Transfer taxes: In Wisconsin, sellers are responsible for paying real estate transfer taxes. The rate is $0.30 per every $100 of value. So, if you sell your home for $270,000, the transfer taxes would be $810. Title insurance: You'll need to pay for a new title insurance policy for the owner in Wisconsin.

Do I have to pay capital gains when I sell my house in Wisconsin?

What is the $250000 / $500,000 home sale exclusion?

What is the capital gains tax on $200 000?

= $

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

Does selling a house count as income?

What is the capital gains tax on selling a house in Wisconsin?

The capital gains tax rate reaches 8.75%. Wisconsin taxes capital gains as income. Long-term capital gains can apply a deduction of 30% (or 60% for capital gains from the sale of farm assets). The capital gains tax rate reaches 7.65%.

Is there a way to avoid capital gains tax on the selling of a house?

The good news is that many people avoid paying capital gains tax on the sale of their primary home because of an IRS rule that lets you exclude a certain amount of the gain from your taxable income. Generally, people who qualify for the home sale capital gain exclusion can exclude: $250,000 of capital gains if single.

Frequently Asked Questions

How does capital gains work on an estate?

Generally, the capital gains pass through to the heirs. The estate reports the gain on the estate income tax return, but then takes a deduction for the amount of the gain distributed to the heirs since this usually happens during the same tax year.

Do I have to pay taxes when I sell my house in Wisconsin?

Cost of selling a home in Wisconsin

Transfer taxes: In Wisconsin, sellers are responsible for paying real estate transfer taxes. The rate is $0.30 per every $100 of value. So, if you sell your home for $270,000, the transfer taxes would be $810.

What happens to profit from sale of home?

In California, capital gains from the sale of a house are taxed by both the state and federal governments. The state tax rate varies from 1% to 13.3% based on your tax bracket. The federal tax rate depends on whether the gains are short-term (taxed as ordinary income) or long-term (based on the tax bracket).

FAQ

- How do I avoid paying taxes on profit from selling a house?

- Can Home Sales Be Tax Free?

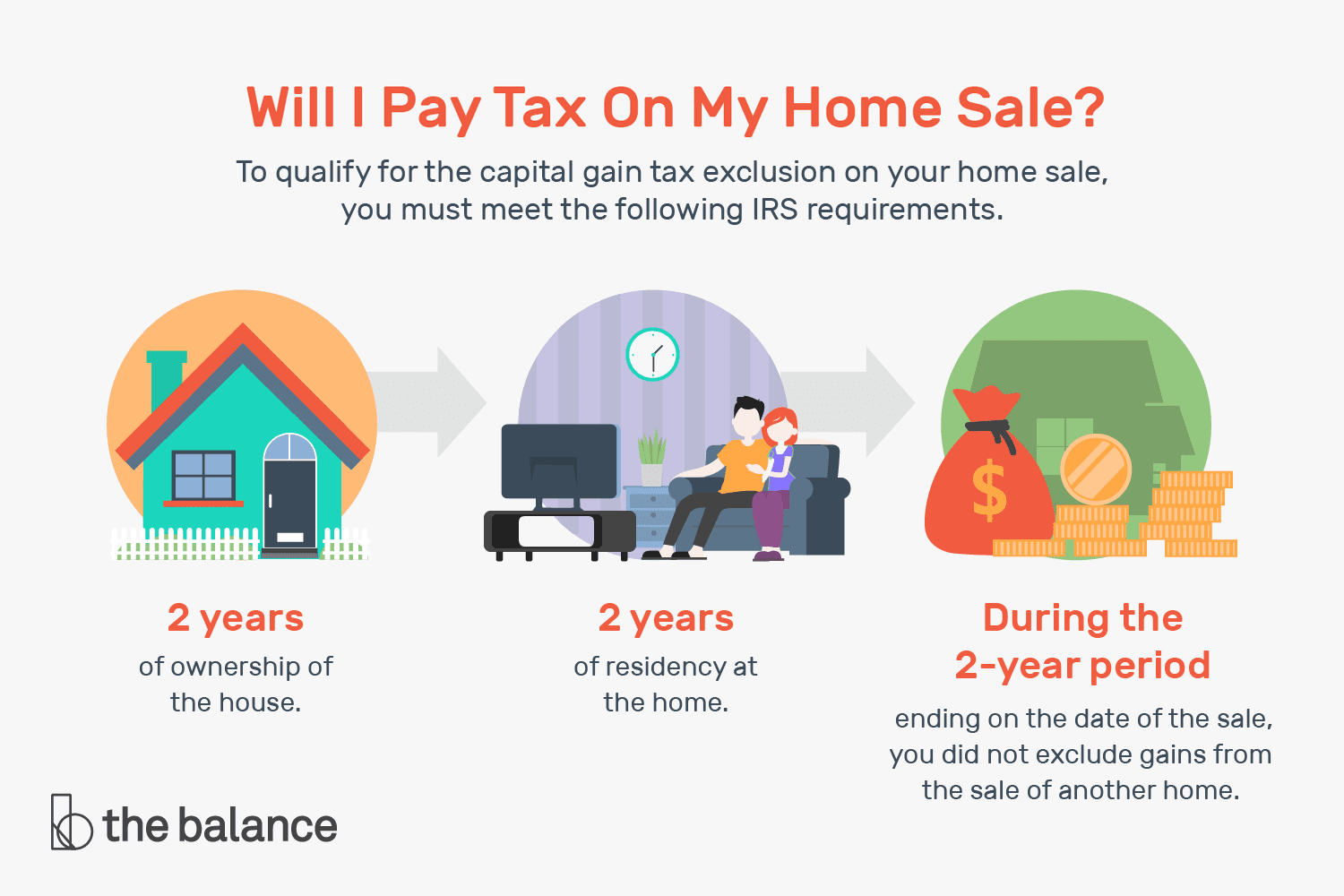

- The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing).

- The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

- What is the capital gains tax on a house in Wisconsin?

The capital gains tax rate reaches 8.75%. Wisconsin taxes capital gains as income. Long-term capital gains can apply a deduction of 30% (or 60% for capital gains from the sale of farm assets). The capital gains tax rate reaches 7.65%.

How much tax do i pay on a home sale profit in wisconsin

| How can I avoid capital gains tax on my home? | The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify. The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. |

| What is the tax that you pay when making a profit from selling a house? | In California, capital gains from the sale of a house are taxed by both the state and federal governments. The state tax rate varies from 1% to 13.3% based on your tax bracket. The federal tax rate depends on whether the gains are short-term (taxed as ordinary income) or long-term (based on the tax bracket). |