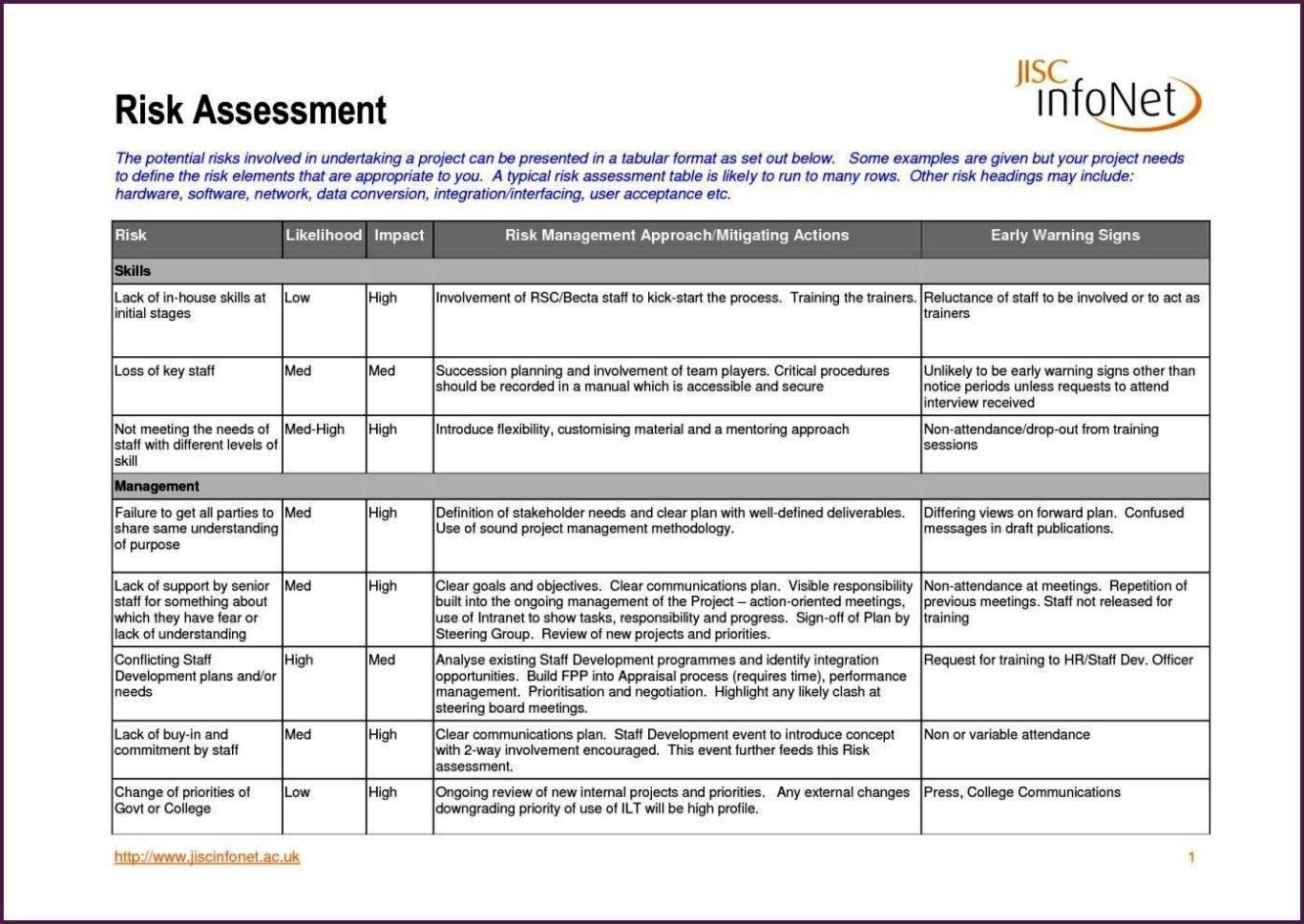

- Identify hazards.

