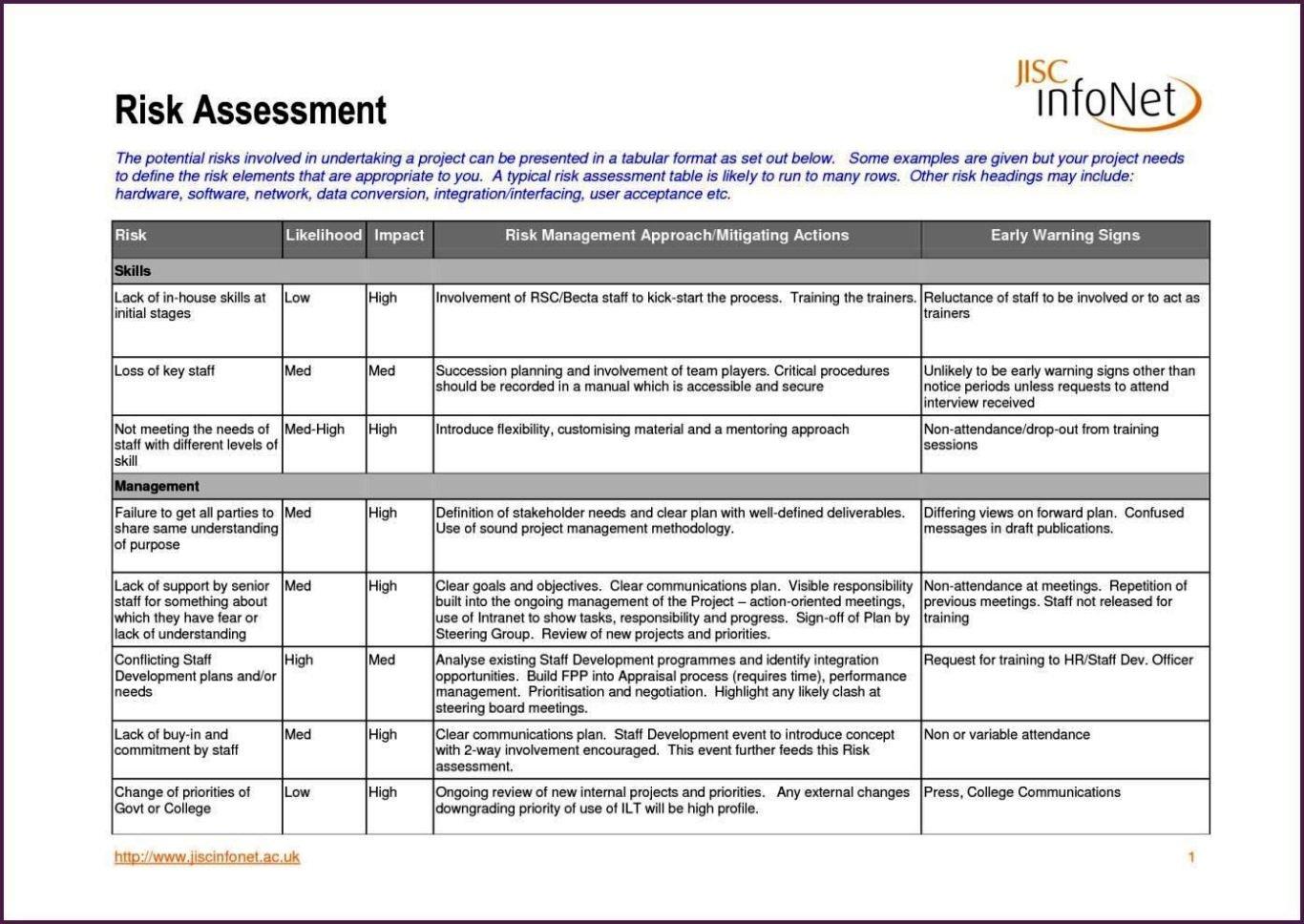

- Identify hazards.

- Assess the risks.

- Control the risks.

- Record your findings.

- Review the controls.

What are the 3 steps to assess risks?

- Risk identification.

- Risk analysis.

- Risk evaluation.

What is the method of assessing risks?

Organizations can take several approaches to assess risks—quantitative, qualitative, semi-quantitative, asset-based, vulnerability-based, or threat-based. Each methodology can evaluate an organization's risk posture, but they all require tradeoffs.

What are the four steps for assessing risk?

- Planning - Planning and Scoping process.

- Step 1 - Hazard Identification.

- Step 2 - Dose-Response Assessment.

- Step 3 - Exposure Assessment.

- Step 4 - Risk Characterization.

What is a risk assessment checklist?

A risk assessment checklist ensures you've evaluated every area of your business when preparing to conduct a risk assessment. With a checklist, you can be sure you have considered risk from every direction and have all the information to allow your company to ultimately develop a risk management plan.

What is retention risk management?

Complete retention is a risk management technique in which a company facing a risk or risks decides to absorb, or accept, any and all potential loss rather than transfer that risk to an insurer or other party. Complete retention is an aggressive form of self-insurance.

Here's a great BiggerPockets article on how to evaluate the risks of real estate investing.https://t.co/GTguNxf2ad#RealEstate #investing #commercialrealestate

— Assetti (@AssettiSW) July 19, 2021

Why is risk retention important in risk management?

Risk Retention is the process where an individual or a company accepts the financial risks and does not act on them before they actually occur. These risks may be too small for which paying attention before could be too early. Some other risks are so big that taking any action on them is impossible due to the costs.

