The value of a property you own — including your residence — can rise enough that you can sell it and make a profit. You can collect rent on property you own. You can receive dividends through non-physical real estate investments like real estate investment trusts, called REITs.

How does investment work in real estate?

Quick turn investing means buying property with the intention of selling it quickly (often called “flipping”). Long term investing means buying property to rent or lease over a long period of time, gaining both the rent and the increasing value of the property over time.

How should a beginner invest in real estate?

Best ways to invest in real estate

- Buy REITs (real estate investment trusts) REITs allow you to invest in real estate without the physical real estate.

- Use an online real estate investing platform.

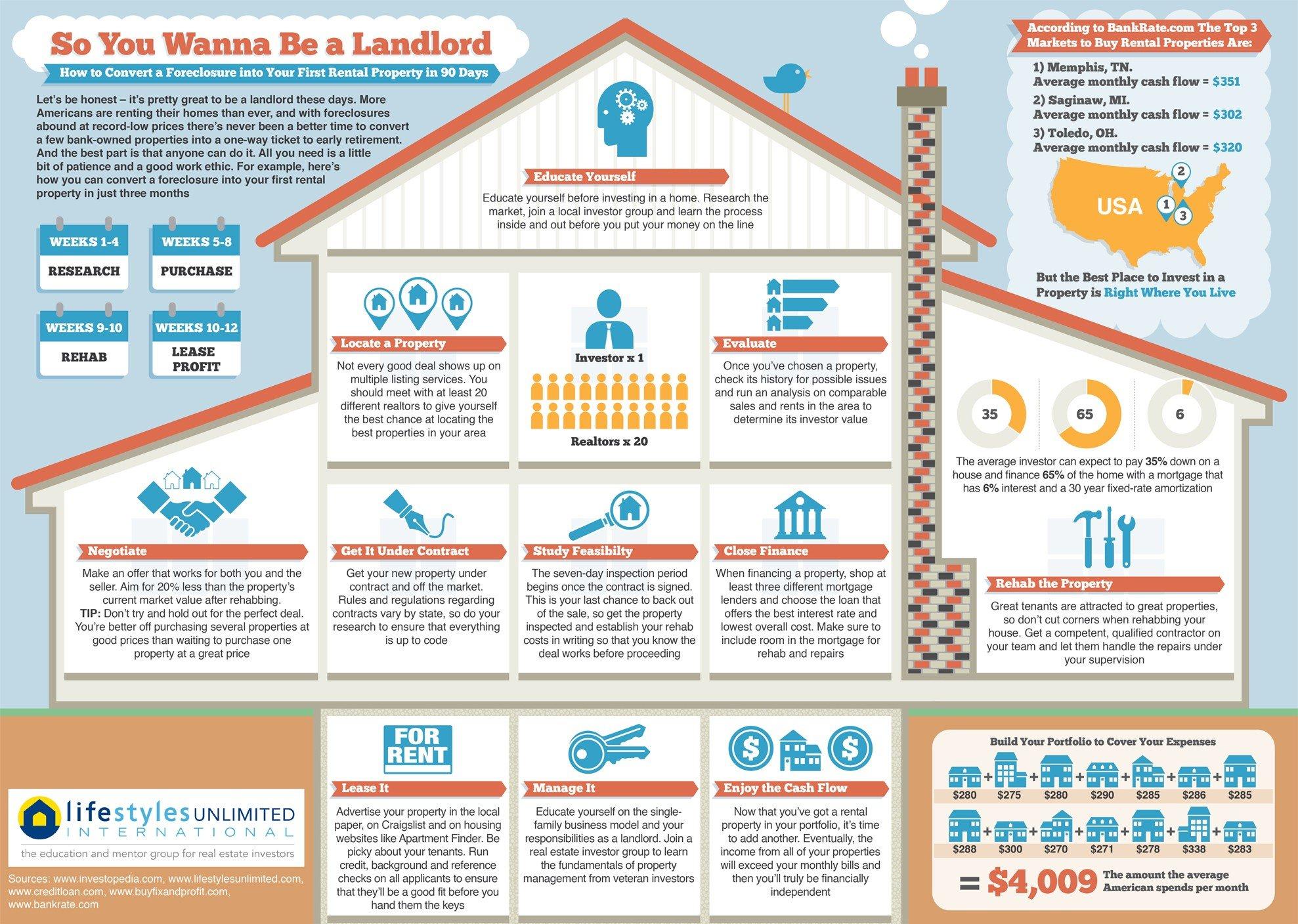

- Think about investing in rental properties.

- Consider flipping investment properties.

- Rent out a room.

Is it a good idea to invest in real estate?

Real estate investments can serve as a hedge against inflation. Real estate ownership is generally considered a hedge against inflation, as home values and rents typically increase with inflation. There can be tax advantages to property ownership.

How can I invest 5000 dollars and make money?

Here are seven of the best ways to invest $5,000, according to experts:

- S&P 500 index funds.

- International stocks.

- Smart beta funds.

- Certificates of deposit.

- Money market funds.

- Target-date funds.

- Real estate investment trusts.

What city has the hottest real estate market?

Hottest Housing Markets for Demand

- Raleigh, North Carolina – 76.4.

- Durham, North Carolina – 74.8.

- Denver – 74.4.

- Phoenix – 69.6.

- Greeley, Colorado – 69.4.

3 Things to note before investing in Real estate.

— LIGHT OF THE WORLD ? ? (@iduatei) May 18, 2020

I have met business men and women who want to invest in real estate, but many don't know how to go about the processes. it takes more than interest or having huge capital to own a property. pic.twitter.com/IT2fFHomHG

Where is real estate growing the fastest?

