The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

How do I avoid 20% down payment on investment property?

Yes, it is possible to purchase an investment property without paying a 20% down payment. By exploring alternative financing options such as seller financing or utilizing lines of credit or home equity through cash-out refinancing or HELOCs, you can reduce or eliminate the need for a large upfront payment.

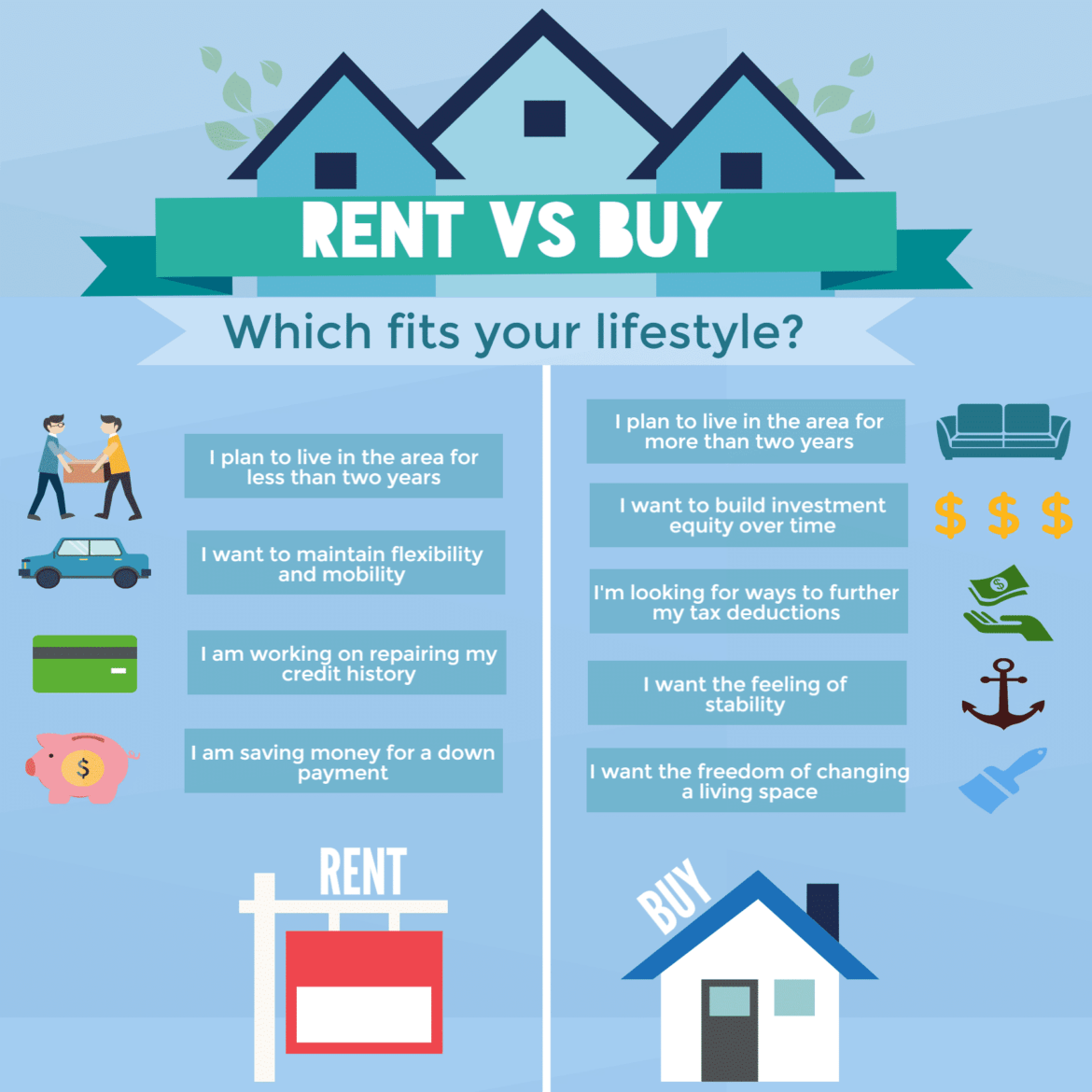

Does it make sense to rent or buy a house?