- Assess the risks.

- Control the risks.

- Record your findings.

- Review the controls.

What are the 3 steps to assess risks?

- Risk identification.

- Risk analysis.

- Risk evaluation.

What is the method of assessing risks?

Organizations can take several approaches to assess risks—quantitative, qualitative, semi-quantitative, asset-based, vulnerability-based, or threat-based. Each methodology can evaluate an organization's risk posture, but they all require tradeoffs.

What are the four steps for assessing risk?

- Planning - Planning and Scoping process.

- Step 1 - Hazard Identification.

- Step 2 - Dose-Response Assessment.

- Step 3 - Exposure Assessment.

- Step 4 - Risk Characterization.

What is a risk assessment checklist?

A risk assessment checklist ensures you've evaluated every area of your business when preparing to conduct a risk assessment. With a checklist, you can be sure you have considered risk from every direction and have all the information to allow your company to ultimately develop a risk management plan.

How do you measure a good real estate investment?

- Your Mortgage Payment.

- Down Payment Requirements.

- Rental Income to Qualify.

- Price to Income Ratio.

- Price to Rent Ratio.

- Gross Rental Yield.

- Capitalization Rate.

- Cash Flow.

Here's a great BiggerPockets article on how to evaluate the risks of real estate investing.https://t.co/GTguNxf2ad#RealEstate #investing #commercialrealestate

— Assetti (@AssettiSW) July 19, 2021

What is the best measure of risk within an investment?

Beta

The Beta is the best measure for estimating the risk of an investment belonging to a diversified portfolio. It allows the investor to quantify the volatility of the security held in the portfolio compared with the market risks.Frequently Asked Questions

What is the 70% rule in real estate investing?

Put simply, the 70 percent rule states that you shouldn't buy a distressed property for more than 70 percent of the home's after-repair value (ARV) — in other words, how much the house will likely sell for once fixed — minus the cost of repairs.

What is the #1 goal of risk management?

The ultimate goal of risk management is the preservation of the physical and human assets of the organization for the successful continuation of its operations.

What is the most important tool of risk management?

A risk register is a platform that controls potential risks you may experience in a project. This tool collects, documents and monitors risks. This may allow you to strategize and respond proactively to these challenges, helping you deliver projects on time and within the budget.

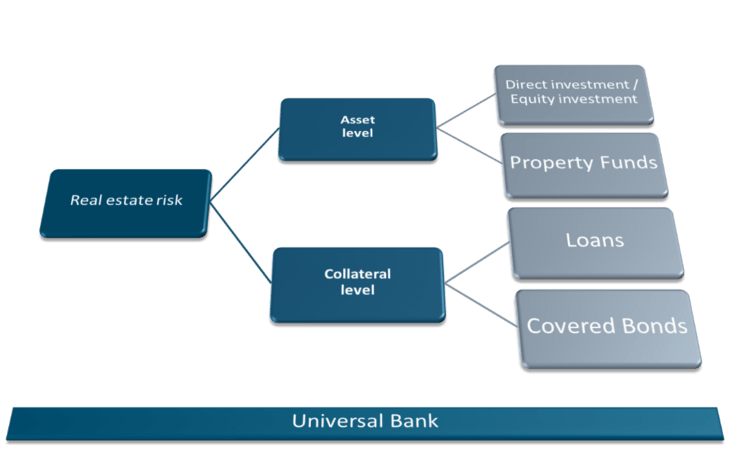

How do you measure risk in real estate investment?

How do you measure risk in commercial real estate? The two most common commercial real estate risk measures are loan-to-value (LTV) and capitalization rate (cap rate), which, taken together, provide a reasonable snapshot of a property's risk and return profile.

What 4 factors of risk should be considered when making an investment in stocks?

These risks could include a disappointing earnings report, changes in leadership, outdated products, or wrongdoing within the company. Because of the large amount of possible risks that come with owning stock in a company, investors know that forecasting these risks is nearly impossible.