Frequently Asked Questions

What is an example of retaining risk?

Risk-retention is the method secured for all other types of risks, that is, unforeseen or foreseen but not significant. For example, risk of getting a flat tyre while on a long road trip. Although the risk is unknown, it is not as significant and you can easily manage it out of your pocket.

How do you analyze risk in real estate?

To evaluate financial risk, you need to perform a financial analysis and projection, which involves calculating the key financial ratios, such as cash on cash return, net operating income, capitalization rate, internal rate of return, and debt service coverage ratio, and estimating the future cash flows, expenses, and

What is the meaning of risk in real estate practice?

In a pragmatic sense, risk can be defined rather simply as the “Difference between expectations and realizations.” That is, it is a measure of the uncertainty surrounding a current or future event or state of nature regarding real estate.

How do you overcome property risk?

Physical property risk

The most obvious solution is to transfer the risk to an insurer. General liability insurance protects an organization against property damage, among other things.

What’s one possible way to manage risk in your real estate business quizlet?

In order to minimize risk, good recordkeeping and transaction documentation practices are essential. Because the licensee cannot anticipate problems that may arise in the future about past actions, good documentation is always a good first line of defense against liability.

FAQ

- What's one possible way to manage risk in your real estate business?

Create Policies and Procedures

One way to help manage risk at your real estate brokerage is to ensure you have standardized policies and procedures for your team to follow. These policies and procedures should set expectations for your team. They can help solve problems and prevent disputes.

- Which of the following is a method of preventing or minimizing risk real estate?

Most quality real estate risk management plans are based on three general strategies; avoiding risk, controlling risk, and transferring risk. Risk avoidance means choosing not to take part in activities that are deemed too risky.

- What is one way to reduce the risk of violating fair housing laws?

The best way to prevent a violation of Fair Housing laws when answering questions asked on the telephone or via any other media is to ensure that all persons who answer questions from the public at your community are fully trained. This is not contingent on your job title.

- What are the four 4 ways to manage risk?

- There are four primary ways to handle risk in the professional world, no matter the industry, which include:

- Avoid risk.

- Reduce or mitigate risk.

- Transfer risk.

- Accept risk.

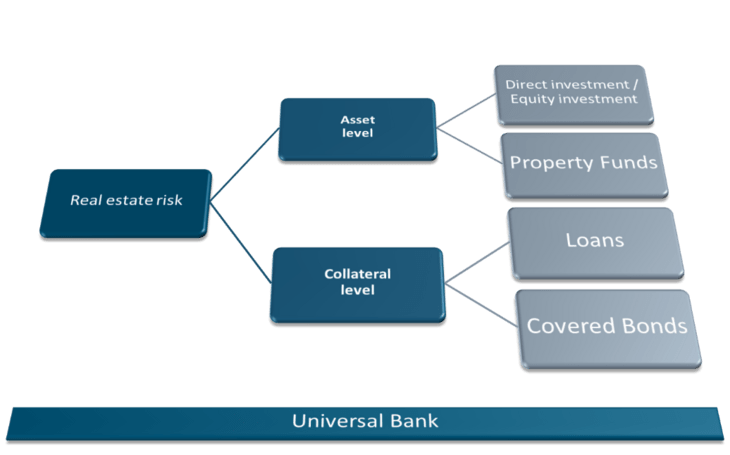

- What is risk in real estate investment?

Market Risk: Market risk in real estate refers to the potential for the value of a property to decrease due to changes in economic conditions and supply and demand. Economic factors such as recession, inflation, and unemployment rates can all affect the demand for housing and, as a result, the value of properties.

How to assess risk in real estate

| Which of the following is an example of a real estate investment? | Apartment rentals, REITs, commercial real estate, land and crowdfunding platforms are all types of real estate investments. |

| What is the biggest risk to a real estate investment? | What Are the Greatest Risks of Investing In Real Estate?

|

| Is real estate a risky investment quizlet? | Real estate investment is different from other investments because there's potential for earning income two different ways from the same investment. Many investors choose real estate over other types of investments because real estate investments are virtually risk free, provided the investor follows the law. |

| What type of risk is real estate? | Capital risk is the possible financial (capital) loss an investor can experience when investing in real estate. Investors stand a chance of losing some or even all of their investment capital. Financial risk is always a possibility when investing in real estate, no matter how confident or experienced an investor is. |

| What does risk management mean as it applies to property management quizlet? | What does risk management mean as it applies to property management? -Controlling and limiting risk through proper insurance. |

- What is an example of risk management in real estate?

A part of risk management is a determination of risk versus reward. A good example is a hot tub or swimming pool on the property. The property manager and owner must balance the value of the pool with the risks incurred.

- What are the rules of risk management in real estate?

Most quality real estate risk management plans are based on three general strategies; avoiding risk, controlling risk, and transferring risk. Risk avoidance means choosing not to take part in activities that are deemed too risky.

- What is property risk in risk management?

Property risks involve property damaged due to uncontrollable forces such as fire, lightning, hurricanes, tornados, or hail. Liability risks may involve litigation due to real or perceived injustice.

- What is risk management as applied?

Risk management is the process of identifying, assessing and controlling threats to an organization's capital, earnings and operations. These risks stem from a variety of sources, including financial uncertainties, legal liabilities, technology issues, strategic management errors, accidents and natural disasters.