Find three to five comparable homes in the area that have sold recently, as close to the home as possible. Ideally, the comps will be within one mile of the property and in the same school district. Focus on similar houses in terms of square footage, lot size, bedrooms, bathrooms, and type of construction.

How to compare two houses?

Look at the features

Compare the “facts” of the homes. This includes square footage, number of bedrooms and bathrooms, age, and lot size. Then look at the other features of the home such as bonus rooms (home office, entertainments room), walk-in closets, pools, etc.

How do you select comparables in real estate?

Real estate agents can perform a sophisticated comparative market analysis to identify comps very precisely. But you can also find general comps yourself by looking online for recent sales in your neighborhood, finding the homes most similar to yours, and checking prices to see how much they sold for.

How do you analyze comps in real estate?

How to Do a Real Estate Comp Analysis in 4 Steps

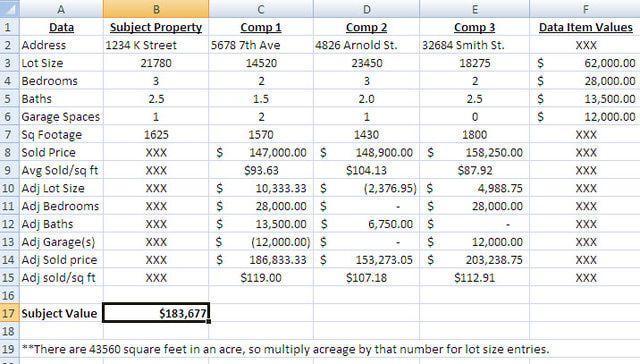

- Analyze the Subject Investment Property.

- Search for Real Estate Comps.

- Find the Average Price per Square Foot for the Comps.

- Make Value Adjustments for Property Differences.

Are Zillow comps accurate?

How Accurate Is a Zestimate? If you ask Zillow, it's very accurate. In fact, Zillow boasts a “nationwide median error rate” for on-market homes of 2.4%. However, for off-market homes, the error rate is more than three times that rate, coming in at 7.49%.

Which appraisal approach is least useful for a special purpose property?

The Cost Approach Is Not Always Relevant

While there are some exceptions, such as found in special-use properties, the high degree of depreciation in older buildings makes it difficult to accurately apply depreciation in the valuation.

interesting to compare how much real estate different pubs are giving to *waves hands* all this pic.twitter.com/PU2jPAwpnr

— Julia Carrie Wong (@juliacarriew) September 10, 2020

Which approach to value is typically used to estimate the value of special purpose property?

The cost approach can be used to appraise all types of improved property. It is the most reliable approach for valuing unique properties. The cost approach provides a value indication that is the sum of the estimated land value, plus the depreciated cost of the building and other improvements.

What are the 3 approaches to appraisal?

Market value is determined by an appraiser who analyzes three types of market data: comparable sales, cost to replace (or reproduce), and income. The process of analyzing data from these sources is commonly referred to as “The Three Approaches To Value”.

What are the three most important things to you in real estate?

I believe the three most important things when it comes to real estate are "location, timing, and circumstances," and here's why.

Why does everyone want to be in real estate?

You have a high earning potential

Real estate agents often have the potential to earn an unlimited salary. This means that your income may have no corporate or legal limitations. You might also be able to determine your own income, depending on how well you're able to help people sell and buy homes.

How do you keep track of real estate leads?

How do you track real estate leads? Property managers, owners, and leasing agents can track leads manually using spreadsheets, CRM tracking systems, or social media platforms. In fact, most real estate professionals utilize all three of these methods to track and manage leads.

What are statistics in real estate?

When working with Sellers, we look at comparable properties and consider months inventory, percentage sold, sold price versus listing price, and more. All of these statistics help the Seller to make an informed decision when determining listing price and also aids in negotiations when a contract is received.

What’s a good lead conversion rate in real estate?

