- Sell the inherited property quickly.

- Make the inherited property your primary residence.

- Rent the inherited property.

- Qualify for a partial exclusion.

- Disclaim the inherited property.

- Deduct Selling Expenses from Capital Gains.

What is the most you can inherit without paying taxes?

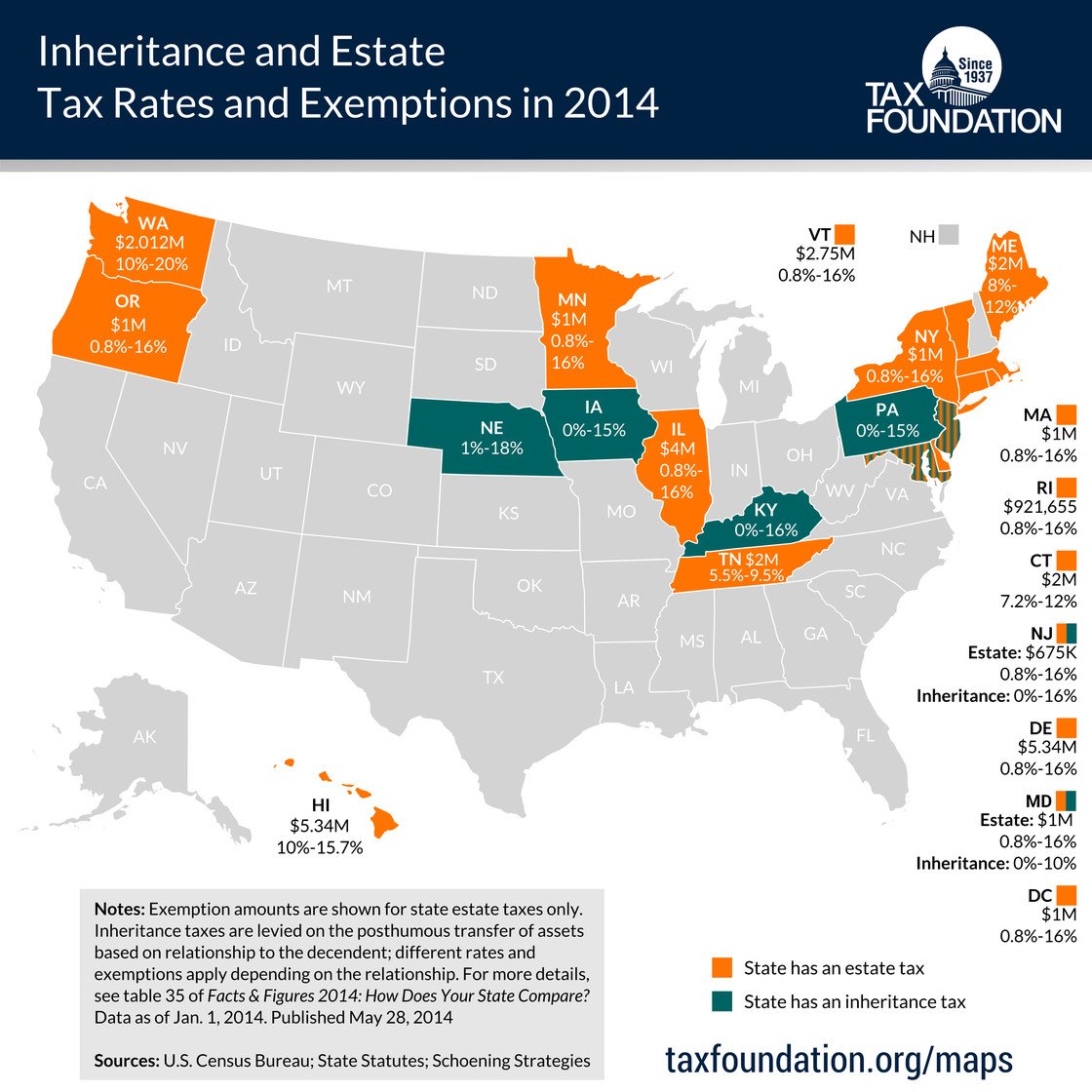

Inheritance Tax vs. Estate Tax

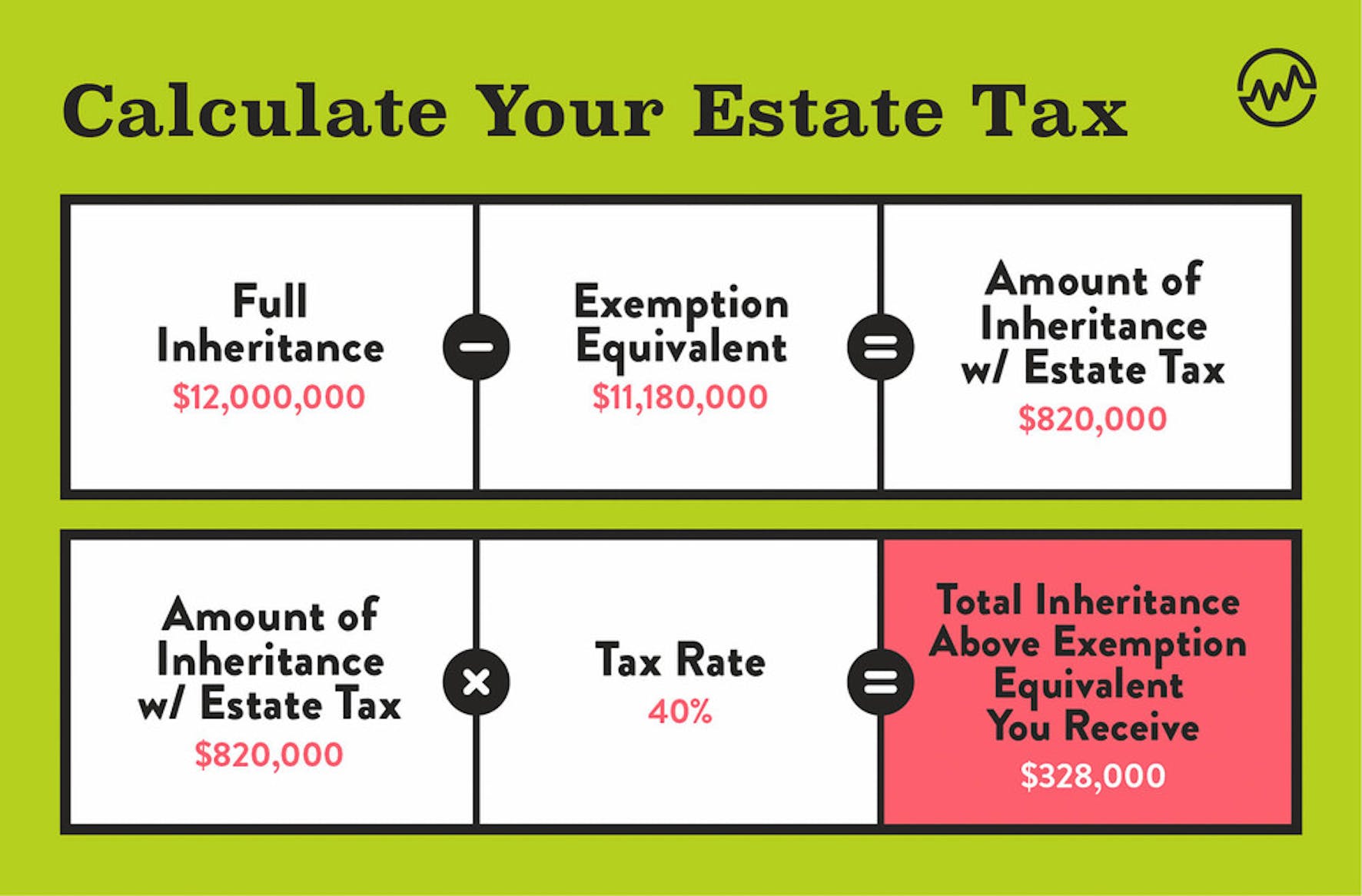

But in some rare situations, an inheritance could be subject to both estate and inheritance taxes. According to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023).