If you and your family do not plan to stay where you are longer than 3 years, you would be better off renting for now according to most experts. If you are not sure, the pointer still leans toward renting. If you are committed to at least 3 to 5 years or more, it's probably in your interest to look into buying.

What is the 50% rule in rental property?

The 50% rule or 50 rule in real estate says that half of the gross income generated by a rental property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits.

How much profit should you make on a rental property?

The amount will depend on your specific situation, but a good rule of thumb is to aim for at least 10% profit after all expenses and taxes. While 10% is a good target, you may be able to make more depending on the property and the rental market.

Who is the best real estate company to work for?

Best Real Estate Companies to Work for in 2023

| Brokerage | Best For |

|---|---|

| eXp Realty | Best overall, featuring an agent-forward virtual approach |

| Keller Williams | Building a team |

| RE/MAX | High-performing, established agents |

| Coldwell Banker | New agents |

Look at the hilarious comments on this thread. Hundreds of people are absolutely furious at my suggestion to run a simple buy-Vs-rent calculation because, as I point out, renting can sometimes be a better financial decision than owning https://t.co/OvzESsiiec

— Ramit Sethi (@ramit) June 9, 2023

What is the most high paying job in real estate?

According to the average salaries statistics in 2023, the highest-paying job in real estate is a mortgage loan officer. On average, loan officers in the United States earn a salary of $183,578 per year, with additional commissions amounting to $35,500 annually, as reported by Indeed.

What do the top 1 of real estate agents make?

Each real estate office sets its own standards for top producers, but it's safe to say that a top producer would have to sell at least one home per month to qualify. Top producers earn around $112,610 a year to start, according to the BLS. 1 Mega-stars could earn $500,000 per year and up.

How much money should you have before renting?

Based on the above categories, you should save an amount equal to at least 3-4 months' rent. That will cover paying rent for the first month, security deposits and last month's rent.

How do you live in an apartment on a budget?

As a standard rule, look for an apartment that costs no more than one-third of your income, says Forbes. Consider allocating another third for other bills and necessities, such as loan payments, food and utilities, while the rest should go toward savings, retirement and entertainment costs, notes Forbes.

Can you deduct improvements when you sell your home?

Home improvements and repairs

If you renovated a few rooms to make your home more marketable (and so you could fetch a higher sales price), you can deduct those upgrade costs as well. This includes painting the house or repairing the roof or water heater. But there's a catch, and it all boils down to timing.

What are fixing up expenses for sale of home?

Key Takeaways. Fixing-up expenses are costs related to repairs made during the process of preparing a home for sale or rental. Since the passage of the Taxpayer Relief Act of 1997, fixing-up expenses are no longer tax-deductible as part of the home selling process.

What does the IRS consider capital improvements?

A capital improvement is a durable upgrade, adaptation, or enhancement of a property that increases its value, often involving a structural change or restoration. The IRS grants special tax treatment to qualified capital improvements, distinguishing them from ordinary repairs.

Does painting a house add to cost basis?

Since the cost was not essential to selling (you were not REQUIRED to paint the home, which is different than being REQUIRED to pay selling commission) it is not added to the basis nor added to selling costs.

How long does it take to get your money after closing a sale of a house?

A seller typically receives their money from the home sale 24 – 48 hours after closing. This timeline can be different depending on your state and whether the seller chooses to receive their money by cashier's check or wire transfer.

How long does it take to wire money for closing?

A domestic wire transfer takes about one business day to receive.

When should I get my cashier’s check for closing?

Typically, you'll need to secure a cashier's or certified check. It should only take a few minutes to have your bank draw one up for you, provided the funds are already in your account, but you'll want to do this a few days in advance of your closing date in case you run into any issues.