U.S. metros with the biggest increases in home values in 2022

- Greensboro-High PointNorth Carolina.

- Myrtle Beach-ConwayS.Carolina/N.Carolina.

- Oshkosh-NeenahWisconsin.

- Winston-SalemNorth Carolina. 15.7%

- El PasoTexas. 15.2%

- Punta GordaFlorida. 15.2%

- Deltona-Daytona Beach-Ormond BeachFlorida. 14.5%

- FayettevilleNorth Carolina. 14.3%

What state has the hottest real estate market right now?

Best Real Estate Markets In The U.S.

- Austin, Texas (Metro Area) Median listing price: $620,000.

- Tampa, Florida. Median listing price: $388,800.

- Raleigh, North Carolina. Median listing price: $389,000.

- Nashville, Tennessee (Metro Area)

- Charlotte, North Carolina.

- San Antonio, Texas.

- Phoenix, Arizona.

- Jacksonville, Florida.

Can I use home sale proceeds to pay off debt?

Capital Gains On Primary Residence

Section 121 allows up to $250,000 in gains for single filers ($500,000 for married couples filing taxes jointly) to be excluded from taxation. These gains can be used to pay off debt or for any other use. The use of the excluded gains will not affect the tax status of those gains.

How do you sell a house and buy another at the same time?

Bridge loan: A bridge loan is a temporary financial arrangement that lets you buy a new home without selling your old one. It's important to know these loans use your current home as collateral, and they are only meant to last a short amount of time (six months to one year).

How do you borrow money for real estate?

Four types of loans you can use for investment property are conventional bank loans, hard money loans, private money loans, and home equity loans. Investment property financing can take several forms, and there are specific criteria that borrowers need to be able to meet.

How do I avoid 20% down payment on investment property?

Yes, it is possible to purchase an investment property without paying a 20% down payment. By exploring alternative financing options such as seller financing or utilizing lines of credit or home equity through cash-out refinancing or HELOCs, you can reduce or eliminate the need for a large upfront payment.

How hard is it to get a home loan?

