Still, some people in the market, as either a buyer or seller, wonder if it is even legal to arrange for a rent to own deal for a residential property in this state. The short answer is, yes, but only if you carefully examine the situation and how the applicable statute in Texas could work for it.

What is a lease to own property agreement in Texas?

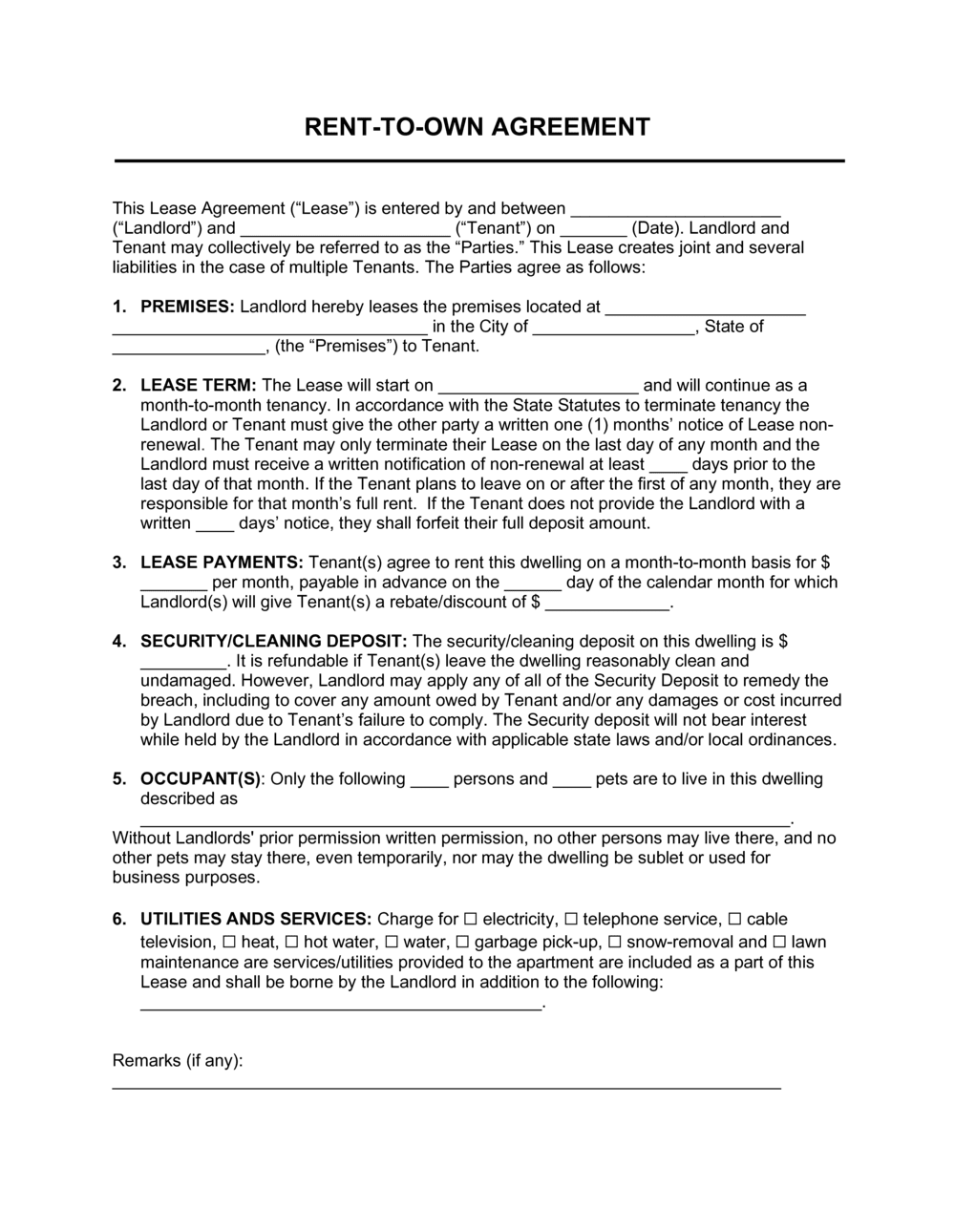

A Texas rent-to-own lease agreement is a standard rental contract with an added option to purchase clause for the tenant. The tenant will commonly have the lease period to buy the property. When electing to buy, the details of the sale will be entered into a purchase agreement.

