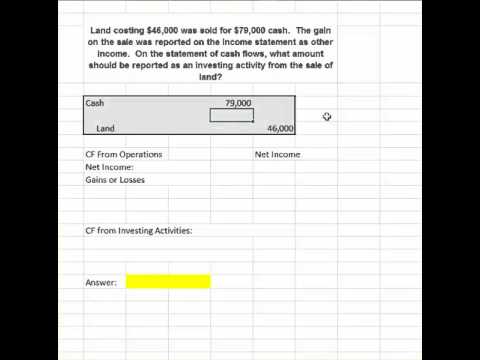

The gain on sale of land in the income statement does not appear in the operating cash flows section. While the land sale may have produced cash, the entire proceeds will be listed in the investing activities section; it is a “nonoperating” item.

Where does loss on sale of land go on statement of cash flows?

If a loss from the sale of real property occurs, a cash flow statement shows an increase in net income in the operating activities section, according to AccountingCoach, a professional accounting information website.

Is gain on sale of land an operating activity?

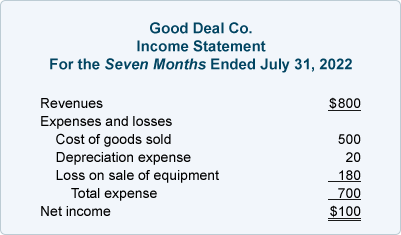

Profit or loss from the sale of land is normally included in operating activities and reported in the income statement. It is factored into the calculation of net income and then compared to the cash inflows and outflows resulting from operating activities in the statement of cash flows.

How do you treat loss on sale of assets in cash flow statement?

Answer and Explanation: Under the indirect method, the cash flow statement adds the loss on sale or disposal of fixed assets in the net income to calculate the cash flow from operating activities. Loss on sale of fixed assets is treated as the expense in the income statement when calculating the net income.

Is the sale of land a cash inflow or outflow?

For instance, the company may have purchased Land and also sold Land in the same year. The purchases would be outflows of cash, and recorded as Debits in the Land account. Sales would be inflows of cash, and recorded as Credits in the Land account.

What cash flow activity is proceeds from sale of land?

Inflows: Money received from selling assets, including land, buildings equipment, stocks, bonds. Money received from loans made to others, such as Notes Receivable.

Is sale of land an investing activity?

Frequently Asked Questions

Where do capital gains go on cash flow statement?

An item on the cash flow statement belongs in the investing activities section if it is the result of any gains (or losses) from investments in financial markets and operating subsidiaries.

Is the sale of land an operating activity?

Is land operating or investing?

The land is an asset of the business, and its purchase would be a cash outflow from investing activities. Payment of dividends is a cash outflow from financing activities. Sales are operational activities.

Why does gain on sale decrease cash flow?

Is gain on sale of land included in net income?

Answer: c.

Gain on sale of land is deducted on net income, as this are included as part of the net income but should have been reported under the investing activities section of the statement of cash flows.What type of activity is sale of land for cash?

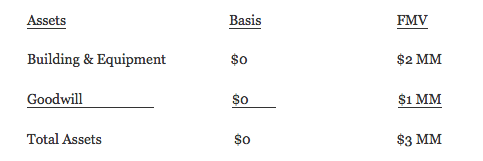

The purchase or sale of a fixed asset like property, plant, or equipment would be an investing activity. Also, proceeds from the sale of a division or cash out as a result of a merger or acquisition would fall under investing activities.

FAQ

- Is land an investing activity?

- Assets included in investment activity include land, buildings, and equipment. Receiving dividends from another company's stock is an investing activity, although paying dividends on a company's own stock is not. An investing activity only appears on the cash flow statement if there is an immediate exchange of cash.

- Where does gain loss on sale of assets go on cash flow statement?

This presents a problem because any gain or loss on the sale of an asset is included in the amount of net income shown in the SCF section operating activities. To overcome this problem, each gain is deducted from the net income and each loss is added to the net income in the operating activities section of the SCF.

- What type of activity is a gain on sale of land?

Profit or loss from the sale of land is normally included in operating activities and reported in the income statement. It is factored into the calculation of net income and then compared to the cash inflows and outflows resulting from operating activities in the statement of cash flows.

- How do you record sale of land on a cash flow statement?

The gain on sale of land in the income statement does not appear in the operating cash flows section. While the land sale may have produced cash, the entire proceeds will be listed in the investing activities section; it is a “nonoperating” item.

