How do I invest in real estate with equity?

Using Home Equity to Buy an Investment Property

If you have equity in your home, you may be able to tap some or even all of it with a home equity loan, which offers a lump-sum payment, a fixed interest rate and a fixed repayment term.

Can I use my equity to buy another house?

Which is better equity or real estate?

When it comes to comparing real estate vs equity investments, both choices have their unique advantages and disadvantages. While a real estate investment offers stable returns and tax benefits, an equity investment has the potential for high returns and easy diversification.

What is the 2% rule in real estate?

The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

Is real estate good for beginners?

No matter what your starting point is, there is no reason real estate should be off-limits. Several investing strategies can serve as a gateway into a successful career in real estate. Take some time to learn about real estate investing for beginners and find the right strategy for you.

I respect Trent but I strongly disagree with this.

— Nick Huber (@sweatystartup) August 2, 2023

Real estate isn’t passive - it is a small business disguised as a building and is insanely risky for the average person.

They couldn’t manage the building.

A home is a great, approachable, realistic investment for most ppl. https://t.co/kWd9uC4sJg

Is real estate worth it now?

These 6 charts show just how bad things are for buyers. Record-high monthly mortgage payments and low home inventory have made the housing market historically unaffordable. Home listings and homebuyer demand have also both tumbled since last year.

Frequently Asked Questions

How to start real estate with $1,000 dollars?

- Fractional Ownership in Properties. Several platforms let you buy fractional shares of individual properties.

- Publicly-Traded REITs.

- Real Estate Crowdfunding: Private REITs.

- Real Estate Crowdfunding: Loans.

- Private Notes.

- Real Estate Wholesaling.

- Invest in Land.

- House Hack.

Why real estate is a safe investment?

