Under this law - California Business and Professions Code 10032, a real estate agent will be considered an independent contractor if: (1) he is licensed as a real estate agent under the law; (2) his income depends substantially on the sales made rather than hours worked; (3) that agent performs work under the written

Can an independent contractor receive commissions?

What is a 1099 commission-only role? A 1099 commission-only role refers to a position where an individual, classified as an independent contractor, is compensated solely based on the commissions from sales or deals closed without a base salary.

What is the difference between commission and independent contractor?

Key Takeaways. If an individual is an employee getting paid commissions by the employer, the employer withholds the taxes and pays the IRS. If the individual is a self-employed independent contractor, the individual is responsible for remitting the taxes to the tax authorities.

What is an independent contractor agreement used for in the real estate profession?

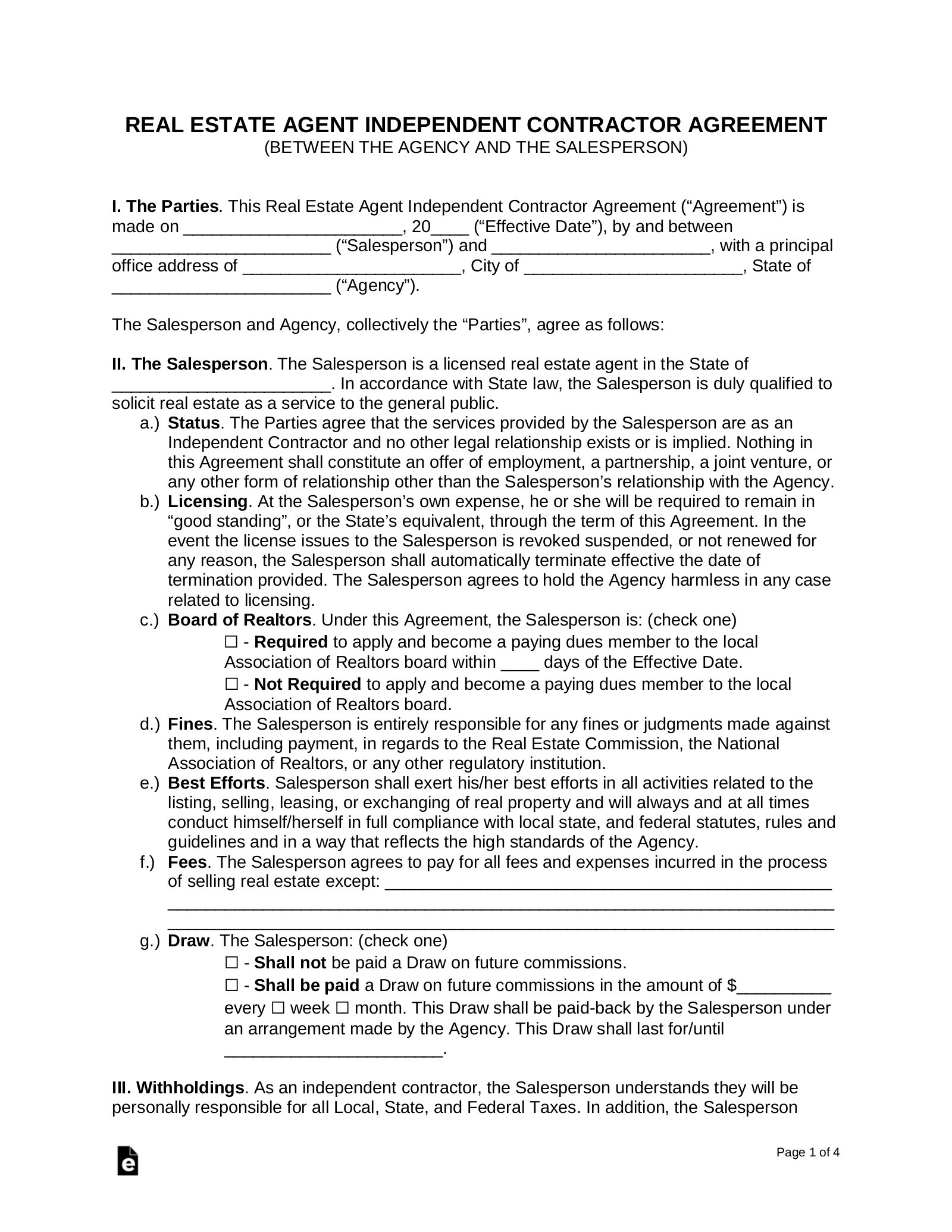

A real estate agent independent contractor agreement is a contract between a real estate company and a salesperson (“agent”) that details the commission split and expenses between the parties.

