When Do You Pay Taxes on the Sale of a House You Inherited?

Discover the crucial details about when taxes must be paid on the sale of an inherited house in the United States. Learn about the timelines, exemptions, and potential deductions to ensure a smooth process.

Inheriting a house can be a bittersweet experience. While it can bring about a sense of loss, it also presents an opportunity for financial gain. However, it is important to understand the tax implications associated with the sale of an inherited house in the United States. This article aims to shed light on the crucial question: "When do you pay taxes on the sale of a house you inherited?"

Understanding the Timelines

- Federal Estate Tax:

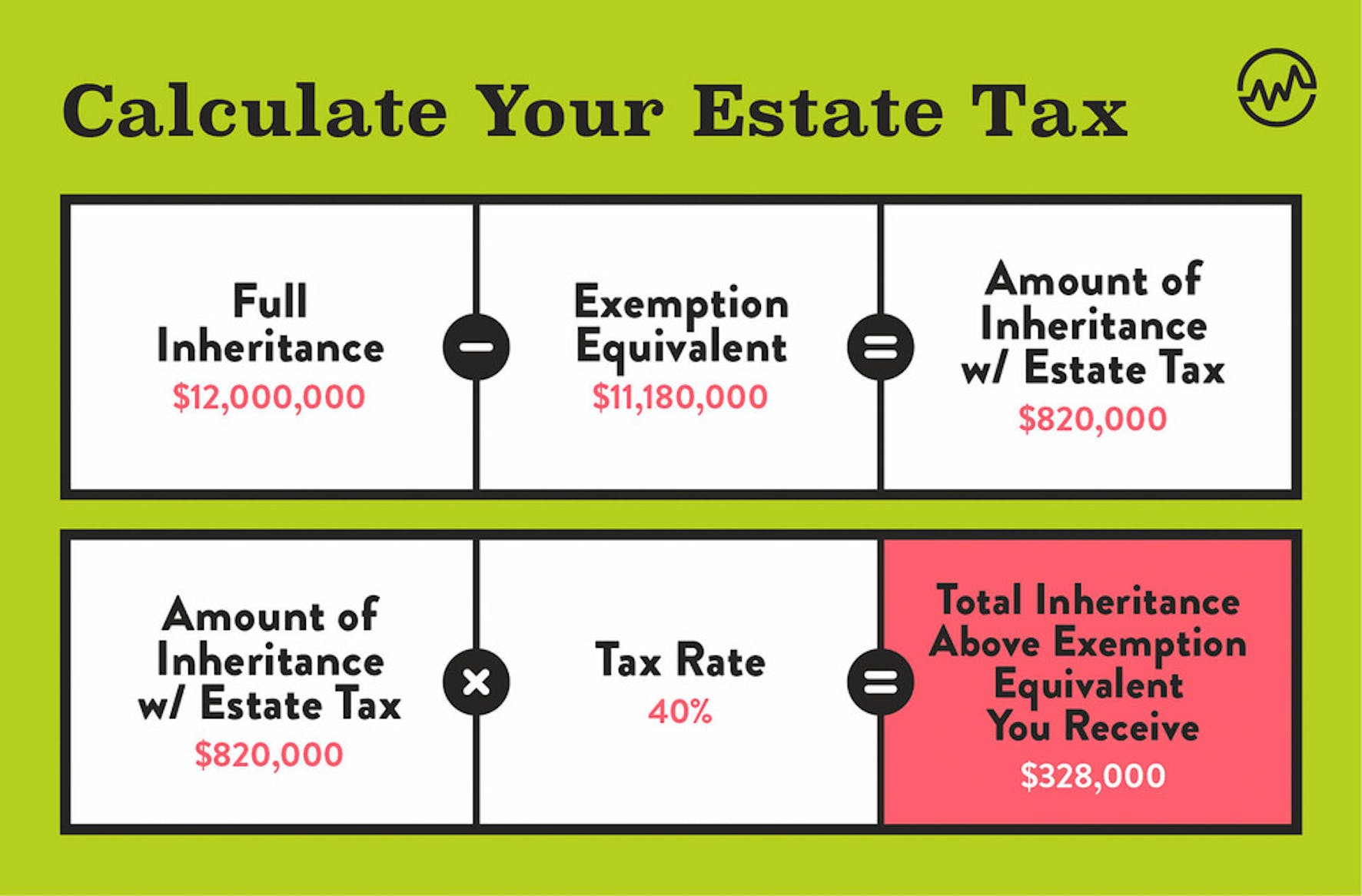

When a loved one passes away and leaves you a house, the first thing you need to determine is whether the estate is subject to federal estate tax. In the United States, only estates valued above a certain threshold are subject to this tax. As of 2021, the estate tax exemption is set at $11.7 million for individuals and $23.4 million for married couples. If the estate's value exceeds these thresholds, you may need to pay federal estate taxes. However, it's important to note that

Does the sale of inherited property count as income?

How to avoid capital gains tax when selling inherited property?

- Sell the inherited property quickly.

- Make the inherited property your primary residence.

- Rent the inherited property.

- Qualify for a partial exclusion.

- Disclaim the inherited property.

- Deduct Selling Expenses from Capital Gains.

Do I have to report the sale of inherited property to the IRS?

What expenses can you deduct when selling an inherited home?

Out of the following, what expenses are allowed - interior repairs and painting, interior cleaning, exterior power washing, new HVAC and new appliances. All of the repairs, maintenance, and improvements to the property can be added to the basis of an inherited property when determining the gain (or loss) on the sale.

How to calculate capital gains on sale of inherited property?

- Calculate your capital gain (or loss) by subtracting your stepped up tax basis (fair market value of the home) from the purchase price.

- Report the sale on IRS Schedule D.

- Copy the gain or loss over to Form 1040.

Capital gains taxes apply when you inherit a property that appreciates in value. However, there are ways to mitigate this tax, such as the IRS's stepped-up basis program. Read our guide to learn how to avoid capital gains tax on inherited property. ⬇️https://t.co/VtbyyN0zyP

— SuperMoney (@supermoney) November 17, 2022

What happens when you sell a house you inherited?

