With an average effective property tax rate of 0.75%, Virginia property taxes come in well below the national average of 0.99%. Since home values in many parts of Virginia are very high, though, Virginia homeowners still pay around the national median when it comes to actual property tax payments. Not in Virginia?

What is property tax in Rockingham County Virginia?

Current County Taxes

| Classification of Tax | Tax Rate for 2022 |

|---|---|

| Real Estate | $0.68 |

| Personal Property | $3.00 |

| Vehicles | $2.65 |

| Motor Homes Only | $2.65 |

What city has the highest property tax in Virginia?

Based on that analysis, Alexandria and Falls Church have the highest adjusted effective personal property tax rates among Northern Virginia cities and are tied with Greenville for the highest in the state at $4.35 per $100 assessed value. The median rate for Virginia cities is $3.12 per $100 and $2.93 among counties.

How often do you pay real estate taxes in Virginia?

Real estate taxes are due in two equal installments. The due dates are July 28 and December 5 each year. If the due date falls on a weekend, the due date moves to the next business day. Tax bills are mailed out three to four weeks prior to the due dates.

How much are estate taxes in Virginia?

Virginia has no estate tax. It is one of 38 states not to levy a tax on an estate of any size.

What is the real estate property tax rate in Virginia?

With an average effective property tax rate of 0.75%, Virginia property taxes come in well below the national average of 0.99%.

Personal Property Taxes and Real Estate Taxes are due TOMORROW, DECEMBER 5! Information on ways to pay your bill: https://t.co/Mhod4t2KqC

— Harrisonburg VA (@HarrisonburgVA) December 4, 2023

Does Fredericksburg VA have personal property tax?

Individual. Personal property tax applies to the assessed value of tangible personal property including all motor vehicles (cars, trucks, motor homes, and motorcycles), trailers, mobile homes, and boats. The City of Fredericksburg is a prorating locality.

Frequently Asked Questions

What is tax rate in Fredericksburg VA?

5.3%

What is the sales tax rate in Fredericksburg, Virginia? The minimum combined 2023 sales tax rate for Fredericksburg, Virginia is 5.3%. This is the total of state, county and city sales tax rates. The Virginia sales tax rate is currently 4.3%.

What is the sales tax rate in Prince William County Virginia 2023?

The minimum combined 2023 sales tax rate for Prince William County, Virginia is 6%. This is the total of state and county sales tax rates. The Virginia state sales tax rate is currently 4.3%.

What is the estate tax rate in Virginia?

Virginia has no estate tax. It is one of 38 states not to levy a tax on an estate of any size.

What is the real estate tax rate in Chesterfield County VA?

$.91 per $100

The real estate tax rate is established each year after two separate public hearings have been held by the County Board of Supervisors - one hearing on the tax rate and one hearing on the budget. The 2023 tax rate is $. 91 per $100 of assessed value.

What types of taxes do we pay in Henrico County?

- Bank Franchise.

- Pari-Mutual Betting Tax.

- Property Tax – Business.

- Property Tax – Personal.

- Public Service Corporations Tax.

- Rental Property Tax.

- Sales & Use Tax.

- Transient Lodging Tax.

Does Newport News have a city tax?

What is the sales tax rate in Newport News, Virginia? The minimum combined 2023 sales tax rate for Newport News, Virginia is 6%. This is the total of state, county and city sales tax rates.

FAQ

- What are real estate taxes in Newport News city VA?

City Council met Tuesday night and voted unanimously to approve its fiscal year 2023 budget. The real estate tax rate will drop by 2 cents, providing about $4 million in tax relief to city residents. The rate will now be $1.20 per $100 of assessed property value.

- What services does Newport News provide via real estate taxes?

Real Estate Taxes aid in supporting the many services provided by the City of Newport News. Police and fire protection, schools, parks, playgrounds, libraries and refuse pick up are but a few of the services provided. If you have any questions, feel free to email the Treasurer's Office. 2.

- What is the real estate tax rate in Newport News 2023?

PUBLISHED: May 5, 2023 at 2:00 p.m. | UPDATED: May 5, 2023 at 10:00 p.m. Re “Newport News plans to reduce real estate tax rate, hire City Council assistants” (April 26): The City Council claims it will reduce the real estate tax rate by 2 cents this year from $1.20 per $100 of assessed value to $1.18.

