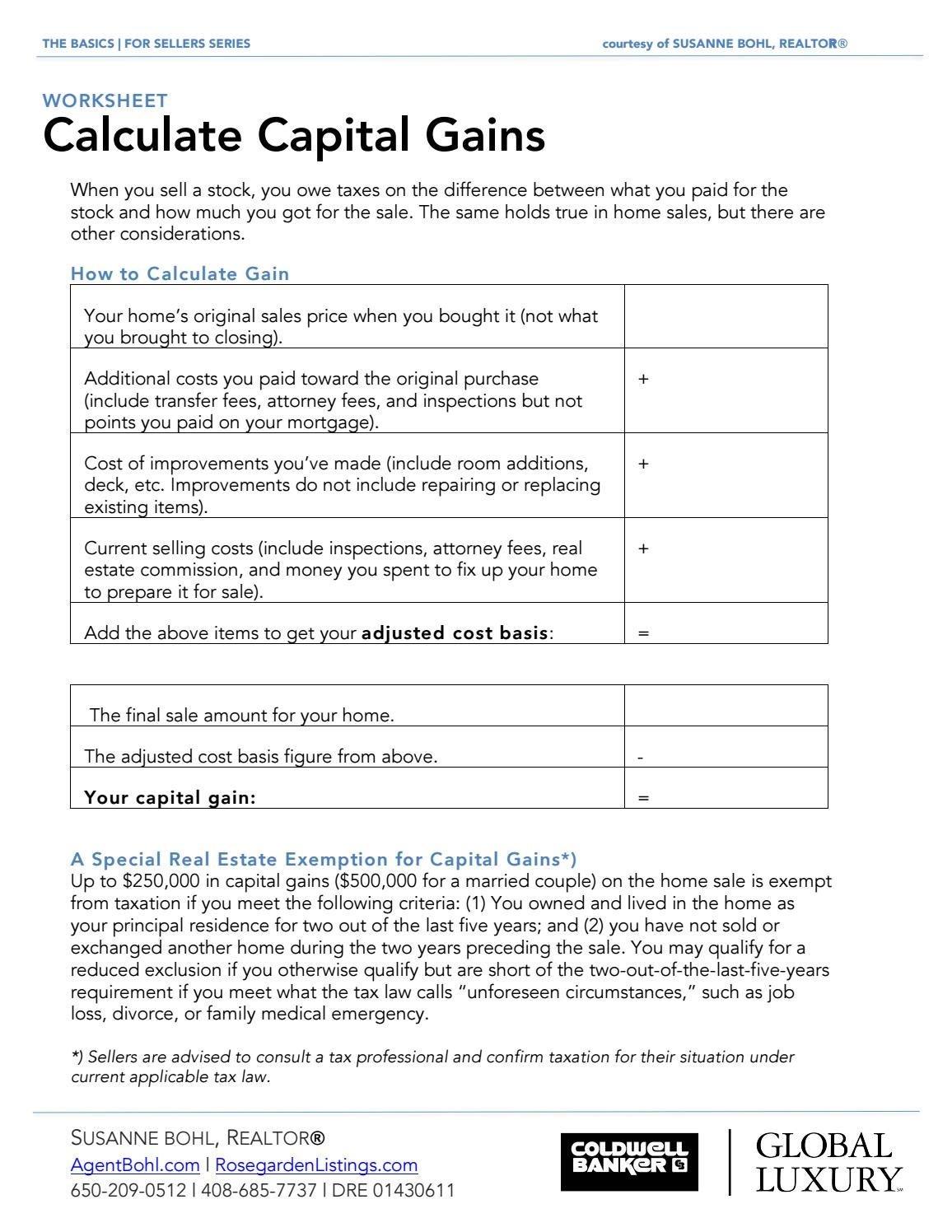

You must subtract mortgage payoff, prep costs, agent commission, closing costs, and all other fees from the sale price to get your net proceeds. Then, you have to do the extra math of subtracting the home's purchase price and any upgrades or improvements done to the home in order to get your true profit.

What is the $250000 $500000 home sale exclusion?

The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9.