0.4% - 1.2%

Anything but typical

Most real estate agents and brokerages have self-reported a customer conversion rate of 3-5%. However, this might be a bit optimistic based on the market the agent is in. The National Association of Realtors® disclosed that the rate is closer to 0.4% - 1.2%.

What is the easiest way to track leads?

What is the best way to track sales leads in five simple steps:

- Understand the Customer's Buying Process.

- Use a Lead Tracking Tool.

- Develop a Lead Scoring System.

- Research Your Competition Campaign.

- Customize Lead Generation Forms.

How do I reinstate my real estate license in NY?

For a NY real estate license that has expired for less than two years, you can have your license reinstated by completing 22.5 hours of approved CE Credits with an approved school, submitting your application for license renewal and paying your renewal fee through the online licensing portal eAccessNY.

What may the real estate commissioner suspend or revoke a license for?

The Texas Real Estate Commission has the power to enforce compliance with the Texas Real Estate License Act. The Texas Real Estate Commission may suspend or revoke the license of a real estate licensee who knowingly withheld from or inserted an inaccurate statement into a statement of account.

What disqualifies you from being a real estate agent in New York?

Article 12-A Real Property Law of New York lays it out pretty clear. If you've been found guilty of a felony in New York or any other state it's an automatic disqualification for getting a real estate license. Being found guilty of any type of sex offense (many of which are felonies) is also an immediate disqualifier.

What is Section 443 of the NYS Real Property law?

RPL 443 states that an agent has, without limitation, the following fiduciary duties to his or her principal: reasonable care, undivided loyalty, confidentiality, full disclosure, obedience and duty to account.

How long can my real estate license be inactive in NY?

Two-year

For a New York real estate license that has expired, there is a two-year period from the date of expiration wherein you can renew your license. With an inactive license, you will not be able to conduct brokerage activity or any real estate sales.

How do you write a buyer and seller agreement?

At its most basic, a purchase agreement should include the following:

- Name and contact information for buyer and seller.

- The address of the property being sold.

- The price to be paid for the property.

- The date of transfer.

- Disclosures.

- Contingencies.

- Signatures.

How do you explain a buyer representation agreement?

A buyer representation agreement is a contract between a real estate agent and the buyer to form an exclusive representation relationship. The contracted agent acts as the buyer's agent in the real estate transaction. The buyer gets the agent's expertise in locating a property and real estate negotiations.

What are the three most common types of listings?

The three types of real estate listing agreements are open listing, exclusive agency listing, and exclusive right-to-sell listing. The listing agreement is an employment contract rather than a real estate contract: The broker is hired to represent the seller, but no property is transferred between the two.

What is the simple agreement between buyer and seller?

THE PARTIES HERETO agree to abide as under: 1. The Seller undertakes to sell the Buyer and the Buyer undertakes to buy from Seller___________ goods (hereinafter called the 'said goods') at a price of Rs. _____________.

How do you write a simple agreement between two parties?

Here is a quick list for you:

- Letter title: Letter of Agreement.

- Names, addresses, and contact informations of both the parties involved.

- Date of signing of the agreement letter.

- Duties/services, fee and costs, timeline or term of agreement, payment terms, other terms of working and clauses.

- Signatures with date.

What is desk cost brokerage?

A desk fee is a payment agreement between a real estate agent and their broker. It's an alternative to splitting commissions between the agent and the broker. A real estate agent must decide whether to sign with a broker who charges a desk fee, a commission split, or some combination of the two.

Which estate agents have lowest fees?

As you can see, Doorsteps.co.uk and The Smart Estate Agency are offering the cheapest prices online, but these online agents don't offer the same services of the bigger agents like Purplebricks and Yopa. The cheaper agents offer more of a DIY service that requires more work on your part.

Which real estate company pays the most commission?

eXp Realty

EXP Realty is the real estate company with the best commission split for its agents. Agents get an 80/20 commission split with an annual cap of $16,000, which means that after you hit that threshold, you earn 100% commission.

How much do most real estate agents charge?

Real estate commissions typically range between 4% and 6% of a property's sale price. This amount is further divided between the brokerage and the agent who worked on the sale.

