- Sell the inherited property quickly.

- Make the inherited property your primary residence.

- Rent the inherited property.

- Qualify for a partial exclusion.

- Disclaim the inherited property.

- Deduct Selling Expenses from Capital Gains.

Do I have to report the sale of inherited property to the IRS?

What is the gain exclusion on the sale of a home after death?

Surviving spouses get the full $500,000 exclusion if they sell their house within two years of the date of the spouse's death, and if other ownership and use requirements have been met. The result is that widows or widowers who sell within two years may not have to pay any capital gains tax on the sale of the home.

What is the $250000 $500000 home sale exclusion?

The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9.

What happens when 3 siblings inherit a house?

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others' shares, or whether ownership will continue to be shared.

Do I have to report sale of inherited home to IRS?

Is money from the sale of an inherited house considered income?

Frequently Asked Questions

What happens when you sell a house you inherited?

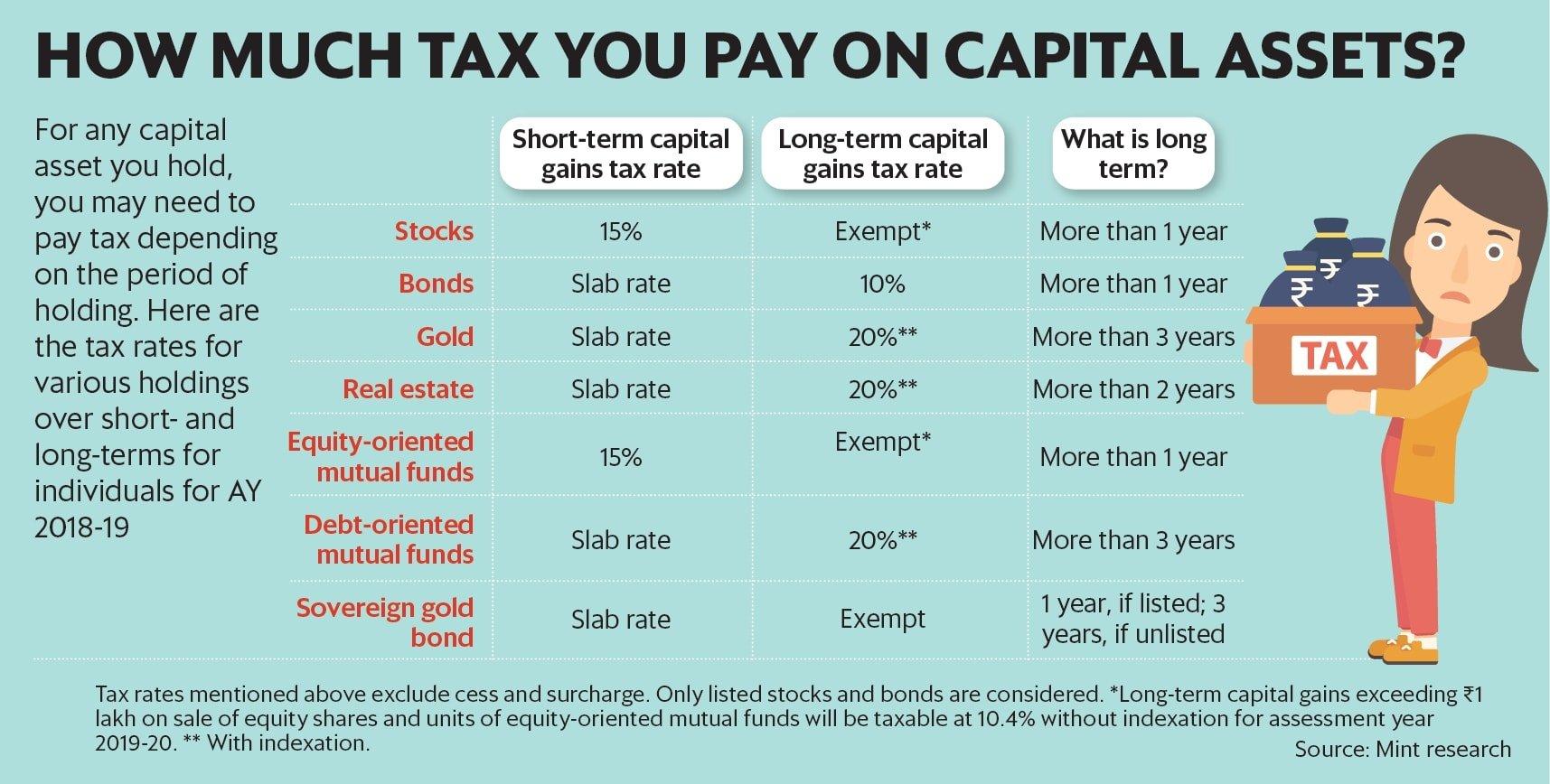

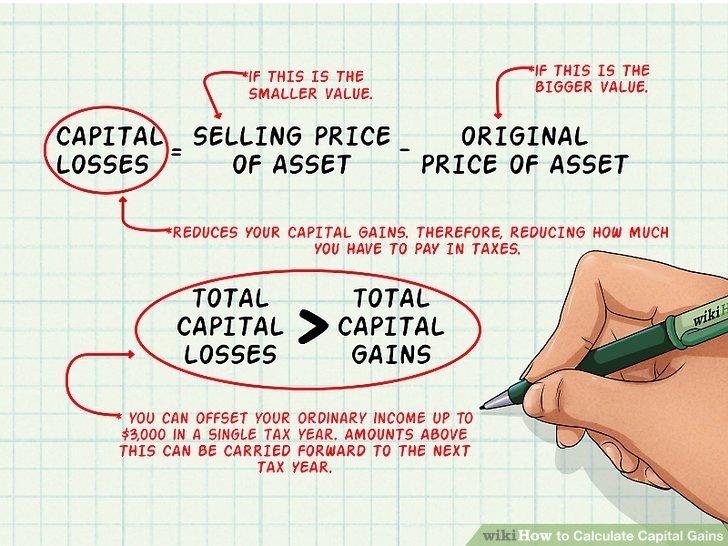

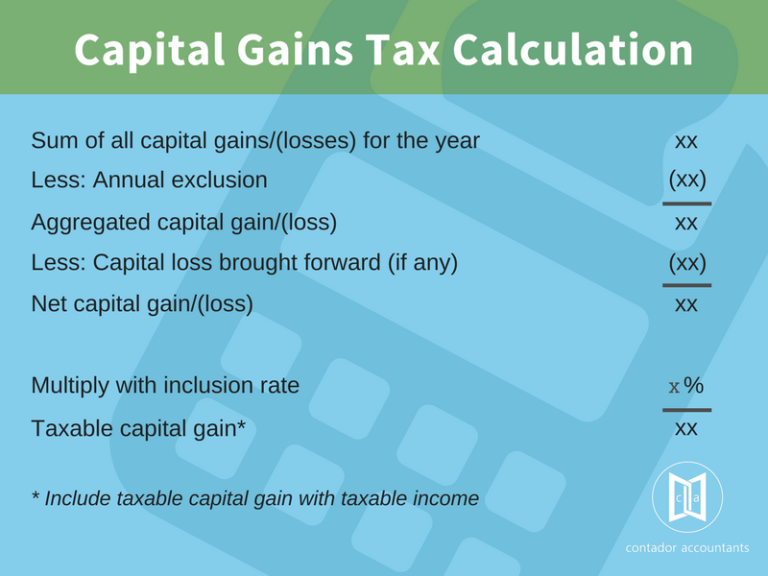

If you sell a property that you inherited, it could trigger certain taxable events. Notably, the sale of an inherited house would result in capital gains taxes. These taxes would be applied to the difference between the property value at the time of inheritance and the final sale price.

Does the sale of inherited property count as income?

Is the sale of a decedent’s home a capital gain?

For example, if you purchased your home 15 years ago for $150,000 and your estate executor sold it for $500,000, your estate would be on the hook for the $350,000 in realized capital gains. At 15 percent long-term capital gains tax rate, that would be a tax bill of $52,500.

How do you determine fair market value at date of death?

Here are the best ways to determine the fair market value of inherited property: Ask local real estate agents for an estimate. Get a formal appraisal from a licensed real estate appraiser. Put the property on the market.

FAQ

- Is my inheritance from my parents house taxable?

If you inherit property or assets, as opposed to cash, you generally don't owe taxes until you sell those assets. These capital gains taxes are then calculated using what's known as a stepped-up cost basis. This means that you pay taxes only on appreciation that occurs after you inherit the property.

- How to avoid paying capital gains tax on inherited property?

- How to Minimize Capital Gains Tax on Inherited Property

- Sell the inherited property quickly.

- Make the inherited property your primary residence.

- Rent the inherited property.

- Qualify for a partial exclusion.

- Disclaim the inherited property.

- Deduct Selling Expenses from Capital Gains.

