What is the average rent in the U.S.? The average rent for an apartment in the U.S. is $1,702. The cost of rent varies depending on several factors, including location, size, and quality.

How much is rent in Florida?

Florida Rental Statistics

The average rent in Florida is $1,790 per month, compared to $1,100 nationwide. Across the U.S., rental rates have increased by 31% in the past ten years. Approximately 109 million Americans reside in rental housing.

How much is rent in Washington state?

Houses in Washington rent between $150 - $56,000 with a median rent of $2,098. 3. How has the rent in Washington changed in the last year? The median rent price in Washington for October 2023 is $2,098.

How do you calculate monthly rent?

To calculate the rent per month, multiply the rent per week by 52 and then divide by 12.

Which state has cheapest rent?

Cheapest State for Rent in the US

The least expensive state for rent is West Virginia with an average rent price of $800.

Before renting a house how do you check if the company can legally rent it out

Apr 12, 2023 — 1. Research Local Landlord-Tenant Laws · 2. Determine a Competitive Rent Price · 3. Advertise Your Property With a Rental Listing · 4. Thoroughly

Time for another deep dive of a Single Family Rental in an elite school district!

— Sean O'Dowd (@SeanODowd15) October 11, 2023

(That's our fund's specific niche)

We'll talk through a specific home in detail:

-What we like about it

-The Agent Profile

-What we don't like

-Why a tenant would like it

-If this is a profitable… pic.twitter.com/tEHg0lTLID

How to calculate rental price?

Typically, the rents that landlords charge fall between 0.8% and 1.1% of the home's value. For example, for a home valued at $250,000, a landlord could charge between $2,000 and $2,750 each month. If your home is worth $100,000 or less, it's best to charge rent that's close to 1% of its value.

How do you calculate total rent?

To calculate your monthly rent repayment, use this simple formula to convert weekly rent into the monthly rent payment.

- Step 1: Weekly Rent ÷ 7 = Daily Rent amount.

- Step 2: Daily Rent x 365 = Yearly Rent amount.

- Step 3: Yearly Rent ÷ 12 = Monthly rent amount.

What is the average monthly rent in the US?

What is the average rent in the U.S.? The average rent for an apartment in the U.S. is $1,702. The cost of rent varies depending on several factors, including location, size, and quality.

How much is the rent in New Jersey?

The median rent in New Jersey is $2,499. Houses in New Jersey rent between $300 - $475,000 with a median rent of $2,499. This is $99 more than October 2022.

How much money should I have before getting an apartment?

To cover all the costs discussed above, it is advisable to save an amount equal to at least 3-4 months' rent. This should cover the first month's rent, the security deposit, and the last month's rent. However, the exact amount of money you should save will depend on the apartment prices, which might vary greatly.

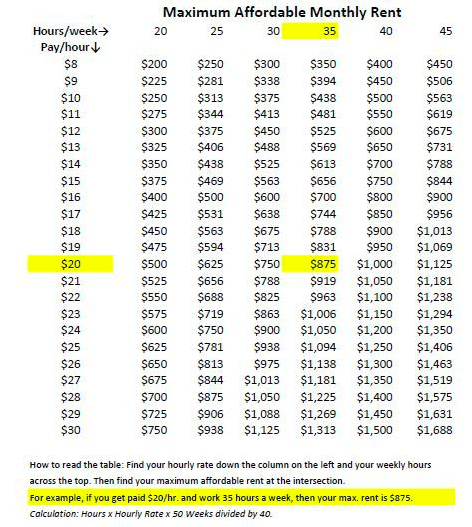

What is the hourly income you need to afford rent around the US?

Nationally, a person would need to make $25.82 per hour to pay for a modest two bedroom rental home without spending more than 30 percent of their income on housing. For a modest one-bedroom rental, it's $21.25. Even where local minimum wages are higher than the federal standard, it's not enough.

How do you budget for an apartment?

As a standard rule, look for an apartment that costs no more than one-third of your income, says Forbes. Consider allocating another third for other bills and necessities, such as loan payments, food and utilities, while the rest should go toward savings, retirement and entertainment costs, notes Forbes.

Can you live on $1000 a month after rent?

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

Is rent 15% of income?

Low Range

Spending 15% of your gross income on rent could allow you to save some money. This is a below average amount of your income to spend on rent. This doesn't take into account any other debts you may have. This is just a suggestion.

What percentage of your income should go to what?

Try the 50/30/20 rule as a simple budgeting framework. Allow up to 50% of your income for needs. Leave 30% of your income for wants. Commit 20% of your income to savings and debt repayment.

Can rent be 50% of your income?

There are a few ways to ballpark how much you should spend on rent. The 30% rule says no more than 30% of your gross monthly income. The 50/30/20 rule says to allocate 50% of your income to necessary expenses, including rent. But you may need to apply a more holistic approach to reach a number you are comfortable with.

Is rent 25 percent of income?

Percentage of Income

“Rent generally should not be more than 25 percent of your gross monthly salary,” says Andy Solari, Realtor Associate at Re/Max Carrier Realtors in Brigantine, New Jersey. “If an individual's income is $4,000 a month, then the rent should be no higher than $1,000.”

What is the 70 20 10 rule money?

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

How much house can you buy with $1,000 a month?

A simple analysis … and interesting historical perspective. These days — with conventional mortgage rates running about 4% — a $1,000 monthly Principle & Interest (P&I) payment gets you a 30-year loan of about $210,000.

How much house can I buy with 2000 a month payment?