What is a good brokerage fee?

Brokerage fee

| Brokerage fee | Typical cost |

|---|---|

| Annual fees | $50 to $75 per year |

| Inactivity fees | May be assessed on a monthly, quarterly or yearly basis, totaling $50 to $200 a year or more |

| Research and data subscriptions | $1 to $30 per month |

| Trading platform fees | $50 to more than $200 per month |

What is the lowest a real estate agent commission?

1.5%

A low-commission real estate agent or broker is any agent willing to list and sell your home for less than the typical commission rate in your area. Most traditional agents charge listing fees between 2.5–3%. The best low-commission real estate brokers offer the same service and support for as little as 1.5%.

Is 6% normal for realtor?

Negotiate the commission rate.

Just because 5–6% is common, it doesn't mean that's what you have to accept. Ask your real estate agent if they're willing to take less.

What commission do most realtors get?

What percent commission do most real estate agents charge? The traditional standard commission is 6 percent of a home's purchase price, which is split evenly (3 percent each) between the buyer's agent and the seller's agent.

What percentage of sales do most realtors make?

While realtor commission fees vary regionally, the average seller can expect to pay between 4.45% to 6.34% of the home's final sale price, according to our research. The U.S. average is currently 5.37%. The listing agent usually receives 2.72% of the proceeds.

What did the lowest 10 percent earn real estate agent?

Pay About this section

The median annual wage for real estate brokers was $62,190 in May 2022. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $36,360, and the highest 10 percent earned more than $173,000.

How do you sell a house and buy another at the same time?

Bridge loan: A bridge loan is a temporary financial arrangement that lets you buy a new home without selling your old one. It's important to know these loans use your current home as collateral, and they are only meant to last a short amount of time (six months to one year).

How do I move a house without selling it first?

A bridge loan is a short-term loan and is most often used to help a homeowner buy their new home before selling. Lenders will typically lend you a percentage of the equity you've accrued in your old house, which you can then use for the down payment on your new home. Bridge loans are not without their drawbacks.

Can you put your house up for sale and then change your mind?

Can you take your house off the market? You can take down the for-sale sign, terminate your listing agreement with your agent, and remove online evidence of your listing so long as you haven't already gone under contract with a buyer. It's your house — you can sell it. Or not sell it.

How can I buy someone out of my house without a mortgage?

Buy out the other person's equity

In the case of shared ownership of a home, you each have equity in the home. If you bought the house together, you will typically split the equity equally, which means you can just pay the other person for their portion of the home in cash.

How do I buy a second house before selling first?

You can buy another house while still owning one by coming up with cash for a down payment on a new home and taking out a second mortgage to finance it. If you don't have cash on hand for a down payment, you might be able to cash-out refinance, take out a loan or work with a buy-before-you-sell company.

What is the basis for converting primary residence to rental property?

What is the cost basis for a primary residence converted to rental property? Most of the time, the basis is the cost of the property plus any amount paid for capital improvements and any casualty losses that may have been claimed for tax purposes.

Can I turn my primary residence into an investment property?

With home costs — and rents — rising in many markets, you might not want to sell your home even if it no longer suits your needs. Most homeowners can become real estate investors by renting out their primary residences. Just be sure you know what you're getting into before advertising your home for rent.

What is the tax consequences of converting rental property to primary residence?

Ownership Taxes and Deductions

Once you occupy the home as your personal residence, you will no longer be able to take any of the deductions you took when the property was a rental. This means you will get no depreciation deduction and you can't deduct the cost of repairs.

What is the gain exclusion for personal residence converted to rental property?

Many people are aware of the advantages of Internal Revenue Code Section 121, which allows a married couple to exclude up to $500,000 of gain on the sale of their personal residence ($250,000 for a single taxpayer).

Is it better to buy a primary residence or rental property?

Mortgage rates for investment properties are generally higher than those for primary residences because lenders view investment properties as riskier. Lenders believe they're riskier because there is a greater potential for default if the property does not generate enough income to cover the mortgage payments.