What documents do I need to sell my house in Texas?

- Seller's Disclosure Notice.

- Lead Based Paint Addendum.

- 1-4 Residential Resale Contract.

- Third Party Financing Addendum.

- Homeowner's Association Addendum.

Can I sell my rental property with tenants in it in Texas?

The short answer is yes, you can sell a rental property with tenants in Texas. However, it's important to note that there are specific laws and regulations in place to protect the rights of your tenants during the sale process.

Do you need a real estate license to own rental property in Texas?

There Is An Exception to the Real Estate Broker License Requirement. This exception is that a Texas property owner may manage their own home as a rental property without a license.

Does Texas have a rent-to-own program?

What is the best website for rent-to-own homes?

Websites like ZeroDown, HomeFinder, Hidden Listings, and Rent to Own Labs often advertise rent-to-own home listings. Websites like Zillow and Redfin allow you to filter your search for rent-to-own homes, while Rent-to-Own Labs and Homefinder specialize in these listings.

Frequently Asked Questions

Does Texas rent relief still have money?

09/25/23 Update: The Texas Rent Relief Program Has Now Closed. After distributing over $2.2 billion in temporary federal rent and utility assistance to more than 323,000 Texas households impacted by the COVID-19 pandemic, the Texas Rent Relief program has now closed.

What are the requirements to rent a house in Texas?

- Two years of verifiable, favorable residence history from a third-party landlord is required.

- Rental history demonstrating residency, but not by a third party, may require an additional security deposit.

- A criminal background check will be performed.

Is Texas a good place to own rental property?

With its desirable locations, thriving economy, continuous population growth, attractive rental rates, and a strong rental market, Texas is a prime destination for investment properties.

What are the benefits of an option agreement?

The option agreement prevents the landowner selling the property whilst the developer is exploring the viability of the project thereby reducing the risk and potential cost to the developer. The land is not purchased until it is exercised by the purchaser, which can be predicated by a trigger event.

Why would a buyer want to use a memorandum buying agreement?

A memorandum of purchase and sale agreement is a legal document that protects a buyer from being outbid after the seller accepts their offer. This agreement is signed by the seller and buyer at the time an offer is accepted, and effectively makes it illegal for a buyer to accept any other offers on the property.

What is the difference between a MOA and a contract?

What are contracts and memoranda of agreement? The greatest difference between a contract and a memorandum of agreement is that a contract is a legal document and is enforceable in court, whereas a memorandum of agreement is neither.

What is a leasehold estate in Texas?

A: (By definition) a leasehold estate is an ownership interest in land in which a lessee or a tenant holds real property by some form of title from a lessor or landlord. Leasehold is a form of property tenure where one party buys the right to occupy land for a given length of time.

Can a landlord assign a lease in Texas?

Under Texas law, if the lease does not provide otherwise, an assignment or sublease always requires the prior consent of the landlord. TEX. PROP. CODE § 91.005 (West 2002).

FAQ

- Who is the holder of a leasehold estate is said to also have?

"The holder of a leasehold estate is the tenant, who does not own the property, but rather has a right to exclusive possession of the property for a specified period."

- What rights are conveyed with a leasehold estate?

All types of leasehold estate convey a temporary right to use the property. Even in the case of a 99-year industrial lease, the tenant eventually loses that right. On the other hand, a freehold estate conveys a permanent right to use and occupy the property.

- How are leasehold estates typically created?

As the name implies, a leasehold estate is created through a lease for real property (real estate.) A leasehold estate refers to a tenant's exclusive, but temporary, right to possess, occupy and use real estate (land or property) during the term of a lease.

- What is an executory real estate contract?

An executory contract in real estate is a contract that has remaining actions or obligations to be completed. A rental lease is one example since the landlord must continue to provide space, and the renter must continue paying rent. Another example of an executory contract in real estate is the escrow process.

