The average closing costs for sellers in California are roughly 5.35% of the home's final selling price. This is based on the latest 2022 median selling price in California (roughly $840,000) and includes realtor fees.

How does escrow work in California?

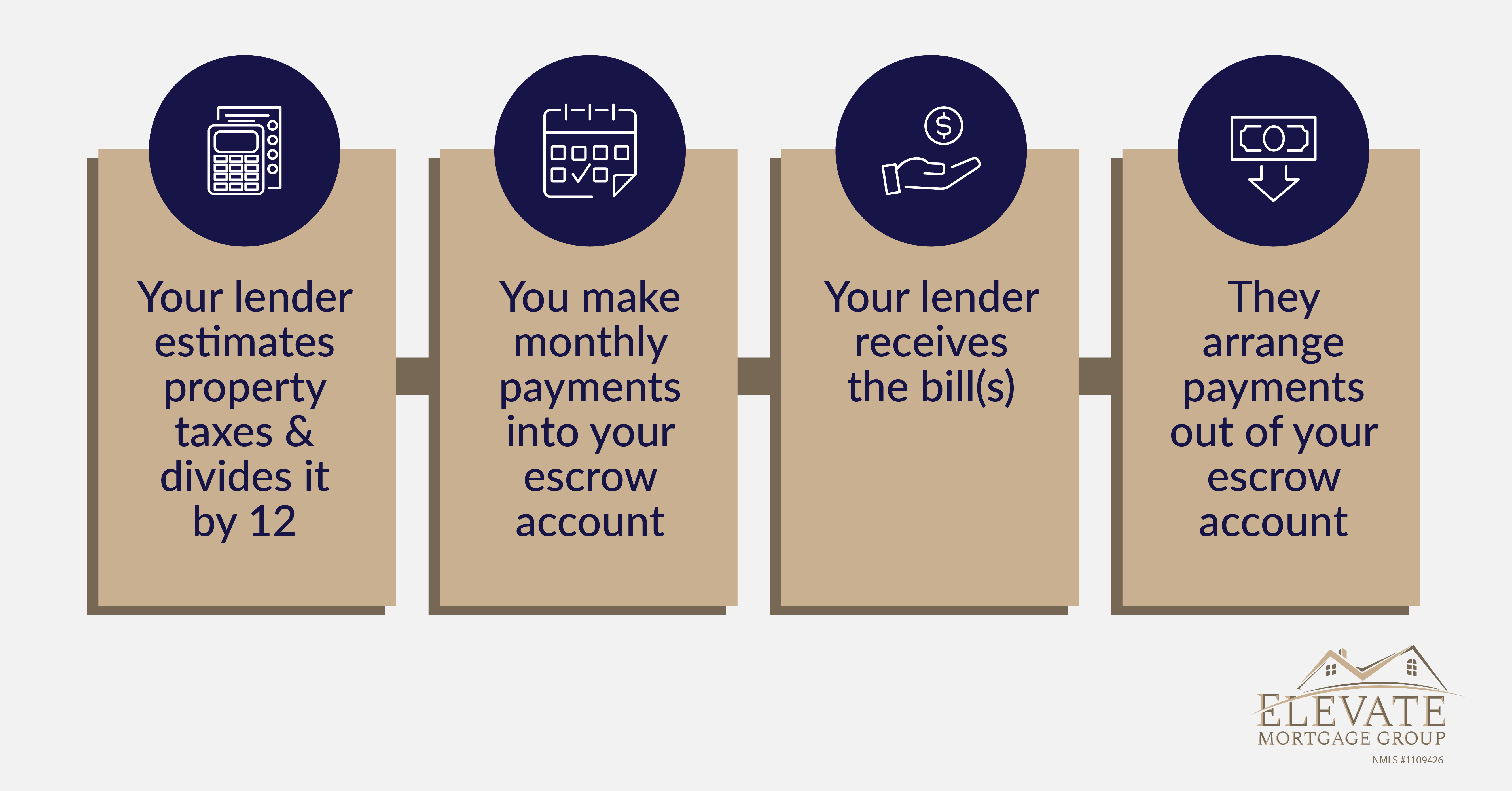

The Escrow Holder collects the Buyer's downpayment and the Lender's loan funds. At the closing, using all funds collected, the Escrow Holder pays the Seller's loans, liens, and Vendor bills approved by parties.

What are typical closing costs in California?

The average closing cost for a buyer in California is 1% of the total purchase price, as per ClosingCorp. It includes the cost of financing, property-related costs, and paperwork costs. Not all California home buyers pay the same costs at closing. It largely depends on the property's location.

What are typical escrow fees in Los Angeles?

Escrow fees for sellers range from $200 base fee plus $2 per $1,000 of sale price up to $250 base fee plus $2.50 per $1,000 of sale price. The variation depends on the escrow company used. For example, if you sold a $1,500,000 home in Los Angeles, escrow fees would be approximately $3,200 to $4,000.

Who pays closing cost in CA?