Between $250,000 to $300,000

With $2,000 per month to spend on your mortgage payment, you are likely to qualify for a home with a purchase price between $250,000 to $300,000, said Matt Ward, a real estate agent in Nashville. Ward also points out that other financial factors will impact your home purchase budget.

How much income do you need to buy a 400k house?

What income is required for a 400k mortgage? To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981. (This is an estimated example.)

How much house can I afford for $500 a month?

How much mortgage can I get for $500 a month? With a total monthly payment of $500 every month for a loan term of 20 years and an interest rate of 4%, you can get a mortgage worth $72,553. Of course, this value might vary slightly, depending on the percentages of property tax and home insurance.

How much do I have to make to buy a $200 000 house?

To be approved for a $200,000 mortgage with a minimum down payment of 3.5 percent, you will need an approximate income of $62,000 annually.

How to rent out your house in Texas?

How to Become a Landlord in Texas Step-by-Step

- Check Local Requirements for Landlord License. In the state of Texas, getting a landlord license is not required.

- Find the Right Property.

- Prepare Your Property.

- Advertise Your Property.

- Screen Potential Tenants.

- Sign the Lease Agreement.

How to rent out a house in Florida?

How to Rent Your House in Florida

- Figure Out What Renters Want.

- Follow State and Local Laws and Restrictions.

- Make Sure You Have a Well-Drafted Lease.

- Get Your Property Rent Ready.

- Don't Forget that Renting Is a Business.

- Want to Rent Your House in Florida?

Who are best tenants to rent to?

a low debt-to-income ratio (especially as unemployment rises and interest rates climb) stable job history and positive interview from their employer about their employment. no contradictions and missing information on their application. no negative indications from previous landlords and good reasons for issues.

What do I need to rent a house in California?

A completed application form per adult - your application can be applied to one property at a time. Proof of income; such as three months of pay stubs, three months of bank statements, or tax documents if self-employed.

Do I need a license to rent my house in Texas?

Rental Registration Process

While there is no state-wide ordinance, several cities have their own requirements regarding Texas rental property registration. For example, in 2017, Dallas adopted the Single-Family Rental Program, where landlords must register their properties each year with the city.

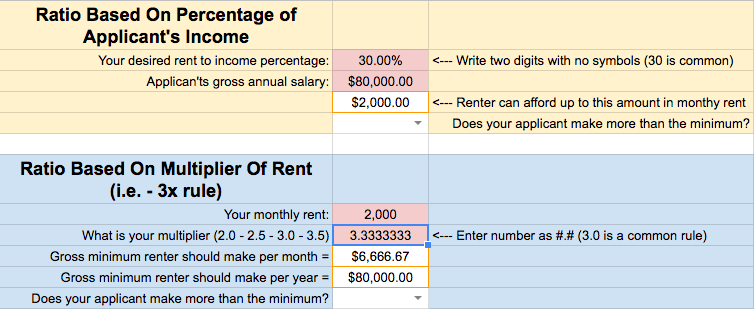

Is 3k in rent too much?

Following the 30% rule might look something like this: If your gross income is $10,000 per month: You can afford a $3,000 monthly rent. If your gross income is $6,667 per month: You can afford a $2,000 monthly rent. If your gross income is $5,000 per month: You can afford a $1,500 monthly rent.

How much should my rent be if I make 3000 a month?

According to this rule, a person or household should not spend more than 3 times their gross monthly income on rent. For example, if a person earns $3,000 per month before taxes, they should not pay more than $900 in rent.

Is 3k enough to move out?

You Have Enough Income To Pay Rent

This is a useful rule of thumb to gauge your own ability to afford a rental of your own. If the rental you have your eye on costs $1,000 per month, you should have at least $3,000 in monthly income to comfortably pay that rent without overstretching your finances.

How much rent do you pay upfront?

You might be asked to pay 1 to 2 months' rent before you move in. This is called paying 'rent in advance'. The actual amount you'II pay will depend on your landlord and your written statement - this shows what's included in your contract. By paying your rent in advance you'll always be paying rent for the month ahead.

How much of your income should go to rent reddit?

The guidelines we've all heard are keeping rent under 30% of your gross income. To stay frugal, I have always aimed to keep it under 30% of net after taxes and retirement savings.

How do you calculate real rent?

A “real interest rate” is an interest rate that has been adjusted for inflation. To calculate a real interest rate, you subtract the inflation rate from the nominal interest rate. In mathematical terms we would phrase it this way: The real interest rate equals the nominal interest rate minus the inflation rate.

Is $2000 too much for an apartment?

Say you stick to the 30% rule or 40x the monthly rent, you would need to earn at least $80,000 annually to afford $2,000 per month in rent. “Typically, 30% of gross income is considered to be the boundary of affordability.

What is a good budget for an apartment?

Try the 30% rule. One popular rule of thumb is the 30% rule, which says to spend around 30% of your gross income on rent. So if you earn $3,200 per month before taxes, you should spend about $960 per month on rent.

Is $1,000 for rent too much?

Your rent payment, including renters insurance (more on that later), should be no more than 25% of your take-home pay. That means if you're bringing home $4,000 a month, your monthly rent should cost you $1,000 or less. And remember, that's 25% of your take-home pay—meaning what you bring in after taxes.

What is the average rent in the US 2023?

The average U.S. apartment rent reached an all-time high of $1,716 in May. Challenges for the sector include slowing demand, growing issues with affordability, slower population growth and competition from a large number of new units coming online through 2024.

Is $1,500 rent too much?

Take rent for example. The traditional advice is simple: Spend no more than 30% of your before-tax income on housing costs. That means if you bring in $5,000 per month before taxes, your rent shouldn't exceed $1,500.