What are the 3 main factors of investors risk tolerance?

- Timeline. Each investor will adopt a different time horizon based on their investment plans.

- Goals. Financial goals differ from individual to individual.

- Age. Usually, young individuals should be able to take more risks than older individuals.

- Portfolio size.

- Investor comfort level.

FAQ

- What are key risk indicators in investment?

Key risk indicator (KRI) KRIs measure how risky certain activities are in relation to business objectives. They provide early warning signals when risks (both strategic and operational) move in a direction that may prevent the achievement of KPIs. Most often executive management and the board.

- What is risk management in real estate?

Most quality real estate risk management plans are based on three general strategies; avoiding risk, controlling risk, and transferring risk. Risk avoidance means choosing not to take part in activities that are deemed too risky.

- What is an example of risk management in real estate?

A part of risk management is a determination of risk versus reward. A good example is a hot tub or swimming pool on the property. The property manager and owner must balance the value of the pool with the risks incurred.

- What is risk management in simple terms?

In business, risk management is defined as the process of identifying, monitoring and managing potential risks in order to minimize the negative impact they may have on an organization.

- What are the two basic approaches to risk management in real estate?

The two basic approaches to risk management in real estate are risk avoidance and risk mitigation or control. Risk avoidance involves employing strategies to prevent risky situations. Risk mitigation involves recovery measures to minimize the impact of risk on your investment.

- What are the 4 types of risk management?

- The way in which risk is managed, therefore, can mean the difference between success and struggle in a commercial enterprise.

- 4 Types of Risk Management. The four types of risk management are quite different and cover a wide range of scenarios.

- Risk Avoidance.

- Risk Reduction.

- Risk Transfer.

- Risk Retention.

How to asses risk in real estate

| How is risk defined in real estate? | By Norman Miller | In the commercial real estate investment context, risk is anything that creates volatility in a property or portfolio's expected or actual returns. In addition to analyzing returns and running cash-flow projections, the most astute investors effectively understand risk analysis and management. |

| What are risks to a real estate agency? | Whether you work independently or for a real estate agency, creating a comprehensive risk management plan can help mitigate the financial consequences of events such as:

|

| What does a risk agent do? | Performing a risk assessment: Analysing current risks and identifying potential risks that are affecting the company. Performing a risk evaluation: Evaluating the company's previous handling of risks, and comparing potential risks with criteria set out by the company such as costs and legal requirements. |

| How do you manage risk in real estate? | General liability and property insurance are two of the best ways to manage real estate-related risks, but the best thing investors can do becomes educated and aware of additional hazards and the best strategies to prevent, avoid, or transfer that risk. |

| What are the four 4 types of risk associated with real estate? | 6 Types Of Real Estate Investment Risks That Investors Need To Know

|

- What is the biggest risk of real estate?

- Navigating the Three Biggest Risks of Real Estate Investing in 2023: What You Need to Know

- Risk #1 – Economic Uncertainty and Market Volatility.

- Risk #2 – Rising Interest Rates.

- Risk #3 – Lack of Liquidity.

- How to Mitigate Your Risk When Investing in Real Estate.

- Navigating the Three Biggest Risks of Real Estate Investing in 2023: What You Need to Know

- What is the 2% rule in real estate?

The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

- What is the risk tolerance of real estate?

Risk Tolerance is the amount or type of risk an investor can afford or is willing to tolerate. For example, purchasing real estate can be extremely profitable. An investor can make improvements and resell the property at a much higher price.

- What is more risky stocks or real estate?

- Stock prices are much more volatile than real estate. The prices of stocks can move up and down much faster than real estate prices. That volatility can be stomach-churning unless you take a long view on the stocks and funds you purchase for your portfolio, meaning you plan to buy and hold despite volatility.

- Is real estate a high risk asset?

Compared to other investment types, like stocks, annuities, and cryptocurrencies, real estate is widely considered to be a low-risk investment.