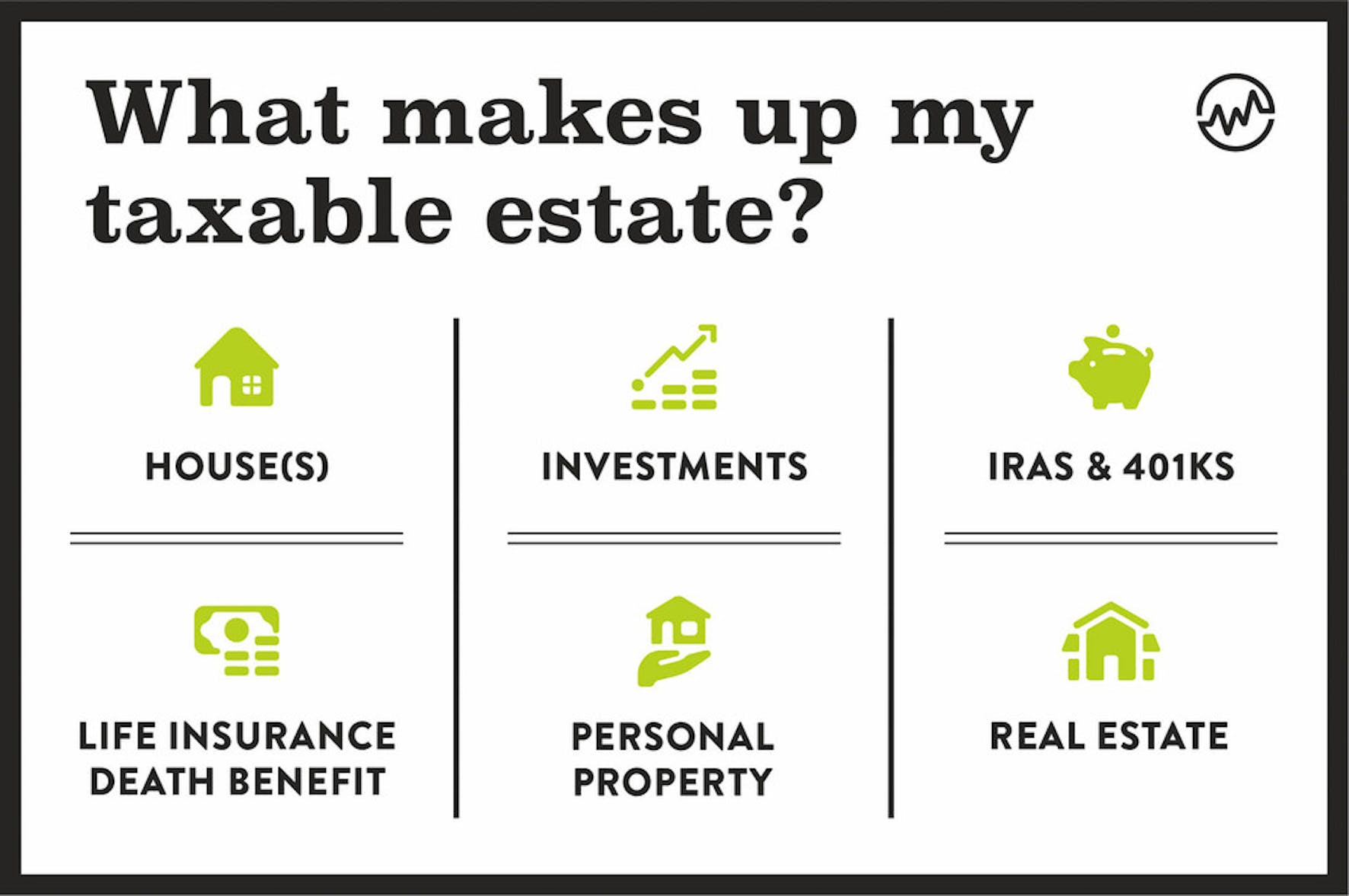

If you sell a property that you inherited, it could trigger certain taxable events. Notably, the sale of an inherited house would result in capital gains taxes. These taxes would be applied to the difference between the property value at the time of inheritance and the final sale price.

Frequently Asked Questions

What happens when you inherit a house from your parents?

Is money from the sale of an inherited house considered income?

How does capital gains tax work when you inherit a house?

FAQ

- How is capital gains calculated on sale of inherited property?

Capital gains on inherited property work a little differently than other assets. When you sell the home, your entire profit isn't taxable. Instead, you're taxed on the property's sale price minus its market value on the date of the owner's death.

- What is the cost basis for selling an inherited house?

Selling the property

Any taxes you pay on the sale of inherited property are determined by cost basis. For example, if you inherit a house worth $500,000 on the date of the owner's death, its cost basis would be $500,000. If you sold it for $600,000, you would owe capital gains tax on the additional $100,000.- What happens when 3 siblings inherit a house?

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others' shares, or whether ownership will continue to be shared.

How is inherited real estate taxed when sold

| What is the capital gains tax rate on the sale of an inherited home? | If the home value goes down and you sell the property for less than the value at which you inherited it, then you would also not incur any capital gains tax. The IRS considers inherited property to be long-term capital gain. The tax rate would be 0%, 15%, or 20%, depending on your income bracket. |

| What taxes are owed on sale of home inherited | Jun 15, 2023 — If you sell the property for more than your basis, you have a taxable gain. · For information on how to report the sale on Schedule D, see |

- How much can you inherit from your parents without paying taxes?

According to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed. 318 Taxes for 2022 are paid in 2023.

- How does selling an inherited house affect taxes?

In the State of California, you won't owe any inheritance tax on the property, but if you sell the home, you'll likely owe capital gains tax on any value that exceeds what the house was worth at the time of your relative's passing.