How do I classify myself as an independent contractor?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Is an agent an employee or independent contractor?

What is the difference between a contractor and a broker?

The contractor can dismiss a worker or refuse to bring on a worker and does not pay the worker directly. Instead, the broker pays the worker and charges the contractor for the wage, expenses, taxes, FICA, Social Security, Medicare, and so on.

Frequently Asked Questions

What is the difference between an agent and independent contractor?

Is an independent contractor always an agent?

The terms “agent” and “independent contractor” are not necessarily mutually exclusive. In fact, by definition, “… an independent contractor is an agent in the broad sense of the term in undertaking, at the request of another, to do something for the other.

What not to say to your real estate agent?

- 10: You Won't Settle for a Lower Price. Never tell your agent you won't reduce the sale price on your house.

- 6: You are Selling the Home Because of a Divorce.

- 5: You Have to Sell Because of Financial Problems.

- 2: You're Interested in a Certain Type of Buyer.

- 1: Anything -- Before You've Signed an Agreement.

Is a broker responsible for the actions of a salesperson?

A broker is permitted to delegate supervision to other brokers or salespersons but cannot completely relinquish their duty of supervision. Regardless of any delegation, the Broker will ultimately be responsible for the actions taken by their salespersons.

Which is a requirement for independent contractor status according to the IRS?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What are the four 4 factors used to determine whether someone is an independent contractor?

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place

What does the IRS require to determine if a person is an independent contractor and not an employee?

The hiring entity must prove that the worker is customarily and currently engaged in an independently established trade, occupation, or business.

What does a real estate sales person classified by the IRS as an independent contractor receive?

To be treated, for IRS purposes, as an independent contractor, the licensee must receive more than 90% of income as a result of negotiated commissions, not hours worked or a salary.

What are the 3 criteria used by the IRS to distinguish a employee from an independent contractor for tax purposes?

The IRS had in the past used a 20-factor test to determine whether a worker was an employee or a contractor. However, the organization has since moved away from that test and now looks at just three broad factors—behavioral control, financial control, and the relationship of the parties.

FAQ

- Are there benefits to being an independent contractor?

- Less commuting, fewer meetings, less office politics – and you can work the hours that suit you and your lifestyle best. Being a contractor means you get paid for every hour of work you do, at the market rate. If your skills are in demand, your income could be high.

- How does the position of an independent contractor licensee differ from that of an employee licensee?

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.

- What are the pros and cons of being an independent contractor for a company?

Being an independent contractor can be rewarding since it offers you the ability to be your own boss, choose which clients to work for, and allow you to work from home. However, being an independent contractor can come with more responsibility. You must fund your Social Security and Medicare taxes.

- Do you pay more as an independent contractor?

While being an independent contractor means you have to pay more in self-employment taxes, there is an upside: You can take business deductions. These business deductions reduce the amount of profit you pay income taxes on. You'll report these deductions along with your income on Schedule C.

- Are most real estate agents employees or independent contractors?

Independent contractors

In the real estate industry in the United States, real estate agents, while under the supervision of real estate brokers, are not generally considered employees unless this employer/employee has been expressly stated. Instead, in most cases, real estate agents are considered independent contractors.

- Why use independent contractors instead of employees?

Hiring independent contractors gives enterprises staffing flexibility, allowing them to staff up or down according to current goals and growth. This can make businesses more agile and competitive among their peers while bypassing the expense of recruiting, hiring, and training an employee for the same work.

- What makes an independent contractor independent as opposed to an agent?