Benefits of Real Estate Investing

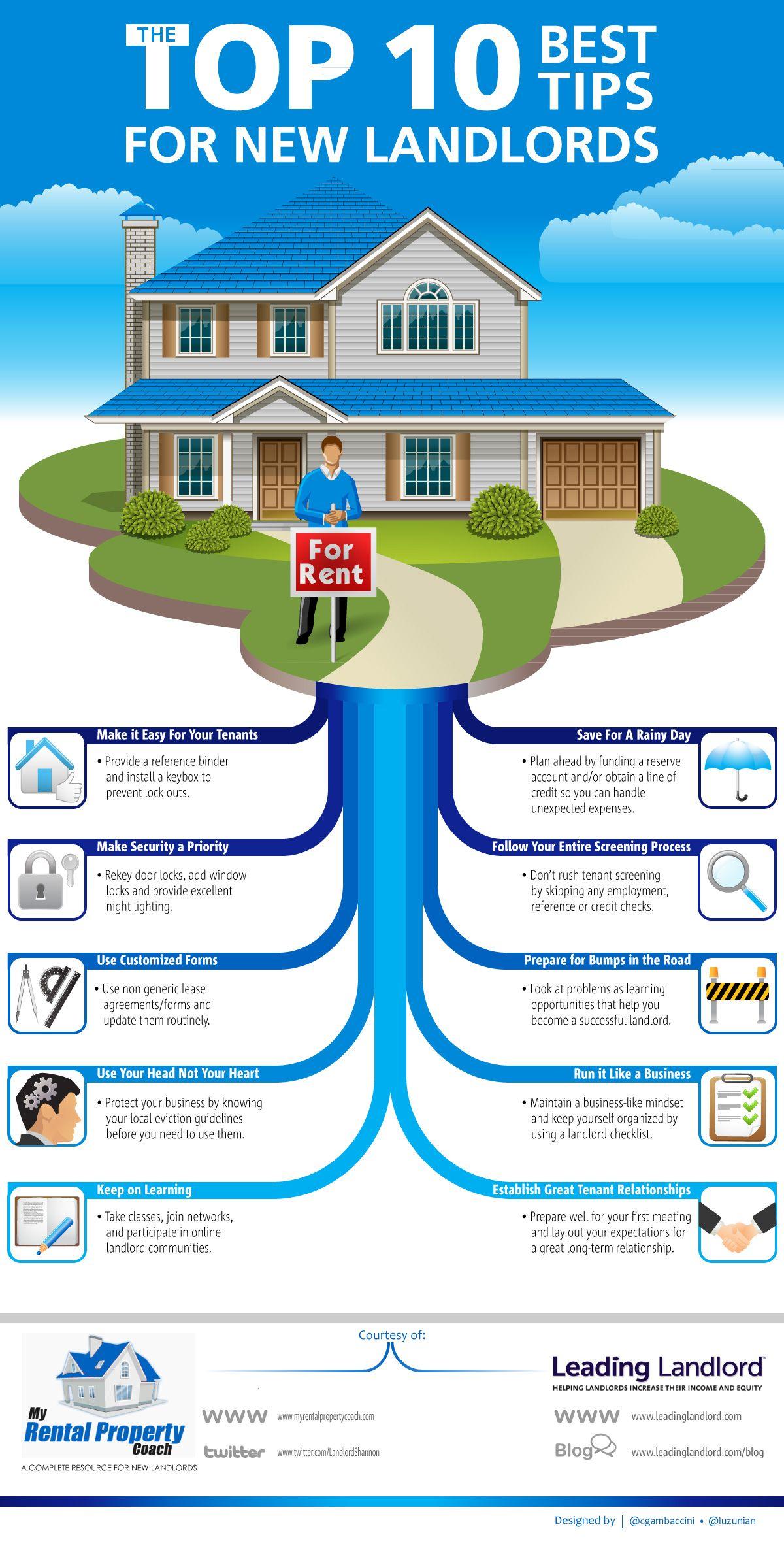

The cash flow is also steady as you receive rent from tenants every month, so you can count on receiving that money. Long-term security: Real estate is usually a long-term investment, though some investors may use flipping to gain short-term returns.How profitable is real estate?

What is the best age to invest in real estate?

In reality, your 20s and 30s are an ideal time to begin investing in real estate. Passively investing in real estate is especially attractive to those who are just learning about the real estate industry. Or for those who simply don't have the time, interest, or resources to invest in property directly.

Can 18 year olds invest in real estate?

Before you begin, spend some time educating yourself on how other real estate entrepreneurs become successful. You'll also want to make sure you put yourself in the mindset that this is going to be a long-term investment and not some get-rich-quick overnight plan.

What is the average age of a real estate investor?

Real Estate Investor age breakdown

The average age of real estate investors is 40+ years years old, representing 71% of the real estate investor population.

Is 5000 enough to invest in real estate?

Despite the common misconception that you need a lot of financial capital to begin investing in real estate, you can start with as little as $5,000. Your chances of success can increase if you diversify your investments — especially should some deals not go as planned!

What creates an estate?

The property that a person leaves behind when they die is called the “decedent's estate.” The “decedent” is the person who died. Their “estate” is the property they owned when they died. To transfer or inherit property after someone dies, you must usually go to court.

How do you pass assets to heirs before death?

The most common way to give an inheritance before death is to write a will and designate specific beneficiaries. This may be done in one of two ways - either by leaving the property or money directly to the person who you want to get it or by placing it in trust so that it goes directly to them after your death.

How do you transfer an estate?

- Joint tenants. You don't need a grant of probate to transfer the inherited property.

- Sole owner. You would need to obtain a grant of probate.

- Tenants in common. You would almost always need a grant of probate.

How do you pass an investment property?

- Bequeath Your Properties to Your Beneficiaries.

- Add Co-Owners to Property Deeds.

- Create a Family or Living Trust.

- Sell Your Turnkey Rental Properties.

What is an estate vs house?

The word estate is mostly used to mean a massive and fabulous house on a big piece of land. When you own an estate, it usually means you have a whole lot of money to go along with it.