What should I do with large lump sum of money after sale of house?

Depending on your financial circumstances, it might make sense to pay down debt, invest for growth, or supplement your retirement. You might also consider purchasing products to protect yourself and your loved ones, including annuities, life insurance, or long-term care coverage.

Can I spend money after closing on a house?

It's your house. All advice aside, remember that once you've closed on a house, it's yours! And you're free to spend money on it however you wish.

Why do real estate agents advertise?

Advertising allows real estate agents to reach a larger audience and increase their exposure to potential clients. By using various advertising platforms, such as social media, newspapers, magazines, billboards, and online directories, real estate agents can showcase their properties to a broader range of people.

How much does a real estate agent make in NYC?

The estimated total pay for a Real Estate Agent is $184,775 per year in the New York City, NY area, with an average salary of $121,305 per year. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users.

Is it worth it to hire a broker in NYC?

If you want to avoid paying a broker fee when you rent an apartment in NYC, it's best to avoid a broker. There are “no fee” options on sites like Streeteasy or Renthop, but if it's posted by a broker, it's likely either a fake listing or has a hidden fee.

What is the difference between a real estate agent and a broker in NY?

Broker: What's the difference? A real estate agent is an individual who is licensed to sell or rent a property. A real estate agent cannot work independently and must work under a licensed broker. A real estate broker is someone who holds an additional license that allows them to own a real estate firm.

Why do realtors do highest and best?

As the seller, you usually ask for the highest and best offer to eliminate negotiations and expedite the deal. It lets buyers know you're looking for only the most serious offers. Conversely, with a best and final offer, you're asking buyers to go above and beyond the competition to convince you to sell to them.

How do you attract real estate investors?

To attract these investors, you need to strategize your communication through email newsletters or social media posts. When real estate investors find a profitable deal aligned with their financial goals, chances are they invest in your venture.

Who is the most successful real estate investor?

Donald Bren. Donald Bren is one of the greatest real estate investors in American history. He is currently the wealthiest real estate investor in the country and has a net worth of $15.3 billion.

What percentage of Americans are real estate investors?

Let's look at what percentage of Americans own stocks or real estate. It's not as high as you might think. According to the latest Gallup poll, only about 54% of Americans own any stocks. Meanwhile, only about 63% of Americans own real estate according to the Census Bureau.

Why do most real estate investors fail?

Not Asking for Help. Next, a rookie real estate investor making a deal on their own without seeking advice from peers or industry professionals is one of the biggest mistakes in real estate investing. Building relationships with other industry leaders is crucial to help you reach success.

What attracts people to real estate?

“You are your own boss, which is a big factor in why people get into it,” said Marcel Tessier, a real estate agent with more than 30 years of experience in residential real estate. “The hours are a big factor,” he said. “Of course you have to put in long hours, but as you get repeat clients they're very flexible.

Does it matter whether the buyer or the seller is responsible for paying a tax?

The sales tax is on the transaction, not specifically the buyer or the seller. The seller, however, has the responsibility to pay. ( and failing that, the buyer must pay) As the other answers have pointed out, the seller generally collects the tax from the buyer as part of the transaction, but not always.

Who pays property tax closing Illinois?

Buyers of Existing Homes will be responsible for paying all real estate tax bills that come due after the closing date. Taxes in Illinois are paid in arrears, i.e., one year after they are assessed. Credits received from a Seller at a closing for taxes will be shown on your settlement statement.

Do I pay taxes to the IRS when I sell my house?

If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. Your gain is usually the difference between what you paid for your home and the sale amount. Use Selling Your Home (IRS Publication 523) to: Determine if you have a gain or loss on the sale of your home.

How are property taxes handled at closing in Texas?

Prorated Bills for Sellers and Buyers

To put it in simple terms, the seller will be responsible for the property tax balance that accrued from the beginning of the tax year until the date of closing, and the buyer will be responsible for property taxes that are due for the period after the closing date.