What tax is based on the value of a person’s property at death?

An estate tax is levied on the estate itself and an inheritance tax is levied against those who receive an inheritance from an estate.

Is capital gains tax paid on property of deceased?

When you inherit property, whether real estate, securities or almost anything else, the IRS applies what is known as a stepped-up basis to that asset. This means that for tax purposes the base price of the asset is reset to its value on the day that you inherited it.

What is the inherited capital gains tax loophole?

When someone inherits investment assets, the IRS resets the asset's original cost basis to its value at the date of the inheritance. The heir then pays capital gains taxes on that basis. The result is a loophole in tax law that reduces or even eliminates capital gains tax on the sale of these inherited assets.

What is the NYC enhanced real property tax credit?

The NYC Enhanced Real Property Tax Credit

NYC Enhanced Real Property Tax credit is designed for NYC residents who have a household gross income of less than $200,000 and pay either real property taxes or rent for their residences. The credit can be as much as $500.

It’s not what you make - it’s what you get to keep.

— Mitchell Baldridge (@baldridgecpa) September 16, 2023

I have helped thousands of entrepreneurs save hundreds of millions in tax by planning ahead.

My favorite framework for tax planning uses three mechanisms -

1. AVOID

2. DEFER

3. MINIMIZE

Let's dig in and save:

Rule #1 -…

Do you have to apply for enhanced star every year in NY?

Frequently Asked Questions

What is the New York City Investment tax credit?

The credit amount is a percentage of the amount of investment. The standard rate is 5% on the first $350 million, and 4% for anything above that amount. The credit is claimed against the business' tax returns. If the investment creates jobs, businesses can receive the Employment Incentive Credit.

Are estate taxes calculated on a person’s property upon death?

An Overview of Estate Taxes

For tax purposes, these levies, both federal and state, are assessed on the estate's fair market value (FMV), rather than what the deceased originally paid for their assets.

How much money can you inherit without having to pay taxes on it?

According to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed. 318 Taxes for 2022 are paid in 2023.

Who is responsible for paying a deceased person’s taxes?

Do you have to pay taxes for a deceased person?

Report all income up to the date of death and claim all eligible credits and deductions. If the deceased had not filed individual income tax returns for the years prior to the year of their death, you may have to file. It's your responsibility to pay any balance due and to submit a claim if there's a refund.

What can be deducted on a decedent’s final return?

Election for decedent's expenses.

You can deduct expenses incurred in the year of death on the final income tax return. You should file an amended return (Form 1040-X) for medical expenses incurred in an earlier year, unless the statutory period for filing a claim for that year has expired.

What debts are forgiven at death?

Upon your death, unsecured debts such as credit card debt, personal loans and medical debt are typically discharged or covered by the estate. They don't pass to surviving family members. Federal student loans and most Parent PLUS loans are also discharged upon the borrower's death.

FAQ

- What is the estate tax?

The estate tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death.

- Is estate tax federal or state?

- There is a federal estate tax and, in some states, a state estate tax. Inheritance taxes, though, are not levied at the federal level. Only six states have inheritance taxes: Nebraska, Iowa, Kentucky, Pennsylvania, Maryland and New Jersey.

- Is real estate taxes the same as property taxes in Texas?

- Real estate tax is a type of property tax that applies only to land and immovable assets. Then there is another type of tax you should be aware of: personal property tax. This kind of tax is one that companies have to pay on movable assets, such as cars, boats, RVs, and planes.

- What is a tax on real estate or personal property called?