An independent contractor has almost absolute discretion whereas an agent is controlled by the principal. Due to the control of the principal, liability is more fairly attributed to the principal for the agent's actions.

- How do you classify as an independent contractor?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

- What is one big difference between employees and independent contractors?

- For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors.

How does a real estate salesperson classified as an independent contractor receive their commission

| Who is most likely to be treated as an independent contractor for federal tax purposes? | The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. |

| Which licensee would be construed as an independent contractor of the brokerage? | Under the statute, an independent contractor relationship has been successfully established if: 1) the real estate salesperson or associate broker is a licensee, 2) substantially all remuneration for services performed is directly related to sales output rather than number of hours worked, and 3) there is a written |

| Who are considered federal contractors? | A federal government contractor is a person who enters into a contract, or is bidding on such a contract, with any agency or department of the United States government and is paid, or is to be paid, for services, material, equipment, supplies, land or buildings with funds appropriated by Congress. |

| What is the difference between an agent and an employee? | Agents act on behalf of a principal who has the legal right to control them. Employees are agents who are subject to a higher degree of control by the principal in terms of how they carry out their duties. |

| What factors are used to determine whether a real estate salesperson is considered to be an independent contractor for tax purposes? | The IRS recognizes the unique nature of the real estate industry and created a statutory non-employee status for real estate professionals, provided three elements are met: 1) the individual is a licensed real estate professional; 2) substantially all of their payments be directly related to sales or other output, |

| What is Section 10032 B of the Business and Professions Code? | (b) A real estate broker and a real estate salesperson licensed under that broker may contract between themselves as independent contractors or as employer and employee, for purposes of their legal relationship with and obligations to each other. |

| How do you classify an employee vs a contractor? | Independent contractors are paid hourly or per project, are free to set their own schedule, and their work is not the core of the business. Relationship: A worker with a written contract with benefits or exclusivity requirements would more than likely be considered an employee and not an independent contractor. |

| Do independent contractors set their own rate? | In most cases, the contractor sets the rate, and you decide whether you want to pay that rate or negotiate. |

| What must independent contractors in a brokerage firm have? | The contractor must be licensed as a real estate salesperson or broker. There must be a written contract in place. Contractors must have access to workers compensation benefits. |

- How much should I ask for as a contractor?

A Simple Framework For Negotiation

A simple rule of thumb would be to ask for a minimum of 7.65% more than if you were a W-2 employee.

- Who appoints the contractor?

A principal contractor is appointed by the client to control the construction phase of any project involving more than one contractor.

- Who is called the contractor?

A contractor is a person or company that does work for other people or organizations.

- How are contractors chosen?

- Ask For Referrals And References

A good contractor should be able to provide you with a list of references of their previous customers. A contractor with a long list of previous customers could be an indication that he has integrity and works well with people.

- Ask For Referrals And References

- What is the job environment likely to be as a real estate agent?

Real estate brokers and sales agents typically work in an office setting. However, they spend much of their time away from their desks to show properties, see properties, and meet with current or prospective clients.

- What personality fits a real estate agent?

Engaging personality

A good real estate agent doesn't just sell properties—they sell themselves. It's important to show your real personality. People will respond to you if you have a great attitude, are personable and honest, have confidence in your abilities, and are interested in helping them and others.

- How long do most real estate agents last?

- Most real estate agents fail in their first year, according to research. Three common mistakes that agents make is inadequate prospecting, failing to market properties in ways that lead to fast sales, and not following up with clients.

- Why a broker is better than an agent?

The main difference between an agent and broker is the number of responsibilities they're able to take on. A broker can do everything an agent can do, but they have the added responsibility of making sure all real estate transactions are lawful, all paperwork is accurately completed and all finances are accounted for.

- What is the job outlook for real estate brokers and agents in other words are job opportunities growing or shrinking and at what rate ?)?

Job Outlook

Overall employment of real estate brokers and sales agents is projected to grow 3 percent from 2022 to 2032, about as fast as the average for all occupations. About 51,600 openings for real estate brokers and sales agents are projected each year, on average, over the decade.