- How much can you inherit from your parents without paying taxes?

According to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed. 318 Taxes for 2022 are paid in 2023.

- Does the estate of a deceased person pay capital gains tax?

Capital gains taxes: These are taxes paid on the appreciation of any assets that an heir inherits through an estate. They are only levied when you sell the assets for gain, not when you inherit. Cash that you inherit is taxed through either inheritance taxes (when applicable) or estate taxes.

How to calculate capital gains tax on sale of home after death

| How does capital gains work on an estate? | Generally, the capital gains pass through to the heirs. The estate reports the gain on the estate income tax return, but then takes a deduction for the amount of the gain distributed to the heirs since this usually happens during the same tax year. |

| What happens to the capital gains in the final year of an estate? | In case of a net capital gain, the estate would pay tax on the income. In the event of a net capital gain, the estate would $3,000 would be available on future estate returns. In the final year of an estate, unused net capital losses can be passed through to the beneficiaries. |

| Do beneficiaries pay capital gains tax? | Capital gains taxes: These are taxes paid on the appreciation of any assets that an heir inherits through an estate. They are only levied when you sell the assets for gain, not when you inherit. |

| How does capital gains tax work with multiple owners? | When a jointly owned property is sold, capital gains tax applies to the difference between the purchase price (the basis) and the selling price. Each owner is typically responsible for reporting their share of the gain on their individual tax return. |

- Who pays capital gains tax on inheritance?

If assets appreciate after you inherit them, you might need to pay capital gains tax if you sell the assets.

- Is capital gains tax paid on property of deceased?

- Capital Gains Are Taxed on a Stepped-Up Basis

When you inherit property, whether real estate, securities or almost anything else, the IRS applies what is known as a stepped-up basis to that asset. This means that for tax purposes the base price of the asset is reset to its value on the day that you inherited it.

- Capital Gains Are Taxed on a Stepped-Up Basis

- How are capital gains taxed at death?

In most cases, heirs don't pay capital gains taxes. Instead, the asset is valued at a stepped-up basis—the value at the time of the owner's demise. This tax provision is huge for many heirs since they may inherit property that the giver has owned for a long time. Suppose that you inherit an investment property.

- Does transfer on death avoid capital gains tax?

Estate and Capital Gains Taxes

If your heirs sell your home, they could be subject to capital gains taxes regardless of whether they receive the property through a living trust or a TOD deed.