FAQ

- How do I educate myself in real estate?

- Read Real Estate Books

Many different books about real estate can provide you with information on the topic. These books can range from introductory guides to more in depth tutorials. By reading these books, you will learn about the basics of real estate and get an idea of what to expect from the process.

- What are the basics to know about real estate?

- 16 Things to Know About Real Estate Investing

- Location, location, location – Location is everything in real estate.

- The real estate market is dynamic.

- You can invest with little to no money.

- Real estate education is key.

- A mentor can help you in your real estate investing journey.

- A business plan is necessary.

- Where do I start if I know nothing about real estate?

- Best ways to invest in real estate

- Buy REITs (real estate investment trusts) REITs allow you to invest in real estate without the physical real estate.

- Use an online real estate investing platform.

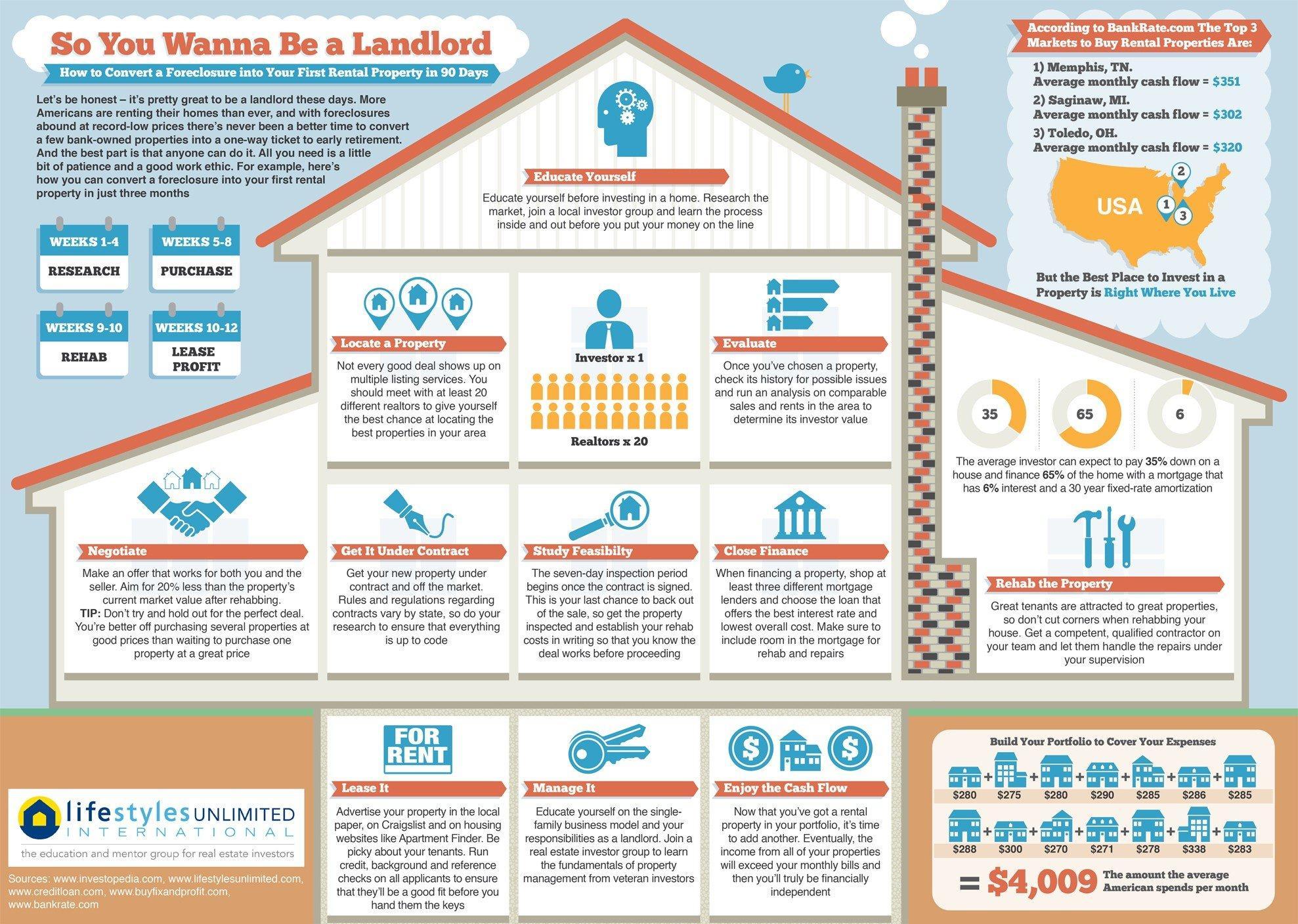

- Think about investing in rental properties.

- Consider flipping investment properties.

- Rent out a room.

- What is the easiest way to start in real estate?

One of the fastest ways to get started in real estate is by wholesaling. This unique strategy involves securing a property under market value and assigning an end buyer to purchase the contract. Wholesalers never own the property and instead make money by adding a fee to the final contract.

- Can real estate be self taught?

There are different sources that are beneficial for those who do not want to use online courses. You can still be able to learn real estate investing through books, blogs, mentors, experienced real estate investors and much more. Let us briefly discuss each one.

- Misc bodybuilding learn how to invest real estate

Aug 3, 2022 — I know 90% of "lol @ rentcels" miscers are LARPing and are ... He gives terrible advice especially when it comes to investing in real estate.

- How do you invest in real estate to make money?

- There are generally four different ways to make money in real estate:

