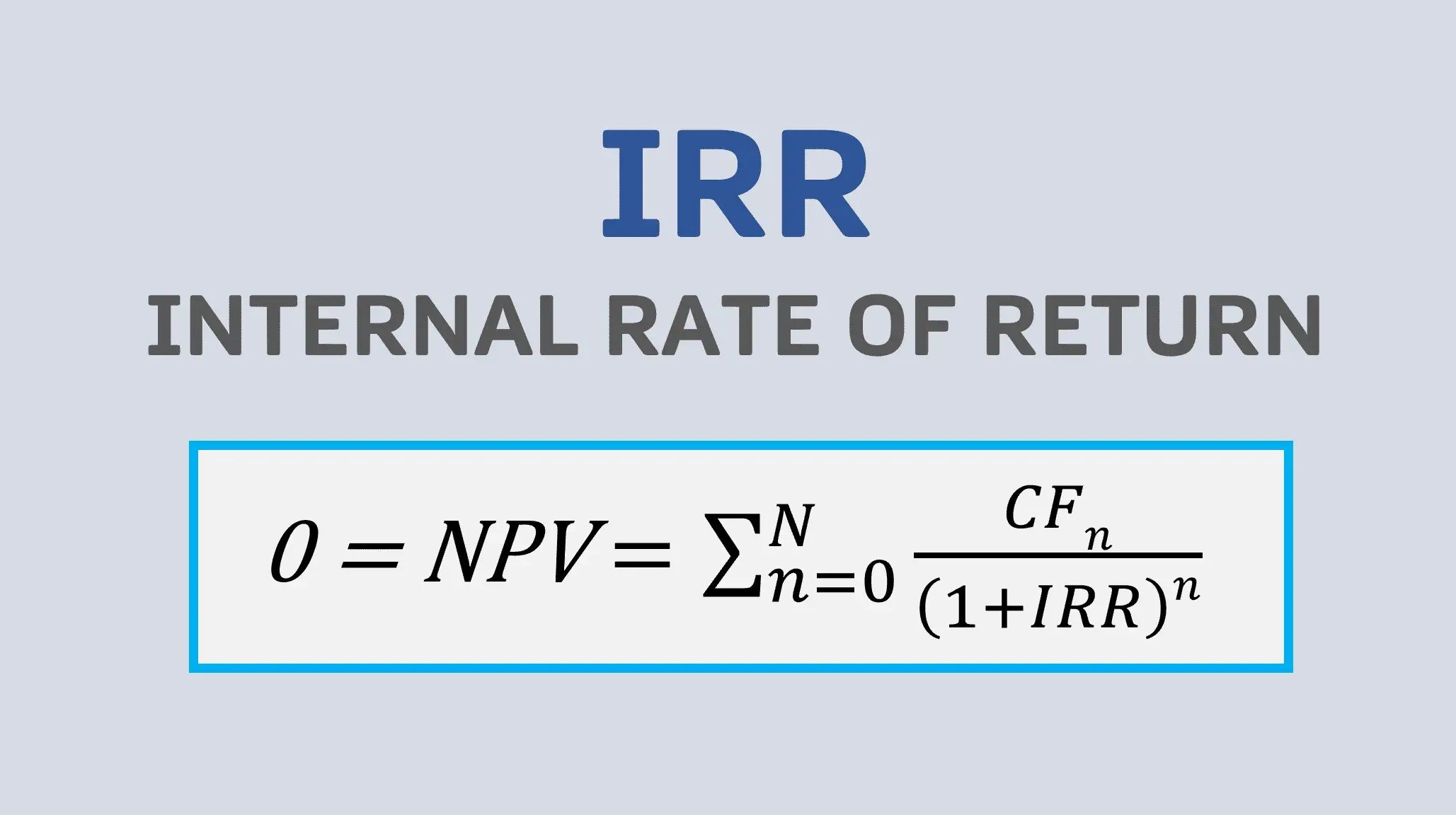

The IRR formula

NPV = net present value. Through this formula, we see that the IRR for any commercial real estate property investment is simply the percentage that brings the property's net present value (NPV) to zero.What is the average IRR for real estate investments?

Generally, an IRR of 18% or 20% is considered very good in real estate. Generally speaking, a high percentage return (greater than 10%) indicates a successful investment, while a low IRR (less than 5%) might mean investors should reconsider their investment options.

How do you calculate real estate IRR in Excel?

Although going all the way till the final. Year that you're investing. So this formula here g9. And then the little colon just includes everything. Between those two numbers g9 to l9.

How do you calculate IRR quickly?

So the rule of thumb is that, for “double your money” scenarios, you take 100%, divide by the # of years, and then estimate the IRR as about 75-80% of that value. For example, if you double your money in 3 years, 100% / 3 = 33%. 75% of 33% is about 25%, which is the approximate IRR in this case.

Is 7% a good IRR?

For unlevered deals, commercial real estate investors today are generally targeting IRR values of somewhere between about 6% and 11% for five to ten year hold periods, with lower-risk deals with a longer projected hold period on the lower end of that spectrum, and higher-risk deals with a shorter projected hold period

What does IRR mean for land?

Internal rate of return

A property's internal rate of return is an estimate of the value it generates during the time frame in which you own it. Effectively, the IRR is the percentage of interest you earn on each dollar you have invested in a property over the entire holding period.

How to Calculate the Internal Rate of Return (IRR) for Rental Propertieshttps://t.co/pBhMu8mkKz#realestate #realestateinvesting #property #investment #rentalproperty

— DealCheck (@DealCheckApp) March 4, 2022

What are good IRR numbers?