You'll generally need to have proof of income for a minimum of two years sufficient to pay the mortgage, a down payment of at least 3.5%, and a credit score of at least 620; however, as a first-time homebuyer, there are programs that can allow you to buy a home with a low income, $0 down, and credit scores as low as

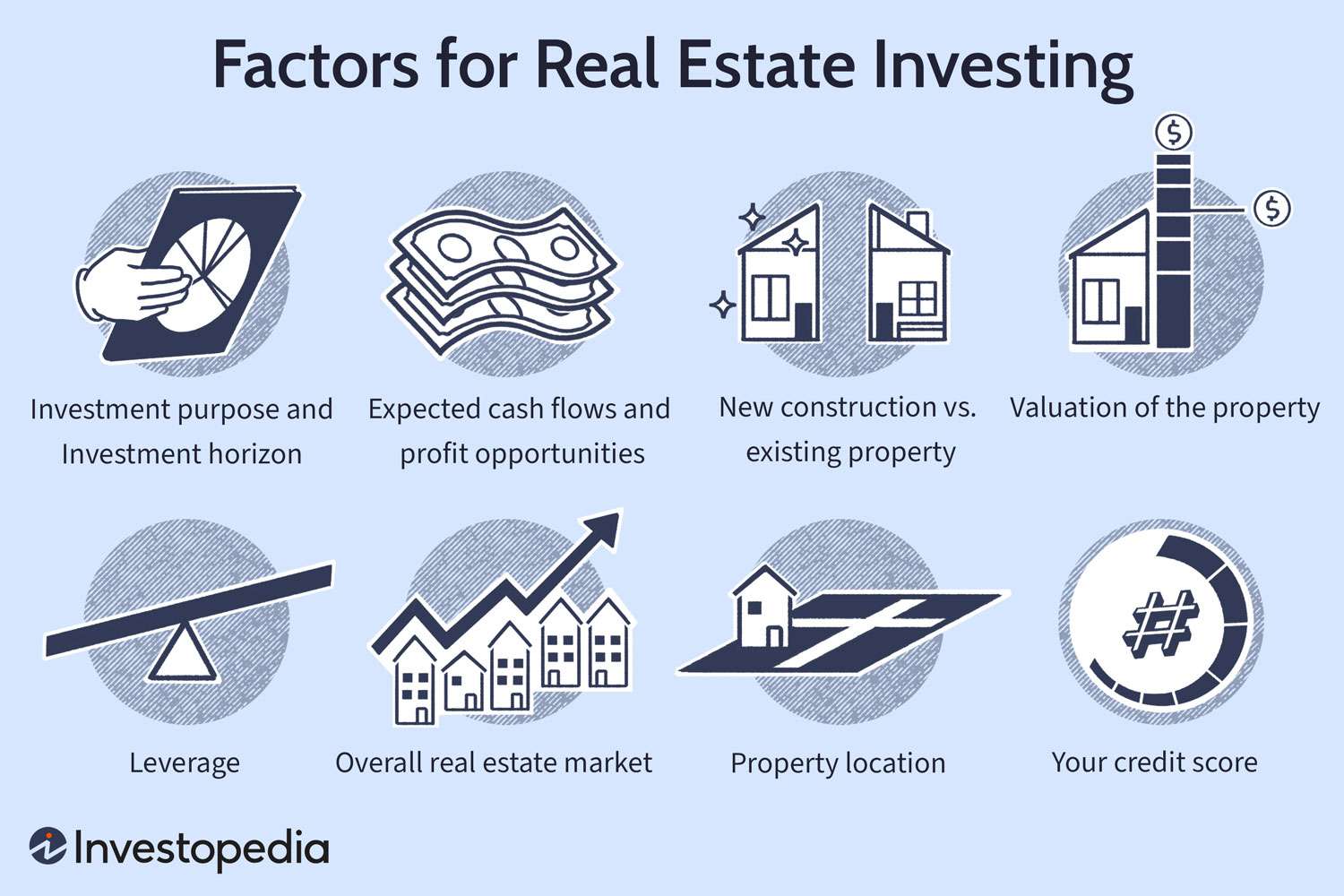

How do I invest my money wisely in real estate?