How do you calculate cost basis for selling a house?

- Start with the original investment in the property.

- Add the cost of major improvements.

- Subtract the amount of allowable depreciation and casualty and theft losses.

How does the IRS know your cost basis?

How Does the IRS Verify Cost Basis in Real Estate? In real estate transactions, the IRS can verify the cost basis by looking at the closing statement of when the property was purchased, or any other legal documents associated with the property, such as tax statements.

How much capital gains tax on $200,000?

= $

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

How does the IRS know if you sold a home?

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

How do I avoid capital gains on sale of primary residence?

Eligibility: To be eligible for the exclusion, you must have owned and used the property as your primary residence for at least 2 of the 5 years preceding the sale.

Frequently Asked Questions

Do I have to tell the IRS I sold my house?

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

Do you pay capital gains if you hold the mortgage?

Is mortgage payoff considered a selling expense?

If there is a mortgage loan on a home, the mortgage payoff will be one part of the costs associated with selling it. The mortgage payoff is exactly what it sounds like — it's the process of paying off the amount that's left on the mortgage loan — including the principal and interest.

How do you calculate basis on a house sale?

- Begin by noting the cost of the original investment that you made in your property.

- Next, add in the cost of major improvements (for example, additions or upgrades).

- Then, subtract any amounts allowed via depreciation or casualty and theft losses.

What is the cost basis for capital gains on real estate?

Cost basis is the original value of an asset for tax purposes, usually, the purchase price, adjusted for stock splits, dividends, and return of capital distributions. This value is used to determine the capital gain, which is equal to the difference between the asset's cost basis and the current market value.