- What is the Newport News personal property tax exemption?

The Personal Property Tax Relief Act of 1998 provides tax relief on the first $20,000 of the assessed value for qualified passenger cars, motorcycles, autocycle, and pickup or panel trucks having a registered gross weight of less than 10,000 pounds.

- What is the capital gains tax on a house in Virginia?

Virginia taxes capital gains as income with the rate reaching 5.75%. Washington State taxes capital gains at a rate of 7%. However, real estate, retirement savings, livestock and timber are exempt from this tax.

- Is there sales tax when you buy a house in Virginia?

In general, all sales, leases, and rentals of tangible personal property in or for use in Virginia, as well as accommodations and certain taxable services, are subject to Virginia sales and use tax, unless an exemption or exception is established.

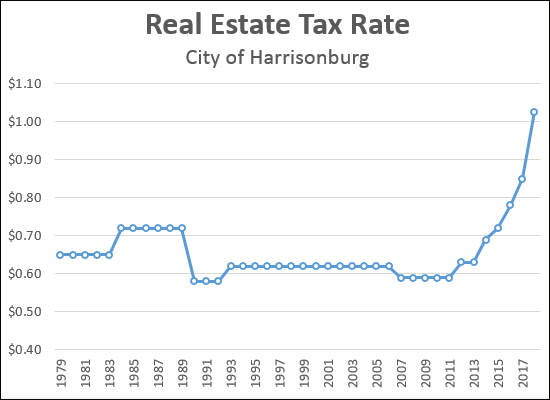

How much real estate tax in harrisonburg va

| What is the $250000 / $500,000 home sale exclusion? | There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale. |

| How can you avoid capital gains tax on the sale of your home? | Avoiding capital gains tax on your primary residence You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years. |

| How much tax do I pay in California when I sell my house? | In California, capital gains from the sale of a house are taxed by both the state and federal governments. The state tax rate varies from 1% to 13.3% based on your tax bracket. The federal tax rate depends on whether the gains are short-term (taxed as ordinary income) or long-term (based on the tax bracket). |

| How do I calculate California sales tax? | The California state sales tax rate is 7.25%. This rate is made up of a base rate of 6%, plus California adds a mandatory local rate of 1.25% that goes directly to city and county tax officials. Depending on local sales tax jurisdictions, the total tax rate can be as high as 10.25%. |

| Is sales tax based on buyer or seller in California? | In the case of California, if you are based in that state and make a sale to another location in California, any city, county or state taxes will be based on the seller's location (origin), while any district sales taxes will be based on the customer's location (destination). |

| What is the $250000 $500000 home sale exclusion? | The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9. |

- How do I calculate capital gains tax on sale of home?

- Capital gain calculation in four steps

- Determine your basis.

- Determine your realized amount.

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference.

- Review the descriptions in the section below to know which tax rate may apply to your capital gains.

- Capital gain calculation in four steps

- What is tax rate for New Kent County VA?

6%

The minimum combined 2023 sales tax rate for New Kent County, Virginia is 6%. This is the total of state and county sales tax rates. The Virginia state sales tax rate is currently 4.3%.

- How much is the late fee for property taxes in VA?

A one-time penalty of 10% of the net tax amount is charged on any tax not paid in full or postmarked on or before the tax due date [Virginia Code §58.1-3915 and Chesapeake City Code §30-512 and 30-513(g)].

- What happens if you don't pay real estate taxes Virginia?

In most cases in Virginia, if your property taxes are delinquent on December 31 following the second anniversary of the due date, the locality can start a foreclosure on your home by filing a lawsuit in court seeking permission to sell the property.

- How much is property tax in Hampton VA?

$1.16 per $100

Details on Real Estate Taxes

The real estate tax rate is $1.16 per $100 of assessed value. The tax year corresponds to the budget year, beginning in July 1 and ending on June 30 of the next calendar year.

- What is the average house tax in Virginia?

With an average effective property tax rate of 0.75%, Virginia property taxes come in well below the national average of 0.99%.