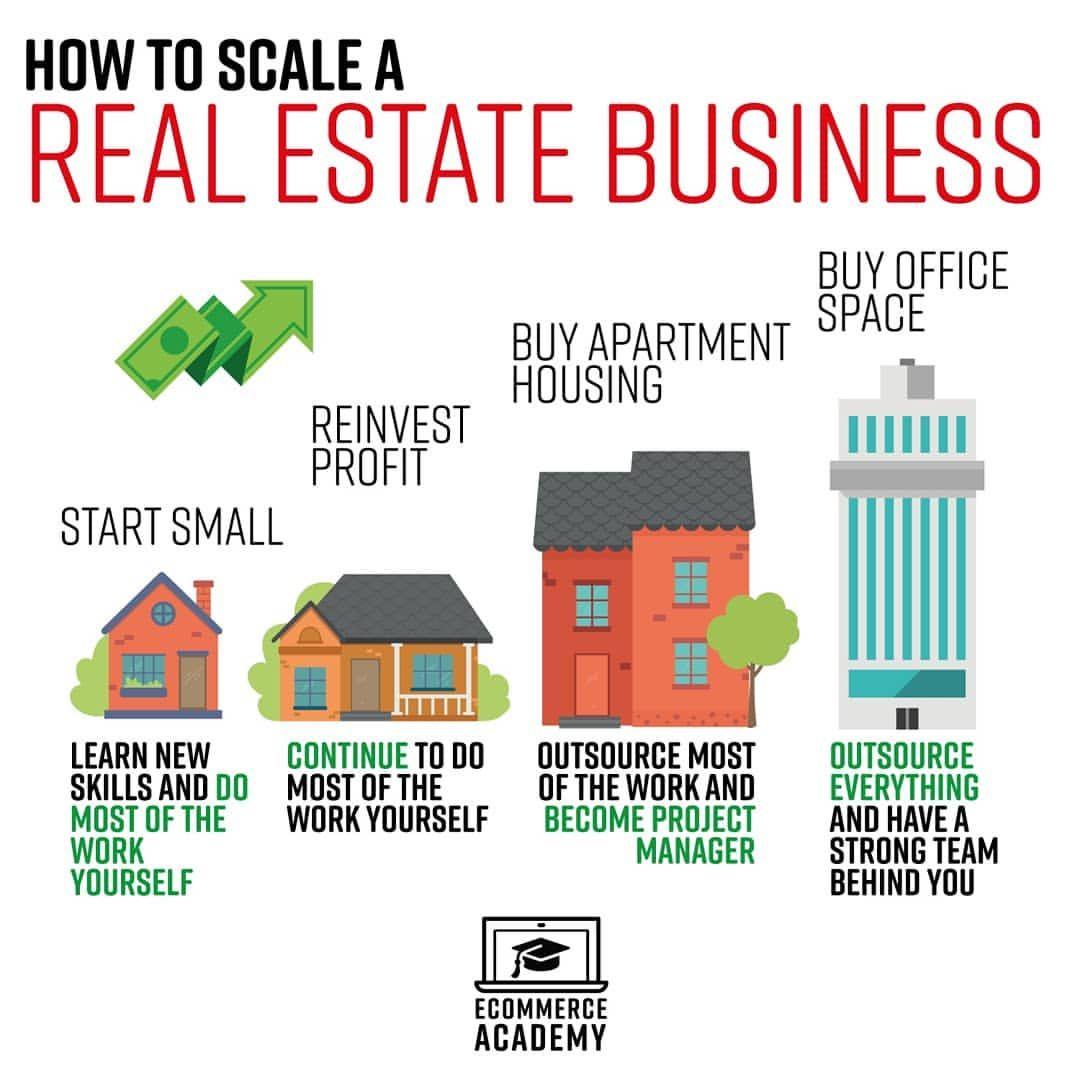

- Increase a property's value.

- Generate regular income through a property.

- Buy and hold residential real estate.

- Participate in investments that don't require you to buy property.

- How does a beginner invest in real estate?

You can invest $10,000 dollars in real estate by flipping houses, becoming a landlord, crowdfunding sites, REITs, and more. Most real estate investing platforms require less than $10,000 to start investing in single-family rental properties, individual properties, and venture funds.

- Is real estate a good way to invest your money?

On its own, real estate offers cash flow, tax breaks, equity building, competitive risk-adjusted returns, and a hedge against inflation. Real estate can also enhance a portfolio by lowering volatility through diversification, whether you invest in physical properties or REITs.

- What is the 2% rule for investment property?

2% Rule. The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

- How to invest $100 000 dollars in real estate?

- How to Invest $100k in Real Estate

- Residential Property for Long-Term Renters.

- Short-Term Rental Property.

- Flipping a House or Condo.

- Multi-Family Rentals.

- Commercial Property.

- Stocks in Real Estate Companies.

- REITs.

- Joint Ventures.

- Is it hard starting in real estate?

Key Takeaways. Working as a real estate agent or broker can be fulfilling and financially rewarding, but it's not easy. A career in real estate requires drumming up business, promoting yourself, tracking leads, handling complex paperwork, providing customer service, and much, much more.

How is real estate

| How to make money with real estate? | How To Make Money In Real Estate: A Guide For Beginners

|

|||||||||||||||

| What do most realtors make their first year? | First Year Real Estate Agent Salary

|

|||||||||||||||

| How does real estate work in simple terms? | Real estate is a form of real property, meaning that it is something you own that is attached to a piece of land. It can be used for residential, commercial or industrial purposes, and typically includes any resources on the land such as water or minerals. |

|||||||||||||||

| How exactly do you make money from real estate? | There are four main money making strategies for real estate investors: buy a property and wait for it to appreciate in value; rent out a property to tenants or businesses to generate cash flow; invest in residential properties; invest in real estate projects or find other work in the industry. |

|||||||||||||||

| Is real estate good income? | The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage. Real estate investment trusts (REITs) offer a way to invest in real estate without having to own, operate, or finance properties. |