- Under which contract does the buyer have title to the property quizlet?

What type of title does the buyer get in a land sales contract? The answer is equitable title. The buyer (called the vendee) takes possession and gets equitable title to the property.

- Which type of title does a buyer have as a result of having an accepted offer?

The answer is buyer receives equitable title to the property. After both buyer and seller have executed a sales contract, the buyer acquires an interest in the land, known as equitable title.

- What does it mean for an agreement to be executory?

Executory refers to something (generally a contract) that has not yet been fully performed or completed and is therefore considered imperfect or unassured until its full execution. Anything executory is started and not yet finished, or is in the process of being completed in order to take full effect at a future time.

How do you make a legal document to sell your house rent to own in texas

| What classification of contract is an executory contract? | In such contracts, one party has already fulfilled his share of duties while the party will have to perform his obligation after a certain period. Executory contracts can again be divided into types based on the presence and performance of the parties included. These are unilateral and bilateral contracts. |

| What are the requirements to buy a house in Oregon? |

|

| What is the meaning of lease to own? | In general, lease-to-own refers to methods by which a lease contract provides for the tenant to eventually purchase the property. One common lease-to-own strategy is to include an “option to purchase” provision in the lease. |

| How to afford a house in Oregon? | To help you with the cost, government entities may offer down payment assistance programs in Oregon to help first-time homebuyers pay for their down payment. The following are examples of these programs: The Department of Housing and Urban Development (HUD): HUD has several programs for first-time homebuyers. |

| Should I buy a house in Oregon? | Like nearly everywhere else in the U.S., housing prices in Oregon have increased throughout the pandemic. Statewide, the median sale price is $527,600. While that's higher than the national median, you can still afford a home in Oregon without having to cross into jumbo/non-conforming loan territory. |

| What is the minimum credit score to buy a house in Oregon? | 580 The minimum credit score to buy a house in Oregon is 580. Borrowers will a lower credit score of 500 to 579 may also be eligible for select mortgage lenders. |

| Can I break my lease if I buy a house in Ohio? | Some landlords or property management companies will cut you a break if they know the details of your situation. Explain that you've found a home that you want to purchase, and you're willing to come up with a mutually beneficial agreement. |

- Can I break my lease if I buy a house in Minnesota?

In reality, neither Minnesota nor Wisconsin has any laws permitting a tenant to terminate a lease because they intend to buy a home. Now, it is possible that your lease agreement gives you the right to terminate it early. But that type of term in a lease is very rare.

- Can you break a lease if you buy a house in Massachusetts?

- If your lease includes a home buying clause, this means that you can terminate your lease early if you have bought a new home. This is provided that you give your landlord proper notice. If you don't have a Home Buying Clause, then you can try to buy your way out.

- Can you break a lease if you buy a house in Illinois?

Illinois law only offers four justifications for breaking a lease without being obligated for remaining rent or paying a penalty. You do not have any legal protection if you want to break a lease because you want to move in with a partner, bought a house, or need to relocate for school or work.

- How can I break my lease without penalty in Ohio?

If your landlord repeatedly violates your rights to privacy, or does things like removing windows or doors, turning off your utilities, or changing the locks, you would be considered "constructively evicted," as described above; this would usually justify you breaking the lease without further rent obligation.

- Can rent a center file theft charges in Texas?

In Texas, the answer is yes. Companies do file criminal charges against people who had failed to pay out rental contracts on items, even if they never intended to steal anything. Treating renters behind on their finances as criminals is stupidly evil, but par for the course in Texas criminal justice.

- Is theft of services a felony in Texas?

Theft of Service Punishment in Texas

The penalties or punishment for theft of service is usually determined by the alleged value of the service rendered and whether the defendant has any prior theft convictions. Under Texas law, theft of service can be classified as either a misdemeanor or felony crime.

- What is the 40 or 48 rule in Texas?

The “40 or 48 Rule” – Requires Foreclosure Instead of Eviction. If the buyer has paid 40% or more of the purchase price, or the equivalent of 48 monthly payments, then the seller must give the buyer a 60-day notice to cure its default instead of the above-mentioned 30 days.