Is tax divided between buyers and sellers?

Tax incidence is the manner in which the tax burden is divided between buyers and sellers. The tax incidence depends on the relative price elasticity of supply and demand.

Should I buy real estate in my 20s?

One of the best reasons to start investing in your 20s is because the longer you own a property, the more valuable it becomes. So, if you buy a property in your 20s and hang onto it for several years, it will appreciate over time. Then, you can sell it for significant profits.

How can a 20 year old make money in real estate?

A few options include investing in REITs (real estate investment trusts), flipping properties, short-term vacation rentals, or real estate wholesaling. Some of these options are associated with less risk or higher returns. It is important to research all the options and choose which strategy works best for you.

What is the best age to get into real estate?

But it's the advantages of being in your 30s and 40s — the ability to secure credit, the professional influence, a work experience that can reduce the small-business learning curve — that makes starting a real estate career at this time an often perfect choice. This all depends on what your exact financial goals are.

What age is too late to invest in real estate?

The good news is that it's never too late. The fact that you are striving and climbing now puts you far ahead of the average person at any age. Remember that small successes and large successes within real estate investing can make positive impacts on your life.

Is 21 too early to buy a house?

There's no minimum age to buy a house. If you're ready and have a down payment, buying a house in your early 20s is a smart move.

How much is a real estate license in NY?

How Much Does It Cost to Get a Real Estate License in New York? Becoming a real estate professional in New York isn't prohibitively expensive. When all is said and done, an aspiring agent will spend around $500 to $1,000 to get their license, while a broker can expect to pay around $950 to $1,450.

How long does it take to get real estate license in NY?

3-5 months

How Long Does It Take to Get a Real Estate License in New York? On average, it takes anywhere from 3-5 months to obtain a real estate license in New York.

How do I get my real estate license in Long Island?

Requirements

- Submit a completed application and the required fee to the Department of State.

- Be 18 years old.

- Have successfully completed 77 hours of approved qualifying education.

- Pass the NYS Real Estate Salesperson examination.

- Be sponsored by a NYS licensed Real Estate Broker.

How do real estate agents get paid in New York?

Real estate agents work solely on commissions. Those commissions are typically split between the buyer's agent and the seller's agent. The broker overseeing the transactions also gets a split of the commissions. New York real estate agents can increase their income potential by earning their NY broker license.

How hard is NY real estate exam?

The passing rate for the New York Real Estate Salesperson Exam is 70%. This test is purposefully difficult, but not impossible. Be sure to pay attention during your pre-license course and take studying seriously. If you put the proper effort forth, we know that you can pass on your first attempt!

Why are you interested in a career in real estate?

If you enjoy helping people and seeing them make positive changes in their lives, this profession may be suitable for you. Real estate agents provide homebuyers and sellers with the knowledge and insight to make informed decisions regarding their financial conditions and livelihood.

Why are you interested in this position?

Talk about how the position will help you learn, grow, develop and achieve your long-term career goals. In answering, you want to come across as upbeat, positive, enthusiastic, committed to doing your best and offering value to the company genuinely and authentically.

What are 3 good things about real estate?

- You Could Earn Passive Income.

- You May Enjoy Tax Benefits.

- Your Property May Appreciate In Value.

- You Have The Potential To Build Capital.

- You Could Have More Protection From Inflation.

- You May Be Able To Finance Your Property.

- You May Be Able To Choose Your Level Of Involvement.

Why do you want to be a real estate agent essay?

I want to become a real estate agent because I have a passion for helping people and pointing them in the right direction. I want to help them with everything from inspections, property analysis, repairs, moving, cleaning, packing, everything involved in a sales transaction, I want to help people with it.

How do you say you are interested in a job position?

"You all seem like a great team, and I'd be honored to work with you." "I'm very interested in the job, but do you have any concerns as to how well I can perform?" "The work I'd be involved with sounds interesting, I'd love if you could tell me what some next steps are going to be."