Best ways to invest in real estate

- Buy REITs (real estate investment trusts)

- Use an online real estate investing platform.

- Think about investing in rental properties.

- Consider flipping investment properties.

- Rent out a room.

How to rent house from real estate company

Nov 2, 2022 — Run a Home Valuation Report · Make Sure You're Allowed to Rent Your Property · Find a Quality Real Estate Agent · Scour the Contract · Consider

Who pays NYS transfer tax buyer or seller?

Seller

Who pays the tax. The base tax and additional base tax are paid by the grantor (seller), and such tax shall not be paid directly or indirectly by the grantee (buyer) except as provided in a contract between seller and buyer.

Who pays PA transfer tax?

The 2% Transfer Tax is paid at the time of recording. State and local governments do not stipulate who pays the Transfer Tax. In most sale agreements, the seller and buyer divide the tax. However, the new owner is responsible if there is any question over the amount paid.

Who pays transfer tax in Ohio?

The seller is usually responsible for the document transfer tax in Ohio. While it is possible for the buyer to assume responsibility for the tax payment during the negotiation process, the seller should expect the tax payments to be deducted from their proceeds at closing.

Who pays transfer tax in Connecticut?

The seller

Connecticut's Real Estate Conveyance Tax

The seller pays the tax when he or she conveys the property. Municipal town clerks collect the tax and remit the state share to the state Department of Revenue Services (DRS) (CGS §§ 12-494 et seq., as amended by PA 19-117, § 337).

How do I avoid transfer tax in NY?

Sellers in NYC can potentially reduce their transfer taxes through an agreement called a purchase CEMA. A purchase CEMA, or a consolidation, extension, and modification agreement, is an agreement between the seller and buyer.

How does it work when you sell and buy a house?

A contingent sale offer is based on the sale and closing of your existing residence, which provides the funds and down payment for your new home purchase. The plus side to making a contingent offer is that if the sale of your current home falls through, it would give you an out on the home you're under contract on.

How do you sell a house and buy another one at the same time?

Bridge loan: A bridge loan is a temporary financial arrangement that lets you buy a new home without selling your old one. It's important to know these loans use your current home as collateral, and they are only meant to last a short amount of time (six months to one year).

When you sell a house do you get all the money at once?

The full amount of the home's final price doesn't go right into your pocket. In fact, all in all, you might only realize only 60 to 70 percent of the home's value in net proceeds. Let's look at where the money goes, and how much you get to keep when you sell a home.

How does buying a house work in simple terms?

Buying a home involves finding the property, securing financing, making an offer, getting a home inspection, and closing on the purchase. National and state first-time buyer programs may be useful if you can't afford a high down payment. Once you've moved in, it's important to maintain your home and keep saving.

How do I avoid capital gains tax?

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

Do you always get a 1099-S when you sell land?

If you've had any involvement with buying or selling property during the tax period, you'll either issue or receive a 1099-S. Federal tax law requires that lenders or real estate agents file this form in the event of these occurrences: The sale of your primary residence, timeshare, or vacation home.

What is a form 4797 for sale of land?

Form 4797 is used to report gains made from the sale or exchange of business property, including property used to generate rental income, and property used for industrial, agricultural, or extractive resources.

Should I use form 8949 or 4797?

For instance - if you sell a rental property - the sale is reported on form 4797, but if you sell a land that was held for investment only and not for production income -the sale is reported on form 8949. If you sell stocks, bonds, etc - these are reported on form 8949.

Should I file form 8949 or Schedule D?

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

How do I report the sale of land to the IRS?

Use Form 1099-S to report the sale or exchange of real estate.

How long can you go without paying rent Illinois?

