prospective buyer quickly is to be as honest as possible.

- Stage It.

- Highlight Upgrades and Warranties.

- Go With a Pro.

- Location, Location, Location.

What should you not do when listing a house?

10 Things Not to Do When Selling a House

- Neglecting Repairs.

- Overpricing Your Home.

- Failing to Stage Your Home.

- Kicking Curb Appeal to the Curb.

- Shying Away From Showings.

- Overlooking the Clutter.

- Leaving Too Many Personal Items Out.

- Ignoring Obnoxious Odors.

What is the most important thing when selling a house?

1. Price: Every home will sell if priced correctly. This one should tower above every other category on the list because it is far and away the most important factor when selling a home. Every house is “sellable” if it is priced accordingly.

What value will be used for estate tax purposes?

Fair market value

Estate taxes are based on the fair market value of property. Fair market value is the price that the property would change hands between a willing buyer and a willing seller. This assumes neither party is under compulsion to buy or sell.

How does the IRS determine fair market value of an inherited home?

The Internal Revenue Service (IRS) typically accepts a property's selling price as fair market value, but only if it is sold within six months to a year from the date of the original owner's death. This value is used to calculate if there was a taxable gain or loss on the sale.

How to avoid capital gains tax when selling inherited property?

How to Minimize Capital Gains Tax on Inherited Property

- Sell the inherited property quickly.

- Make the inherited property your primary residence.

- Rent the inherited property.

- Qualify for a partial exclusion.

- Disclaim the inherited property.

- Deduct Selling Expenses from Capital Gains.

What estate value or values would be subject to federal estate tax?

Currently, assets worth $12.92 million or more per individual are subject to federal estate tax. Some states also levy estate taxes. Estate tax is different from inheritance tax and gift tax.

What should be included in the value of an estate?

One of the most important responsibilities of a personal representative in the probate process is to value the estate of the person who died. The probate valuation of an estate includes everything the person owned at the time of their death, minus any debts that they had.

What type of property sale is the simplest?

Standard sales are usually the easiest and most cooperative.

Can you sell a house without equity?

The good news is that selling a house with no equity is possible through a short sale. A short sale is an option for financially struggling homeowners who owe more on a property than what it's worth.

How much money can you keep from the sale of a house?

After selling your home, you must pay any outstanding mortgage, agent commissions, and closing fees. You keep the remaining money after settling these costs. After all the deductions, you have 60 to 85 percent of the house's total sale.

Can you sell a percentage of a house?

You may not own the entire property, but you may own a sizable portion of it. This is your share so it's in your control. You may decide to sell your share of a property to someone else. However, this is not something your co-owner(s) may be in favor of.

What are the 3 most common methods of selling property?

Each method has its pros and cons, and which one you pick can significantly affect how well your house sells. The three most common ways to sell are auction, private treaty, and expression of interest (EOI).

What is an agent who represents the seller of real property called?

The term “agency” is used in real estate to help determine what legal responsibilities your real estate professional owes to you and other parties in the transaction. The seller's representative (also known as a listing agent or seller's agent) is hired by and represents the seller.

Which of the following is not a duty an agent has to all parties of a real estate transaction quizlet?

Which of the following is not a duty owed to every party in a transaction? Explanation: An agent owes the duty of confidentiality only to his or her principal.

What type of agent is a real estate licensee considered to be in the broker seller relationship?

As a special agent, the real estate licensee is authorized to represent the licensee's principal with third persons in real property or real property secured transactions. (Business and Professions Code § 10131 et seq.; Civil Code § 2079.13 et seq. and § 2297.)

What is an agent in a real estate transaction?

Transaction agents assist buyers and sellers in real estate transactions without representing any party's financial interests. They act as neutral third parties in real estate deals but are still bound to act according to the law and industry ethical principles.

What is the definition of agent of the seller?

A seller's agent is a real estate professional (a Realtor, a real estate agent or a real estate broker) who helps prepare and list a property for sale (the latter being the reason they're also known as listing agents). They represent the person selling a property and must work in their best interests.