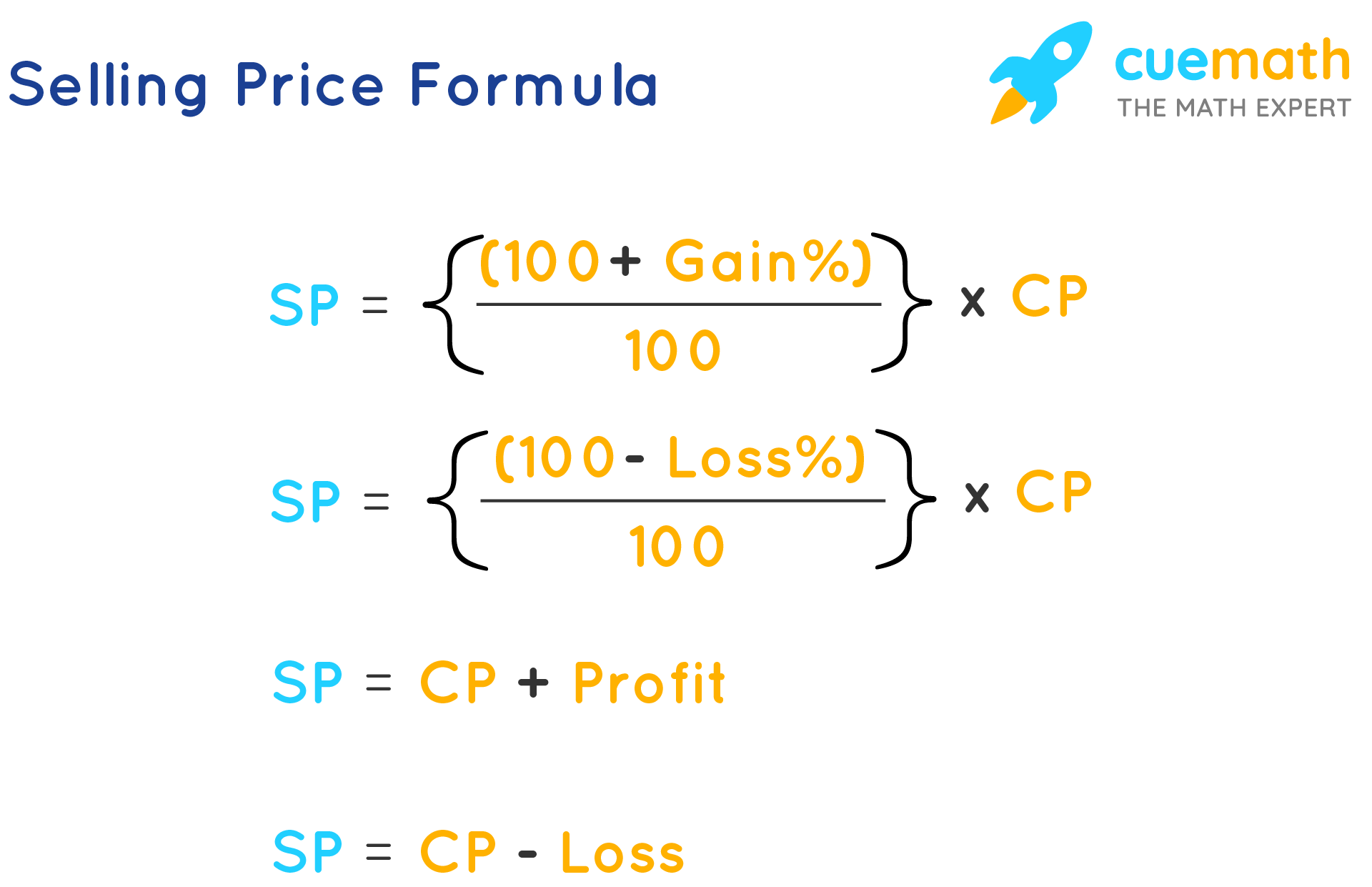

How is capital gains calculated on sale of home?

FAQ

- What is the formula to calculate basis?

To calculate your basis, the average cost method takes the cost of all the shares you have purchased and divides it by the number of shares.

- How does IRS know I sold a house?

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

- Can IRS take proceeds from sale of home?

If the IRS seizes your house or other property, the IRS will sell your interest in the property and apply the proceeds (after the costs of the sale) to your tax debt. Prior to selling your property, the IRS will calculate a minimum bid price.

- What can be deducted from capital gains when selling a house IRS?

If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it. The exclusion is increased to $500,000 for a married couple filing jointly. This publication also has worksheets for calculations relating to the sale of your home.

- What is the $250000 / $500,000 home sale exclusion?

- There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

- Do I have to report the sale of my home to the IRS?

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

How to calculate sale price of home irs

| How do you calculate profit on sale of a house for tax purposes? | You must subtract mortgage payoff, prep costs, agent commission, closing costs, and all other fees from the sale price to get your net proceeds. Then, you have to do the extra math of subtracting the home's purchase price and any upgrades or improvements done to the home in order to get your true profit. |

| How do you calculate gain or loss on a house sale? | Upon the sale of a piece of real estate (for example, your single-family home residence) profit or loss is calculated by taking the property's sales price and subtracting it from your cost basis on the date of sale. |

| How is sale of real estate reported to IRS? | Reporting the Sale Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S. |

| Is profit from the sale of your home taxable income? | It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000. |

| How do you calculate profit from a real estate sale? | To calculate net proceeds on a home sale, subtract the sum of the seller's closing costs, expenses and mortgage balance from the final sale price of the home. |

- Can you deduct a mortgage from capital gains?

Yes and maybe. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence.

- When calculating capital gains what is subtracted from the selling price?

Determine your realized amount. This is the sale price minus any commissions or fees paid. Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

- Do you subtract closing costs from capital gains?

Capital Gains Tax

This tax is based on the original purchase price (basis) of the investment and its value when you sell. The closing costs associated with selling a rental property that are tax deductible, however, can adjust your overall basis and potentially reduce your capital gains tax liability.

- How does capital gains work with a mortgage?

- You only pay the capital gains tax after you sell an asset. Let's say you bought your home 2 years ago and it's increased in value by $10,000. You don't need to pay the tax until you sell the home. In this example, your home's purchase price is your cost basis in the property.

- What costs can be deducted from capital gains tax?

You normally work out your gain by taking the proceeds (or in some cases, the market value on disposal) and then deducting all of the following: Original cost (or in some cases, market value when acquired) Incidental costs of purchase. Costs incurred in improving the asset.