|||||||||||||||

| Is the investor the buyer or seller? | Investors are people or companies that want to purchase your home in order to make money. So negotiations will go differently (and hopefully easier) than they would if the buyer was going to live on your property. But sometimes the investor(s)' intention should be reason enough to give you pause. | |||||||||||||||

| How does a real estate investment company work? | In search of profits, real estate investment groups may choose to buy, renovate, sell, or finance properties. Real estate investment groups commonly buy out multi-unit properties, selling units to investors while taking responsibility for administration and maintenance of the property. |

|||||||||||||||

| What is the difference between a realtor and a real estate investor? | Working in real estate is exactly what a real estate agent does. He/she only deals with real estate transactions and not the properties themselves. On the other hand, a real estate investor is the one who makes a living by purchasing investment properties and using them to generate money in the long-term. |

|||||||||||||||

| How much property is owned by investors? | According to data reported by the PEW Trust and originally gathered by CoreLogic, as of 2022, investment companies own about one fourth of all single-family homes. Last year, investor purchases accounted for 22% of American homes sold. |

|||||||||||||||

| Do investors become the owners? | Investors in stocks are buying an ownership interest in a company; they become real "owners" of the company. Investors in bonds are buying a debt interest in a company; they become "creditors" of the company, not owners. | |||||||||||||||

| How does an investor get paid from real estate? | There are three primary ways investors could potentially make money from real estate: An increase in property value. Rental income collected by leasing out the property to tenants. Profits generated from business activity that depends upon the real estate. |

- How much do investors usually pay for houses?

Many investors use the 70% rule to identify whether your home will be a good investment for them. This rule states that they need to pay no more than 70% of what they can sell it for once they fix it up and sell it for a move-in ready full market price for an investment to be worth their while.

- Do investors pay asking price?

Most investors buy properties below market value, so they might try to negotiate down the price of the house. Whereas a traditional buyer is more likely to pay your asking price. Investors aren't legally required to tell you who's purchasing your home or why they want to buy it.

- Where do investors get their money from?

How Do Investors Make Money? Investors make money in two ways: appreciation and income. Appreciation occurs when an asset increases in value. An investor purchases an asset in the hopes that its value will grow and they can then sell it for more than they bought it for, earning a profit.

- What do investors get in return for real estate?

- Capital appreciation is perhaps the most obvious source of real estate investment return. It refers to how much a property gains in value over time. So if you buy a property for $100,000 and you are able to sell it later for $200,000, your capital appreciation would be $100,000 ($200,000 – $100,000 = $100,000).

- What is the basic understanding of real estate?

What Is Real Estate? Real estate is defined as the land and any permanent structures, like a home, or improvements attached to the land, whether natural or man-made. Real estate is a form of real property.

- What is the 7 rule in real estate?

Essentially, the property must be paid off in 7 years (or less). This is my favorite rule: as a cash flow guy, I look forward to getting my capital back as soon as possible, and that is what I think of when investing.

- How to learn about real estate?

- Participating in real estate seminars and relevant events will help you learn about the current trends in the real estate industry. Conferences and workshops bring you an opportunity to listen to many successful real estate professionals in one place.

- How technology has helped real estate?

Property Management and Maintenance: Technology has greatly improved property management processes. Internet of Things (IoT) devices allow for remote monitoring and control of various aspects of a property, including security systems, temperature control, and energy management.

- What are the 3 most important factors in real estate?

- Home prices and home sales (overall and in your desired market) New construction. Property inventory. Mortgage rates.

- What type of technology does a real estate agent use?

- A CRM (client relationship management) tool is vital for every single agent. It tracks your clients through the buying or selling process, records your lead sources so you can see which marketing efforts are paying off, and reminds you to follow up with old leads and past clients to earn repeat business and referrals.

- How technology will impact real estate?

- Greater Access to Information: One of the most significant impacts of technology on the real estate industry is the increased access to information. Online databases and real estate portals have made it easier for buyers and sellers to research properties, compare prices, and evaluate market trends.