If the tenant pays within the 5 days, the landlord must take the money. If the tenant does not pay the rent within those 5 days, the landlord can file an eviction case in court. In Chicago, the tenant can even pay the rent after the 5 days is up and stay in the unit, as long as the landlord accepts the rent.

How long can someone stay in your home before they can claim residents California?

California: Guests become tenants when they stay for over 14 days within six months, or seven nights in a row. Colorado: Guests become tenants after staying for over 14 days within six months. Connecticut: Guests become tenants after staying for over 14 days within six months.

How long can you go without paying rent in NY?

A rent payment can only be considered late if it is received more than five days after it is due. The most your landlord can charge as a late fee is $50 or 5% of your monthly rent, whichever is less.

What a landlord Cannot do in Tennessee?

You cannot be evicted without notice. The landlord cannot change the locks or shut off your utilities to make you leave. Most of the time, a landlord needs to go to court before evicting you. If you did something dangerous or threatening, the landlord only needs to give you three (3) days to move out.

How far behind in rent before eviction in Illinois?

Five day

Payment of back rent within the five day period could prevent an eviction case from being filed against you for failure to pay rent. Depending on the facts of your case, you may still have an opportunity to resolve other issues during the notice period.

Does Keller Williams use Opcity?

Opcity only receives a commission when a match results in a closed deal. More than 40,000 agents and 5,000 brokerages have signed on to use the platform. Customers include Keller Williams, ReMax, Century 21 and Berkshire Hathaway Home Services.

Where do realtors get most of their leads?

20 Places to Find Real Estate Leads for New Agents

- Reach Out to Friends and Family.

- Attend Chamber of Commerce Events.

- Get Active on Social Media.

- Research Instagram Hashtags.

- Reach Out to FSBO's.

- Reach Out to FRBO's.

- Give a Free Seminar.

- Host an Open House.

What is market leader in real estate?

Market Leader is a real estate customer relationship management (CRM) tool that helps agents, teams and brokerages generate and nurture new leads with its marketing automation and website customization features.

What realtor has sold the most homes?

The third time is the charm for Ben Caballero, who shattered his own sales record by selling 6,438 homes in just one year. Can he do it again? Caballero holds a plaque reflecting his 2020 Guinness World Record title. Real estate pro Ben Caballero is breaking records yet again.

Who is Keller Williams biggest competitor?

Keller Williams competitors include RE/MAX, Zillow, Realty ONE Group, Coldwell Banker and KKR. Keller Williams ranks 1st in CEO Score on Comparably vs its competitors.

How long does it take to get your real estate license in Connecticut?

To obtain a Connecticut real estate broker's license, you must have two years' experience working as a salesperson, and complete the following steps: Complete the required Prelicense Education: 60 hours Principles and Practices of Real Estate consisting of: 15 hours — Real Estate Legal Compliance.

How long does it take to get your real estate license in Virginia?

60-hour

Complete the 60-hour Virginia Real Estate License Course. This course must be approved by the Virginia Department of Professional and Official Regulation (DPOR). Step 2: Schedule and pass the VA Real Estate License State Exam.

How long does it take to get a real estate license in Maine?

55 hours

Maine requires that real estate sales agents complete 55 hours of pre-license coursework before sitting for their exam. Most people choose to take their pre-license education course online. The majority of online courses are self-paced and include study materials like real estate practice exams and flashcards.

How long does it take to get your real estate license in Colorado?

If you're entirely new to real estate, just make sure you budget at least two months for the entire licensing process, but it could take as long as four months as well. Learn more about getting a Colorado real estate license and get exclusive offers!

What is the pass rate for CT real estate license?

The passing rate for the Connecticut Real Estate Salesperson Exam is 70%. This test is purposefully difficult, but not impossible. Be sure to pay attention during your pre-license course and take studying seriously. If you put the proper effort forth, we know that you can pass on your first attempt!