Who pays closing costs in California? In California and any state, both the buyer and the seller are responsible for a portion of the closing costs in a real estate transaction. Typically the seller pays a bit more in closing costs than the buyer.

Who pays for title insurance buyer or seller in California?

The buyer

It has been the practice in Northern California that the buyer customarily pays the premium for title insurance, or occasionally the premium is split between buyer and seller. In almost every county, the buyer pays the lender's policy premium. The parties are free to negotiate a different allocation of fees.

Who usually pays title and escrow fees in California?

In California and any state, both the buyer and the seller are responsible for a portion of the closing costs in a real estate transaction. Typically the seller pays a bit more in closing costs than the buyer.

Frequently Asked Questions

Which of the following is normally paid by the seller?

Sellers often pay real estate agent commissions, title transfer fees, transfer taxes and property taxes.

Are escrow fees typically split between the buyer and seller?

How does escrow work in a real estate transaction?

What Is Escrow? The sale of real property involves transferring large sums of money and signing important documents by you, the Seller and your lender. Escrow is the process in which an impartial third party acts as a stakeholder and facilitator for both you and the Seller. Typically this entity is the Title Company.

Who pays for closing costs in California?

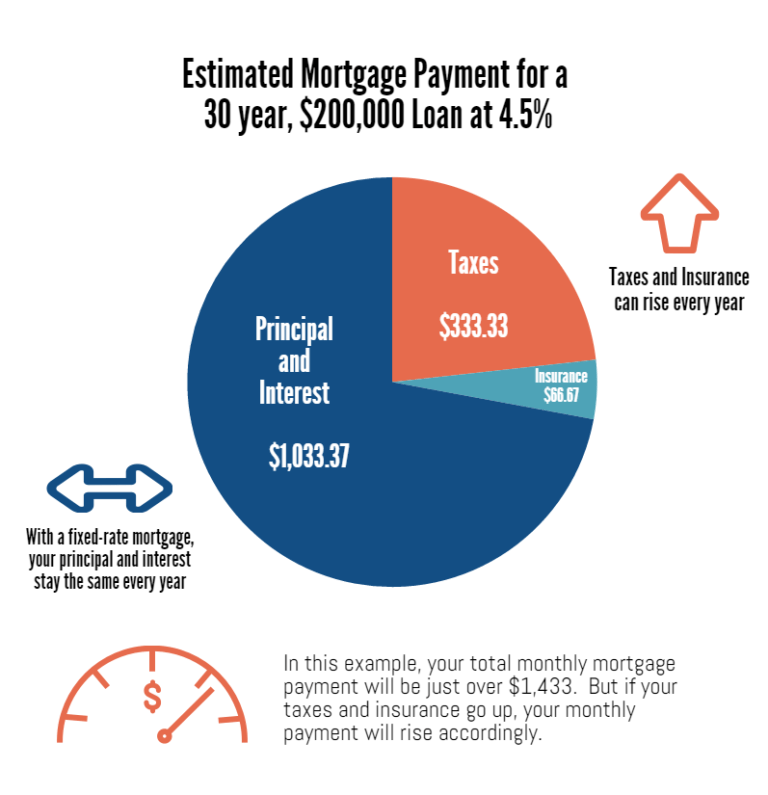

Average closing costs in California are about 1 percent of a home's sale price, according to data from ClosingCorp. For a $500,000 home, that would amount to around $5,000. These costs are split between the buyer and the seller, though, so one party would not be responsible for the full amount.

How much are closing costs for a buyer in California?

For buyers in California, closing costs typically run between 2% and 5% of the home's purchase price. For example: Average closing costs can range from ~$10,000 on the low end to ~$25,000 on a $500K house in California.

Does buyer or seller pay escrow fees in California?

How much are escrow fees and who pays them? In California, both the buyer and the seller pay the escrow agent for their work. Typically each side will be charged the same amount (but some geographies are slightly different). Escrow fees are not fixed or determined by the state of California.

FAQ

- What should the seller provide the buyer during the inspection period?

The primary seller-required disclosure is the Transfer Disclosure Statement, or TDS. This is a 3-page form on which the seller will list features of the house (type of water heater, utilities, # of garage door openers, etc), as well as listing/detailing any known defects regarding the home or property.

- Who pays for home inspection in California?

Buyer

Typically, a buyer pays for a home inspection in California. Home inspection costs are also considered a part of closing costs, but they are paid at the time of inspection. Sellers may pay for a home inspection if they perform one anytime before putting their house up for sale or before accepting an offer.

- What inspections are needed when buying a house in California?

- Types of Home Inspections in California

- General inspection.

- Foundation inspection.

- Plumbing inspection.

- Septic tank inspection.

- Termite inspection.

- Mold inspection.

- Chimney inspection.

- How much does a home inspection cost in California?

For a professional home inspection, you can expect to pay anywhere from $300 – $450 and up. Though the 2021 national average home inspection cost ranges from $280 – $400, an inspection report can ultimately save you thousands of dollars in repair costs.

- What is the inspection period in California?

Paragraph 3L(3) of the RPA automatically gives a buyer a 17-day period of time to investigate all aspects of the property.