IRR tells you how profitable an investment is; a higher IRR means a higher return on investment. In the world of commercial real estate, for example, an IRR of 20% would be considered good, but it's important to remember that it's always related to the cost of capital.

Frequently Asked Questions

What are the disadvantages of IRR?

One of the disadvantages of using IRR is that all cash flows are assumed to be reinvested at the same discount rate, although in the real world, these rates will fluctuate, particularly with longer-term projects.

How is IRR calculated in real estate?

Simply put IRR refers to the average annual return over a specific number of years. For example; a retail center property investor would determine the IRR of a specific opportunity by calculating the net cash flow from operating the property and appreciation growth expected for the period a property will be held.

What is the rule of thumb for IRR?

So the rule of thumb is that, for “double your money” scenarios, you take 100%, divide by the # of years, and then estimate the IRR as about 75-80% of that value. For example, if you double your money in 3 years, 100% / 3 = 33%. 75% of 33% is about 25%, which is the approximate IRR in this case.

What is the formula for calculating IRR?

The manual calculation of the IRR metric involves the following steps: The future value (FV) is divided by the present value (PV) The amount is raised to the inverse power of the number of periods (i.e., 1 ÷ n) From the resulting figure, one is subtracted to compute the IRR.

What is the difference between IRR and ROI on rental property?

ROI is a simple calculation that shows the amount an investment returns compared to the initial investment amount. IRR, on the other hand, provides an estimated annual rate of return for the investment over time and offers a “hurdle rate” for comparing other investments with varying cash flows.

What is an IRR in real estate?

A property's internal rate of return is an estimate of the value it generates during the time frame in which you own it. Effectively, the IRR is the percentage of interest you earn on each dollar you have invested in a property over the entire holding period.

FAQ

- How do you calculate IRR in real estate?

The IRR formula

NPV = net present value. Through this formula, we see that the IRR for any commercial real estate property investment is simply the percentage that brings the property's net present value (NPV) to zero.- What is a typical IRR for real estate?

Generally, an IRR of 18% or 20% is considered very good in real estate. Generally speaking, a high percentage return (greater than 10%) indicates a successful investment, while a low IRR (less than 5%) might mean investors should reconsider their investment options.

- How do you use IRR formula?

Excel's IRR function.

Excel's IRR function calculates the internal rate of return for a series of cash flows, assuming equal-size payment periods. Using the example data shown above, the IRR formula would be =IRR(D2:D14,. 1)*12, which yields an internal rate of return of 12.22%.

- What does a 12% IRR mean?

Internal rate of return (IRR) is a financial metric used to measure the profitability of an investment over a specific period of time and is expressed as a percentage. For example, if you have an annual IRR of 12%, that means you have 12% more of something than you did 12 months earlier.

- What is the difference between IRR and ROI?

Return on investment (ROI) and internal rate of return (IRR) are both ways to measure the performance of investments or projects. ROI shows the total growth since the start of the projact, while IRR shows the annual growth rate. Over the course of a year, the two numbers are roughly the same.

How to calculate irr for real estate investment

| What is a good IRR for real estate development? | Generally, an IRR of 18% or 20% is considered very good in real estate. Generally speaking, a high percentage return (greater than 10%) indicates a successful investment, while a low IRR (less than 5%) might mean investors should reconsider their investment options. |

| How do you calculate IRR for real estate projects? | Calculate IRR based on property cash flows. Calculate the Total Present Value (PV) of the cash flows using IRR as the discount rate. Divide the PV of Cash Flow from Rent by Total PV. Divide the PV of Cash Flow from Sale by Total PV. |

| What is the internal rate of return for development? | The internal rate of return (IRR) for multifamily real estate development is a measure of the expected return on an investment. It is calculated by taking into consideration the cash flows net of financing to come up with a valuable equity. |

| How do you know if IRR is acceptable? | The IRR rule is a decision criterion that states that a project should be accepted if its IRR is greater than or equal to the hurdle rate, and rejected otherwise. The IRR is the discount rate that makes the net present value (NPV) of a project's cash flows equal to zero. |

| Is a 13% IRR good? | An excellent acceptable IRR for a multifamily deal ranges from 12% to 15%. The IRR is the rate needed to convert the sum of all future uneven cash flows (cash flow, sales proceeds, and principal paydown) to equal the equity investment. |

- What is NPV and IRR in real estate?

What Are NPV and IRR? Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

- What is the IRR in real estate investing?

What Is IRR In Real Estate? A piece of real estate's internal rate of return is the projected profit it could earn over the time you own the property. The number is expressed as a percentage you can generate based on each dollar invested. Next, we'll explain how to calculate this estimate.

- How do you calculate IRR over 10 years?

- Guess an IRR that you think the investment might generate over the 10-year period.

- Substitute the investment's information into the formula CF/[(1 + R)^N], in which CF represents each annual cash flow, N represents the year of each cash flow and R represents your guessed IRR as a decimal.

- Solve each of the 10 formulas.

- What is a normal IRR rate?

Businesses select projects with an internal rate of return exceeding their minimum hurdle rate return, which is equal to or exceeding its weighted-average cost of capital (WACC). In real estate, a good IRR may vary from 12% to 20%, depending on the risk level.

- How do you calculate real estate irr

The IRR formula helps investors understand their yearly earnings. Its result is based on a percentage of the investor's original investment and what they hope