Property ad valorem taxes—i.e. property taxes—are usually levied by local jurisdictions, such as counties or school districts. Ad valorem taxes are generally levied on both real property (land, buildings and other structures) and major personal property, such as a car or boat.

- What is an example estate tax?

An Overview of Estate Taxes

For example, if a house was bought at $5 million, but its current market value is $4 million, the latter amount will be used. Anything in the estate that is bequeathed to a surviving spouse is not counted in the total amount and isn't subject to estate tax.

- How much is NYS estate tax?

New York Estate Tax Rate

The estate tax rate for New York is graduated. It starts at 3.06% and goes up to 16%. The taxable estate is the value of the estate above the $6.58 million exemption (unless the estate reaches that cliff of 105% of $6.58 million, then the whole estate is taxable).

- What is the NYS estate tax exemption for 2026?

Spread Between Federal and New York State Estate Tax Exemptions

Date of Death Federal Exclusion Spread January 1, 2019, to December 31, 2025 $11,400,000* $5,660,000* January 1, 2026, and beyond $5,740,000** ~$0**

How is real estate taxed at death

| How is property tax calculated in NY? | The amount of your property tax bill is based on your property's taxable assessment and local tax rates. Local governments determine tax rates by dividing the total amount of money that has to be raised from the property tax (the tax levy) by the taxable assessed value of real property in the municipality. |

| How often do you pay property tax in NY? | Four times a year New York City's fiscal year for property taxes is July 1 to June 30. The Department of Finance mails property tax bills four times a year. You will pay your property taxes two or four times a year, depending on the property's assessed value. |

| How to avoid nys estate tax? | Generally, for New York estate tax purposes, if the value of assets passing to beneficiaries other than a spouse or charity is below a certain threshold ($6.58 million in 2023), the assets are fully exempt from tax and no New York estate taxes will be due. |

| Who pays capital gains taxes when there are multiple heirs? | Generally, the capital gains pass through to the heirs. The estate reports the gain on the estate income tax return, but then takes a deduction for the amount of the gain distributed to the heirs since this usually happens during the same tax year. |

| Does the sale of inherited property count as income? | Any gains when you sell inherited investments or property are generally taxable, but you can usually also claim losses on these sales. |

| Do I have to report the sale of inherited property to the IRS? | The gain or loss of inherited property must be reported in the tax year in which it is sold. The sale goes on Schedule D and Form 8949 (Sales and Other Dispositions of Capital Assets). Schedule D is where any capital gain or loss on the sale is reported. |

| How to avoid capital gains tax when selling inherited property? | How to Minimize Capital Gains Tax on Inherited Property

|

- What happens if 3 siblings inherit a house?

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others' shares, or whether ownership will continue to be shared.

- How much can you inherit without paying taxes in Oregon?

$1 million

The Oregon estate tax is a tax that is levied on the transfer of the estate of a deceased person. It is separate from the federal estate tax, which is a tax on the transfer of the estate of a deceased person at the federal level. The Oregon estate tax applies to estates with a value of more than $1 million.

- Are heirs accountable for estate tax?

Liability for the estate tax falls on the estate assets and is limited by the value of those assets. Executors and beneficiaries generally do not have personal liability for estate taxes although the IRS can come after the assets held by the executor and beneficiaries if the taxes are left paid.

- Are estate taxes calculated on the ___ of a person's property at death?

An Overview of Estate Taxes

For tax purposes, these levies, both federal and state, are assessed on the estate's fair market value (FMV), rather than what the deceased originally paid for their assets.

- How do I get around real estate inheritance tax?

- Here are 4 ways to protect your inheritance from taxes:

- See if the alternate valuation date will help. For tax purposes, the estates are evaluated based on their fair market value at the time of the decedent's death.

- Transfer your assets into a trust.

- Minimize IRA distributions.

- Make charitable gifts.

- Here are 4 ways to protect your inheritance from taxes:

- How much can you inherit from your parents without paying taxes?

According to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed. 318 Taxes for 2022 are paid in 2023.