How much do escrows charge for real estate in california

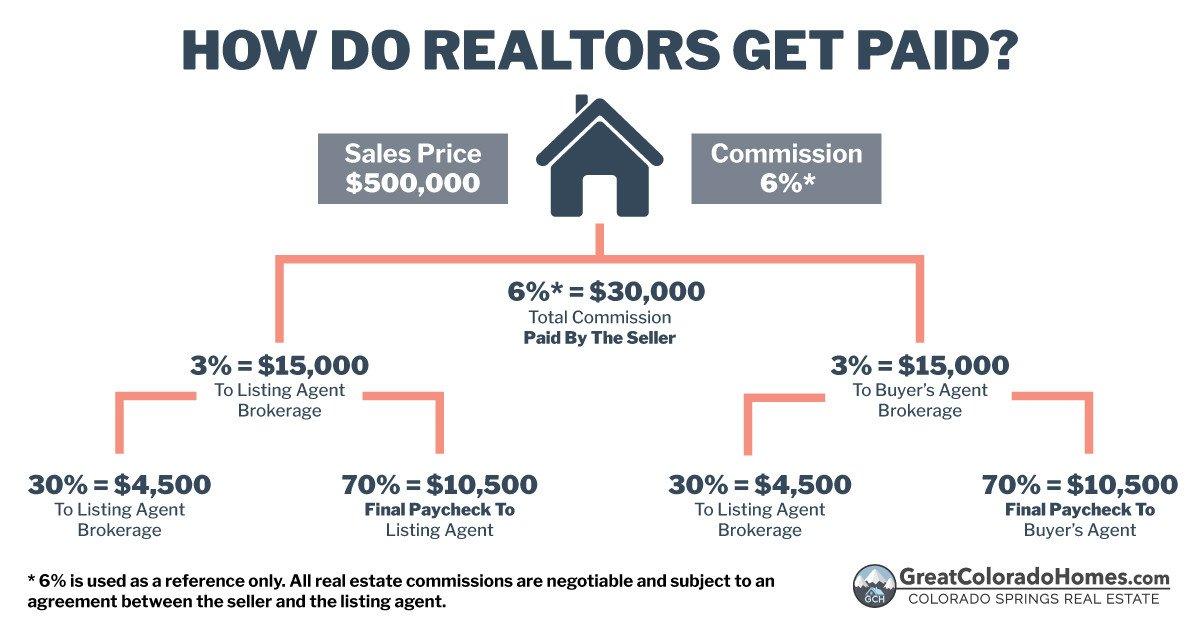

| What percentage do most realtors charge in California? | The average realtor commission in California is 4.92% of a home's sale price. That's significantly lower than the national average commission of 5.49%. Realtor commission is typically the single largest cost you'll pay when selling your home. California has a median home value of $790,475, according to Zillow. |

| How much are closing costs in California for seller? | The average closing costs for sellers in California are roughly 5.35% of the home's final selling price. This is based on the latest 2022 median selling price in California (roughly $840,000) and includes realtor fees. |

| What percentage do most realtors charge? | Nowadays, real estate commissions can be negotiated, and they typically run about 5 percent to 6 percent of a home's sale price. The exact terms of an agent's commission vary from sale to sale, and can depend on the region and which firm they work for. |

| Is 6% normal for realtor? | Negotiate the commission rate. Just because 5–6% is common, it doesn't mean that's what you have to accept. Ask your real estate agent if they're willing to take less. |

| Who pays closing costs in California buyer or seller? | Who pays closing costs in California? In California and any state, both the buyer and the seller are responsible for a portion of the closing costs in a real estate transaction. Typically the seller pays a bit more in closing costs than the buyer. |

- Who pays for title insurance in California?

The buyer

It has been the practice in Northern California that the buyer customarily pays the premium for title insurance, or occasionally the premium is split between buyer and seller. In almost every county, the buyer pays the lender's policy premium. The parties are free to negotiate a different allocation of fees.

- Who pays property taxes at closing in California?

The Seller

Typical Closing Costs Paid by the Seller

The other 1 to 3 percent may be in other closing costs like back property taxes that are owed by the seller that will have to be paid at the close of escrow. Even if the property taxes are not delinquent, these taxes are a seller responsibility until the escrow closes.

- Do buyers pay realtor fees in California?

Some home buyers avoid working with Realtors® or agents, believing it will save them money. This isn't necessary, however, because the buyer is not responsible for paying any real estate commission. Home sellers are typically responsible for paying the Realtor® commission for both their and the buyer's agents.

- What is the average escrow fee in California?

$2 per $1000

Escrow fees are not fixed or determined by the state of California. Generally, escrow agent fees in California are roughly 0.20% or $2 per $1000 of the property price plus $250 (for both the buyer and the seller). So the total for a million dollar property could be $4,500 or $2,250 per side.

- What percentage are closing costs in California?

In California, as a rule of thumb, closing costs amount to approximately 11 percent of the total sales price of a home. They usually include a real estate commission, loan fee, escrow charge, title insurance premium, a pest inspection and the like.