- Is selling land for cash an operating activity?

- The land sale for cash is considered the investing activity because investing activities are related to the purchase or sale of the non-current assets as property, securities, etc. This transaction is bringing cash inflow under investing activities.

- Where does sale of land go on cash flow

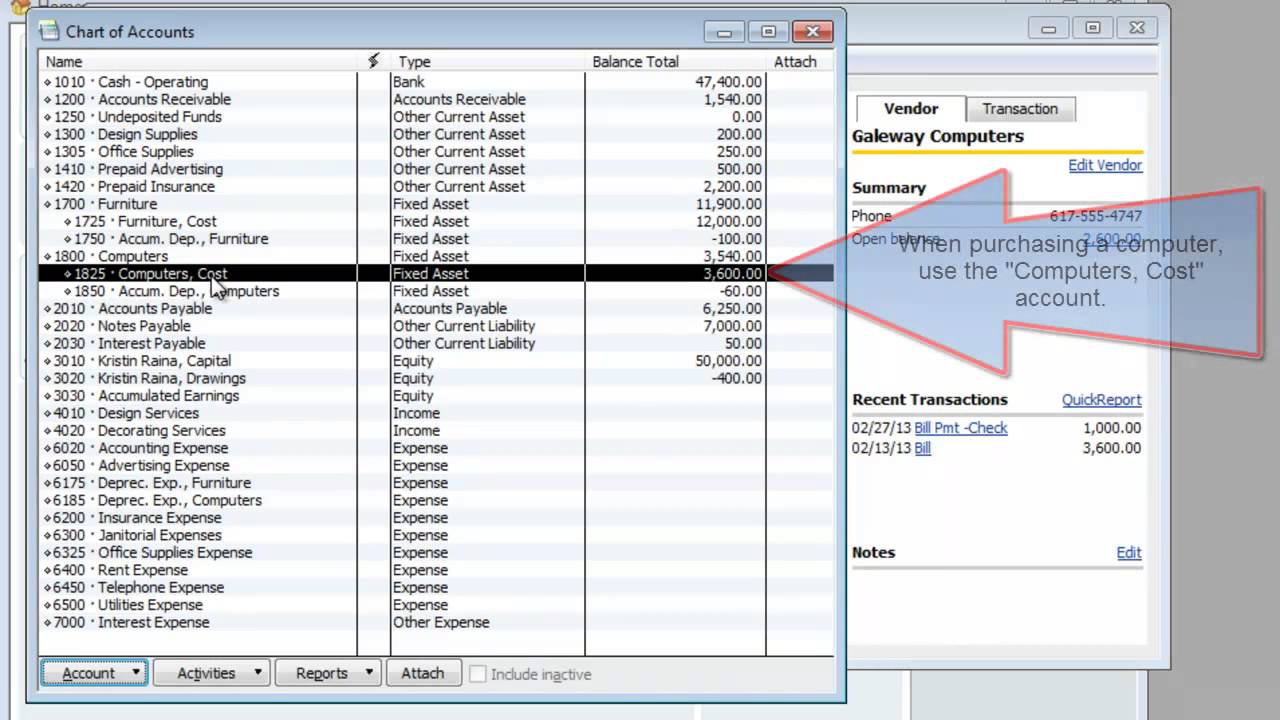

Recording the sale of business property, including real estate, on a company's cash flow statement has several requirements, depending on the gain or loss

How do you categorize no gain or loss on sale of land on a cash flow statement

| Where does land go on cash flow statement? | Answer and Explanation: Purchase of land and building will be reported in Investing Activity in the cash flow statement. |

| Is land for sale an operating asset? | Until it is used, the land is considered to be a non-operating asset. Common non-operating assets include unallocated cash and marketable securities, loans receivable, idle equipment, and vacant land. |

| Why is gain on sale of land deducted on cash flow statement? | Gain on sale of land is subtracted, because it increased income, but is not related to operations (remember, it is an investing item and the “gain” is not the sales price). Increase in accounts receivable is subtracted, because it represents uncollected sales included in income. |

| Does gain on sale go on cash flow statement? | The gain on sale of office building is recorded in the statement of cash flows under the head operating activities. In operating activities section, it is deducted from the amount of net earnings as the excess value over and above the asset's net value at the time of sale. |

| Where does gain on sale of land go on income statement? | The gain on sale of land is usually reported as a separate item in the income statement under other income or gains. It's considered an unusual or infrequent item because selling land isn't part of the company's usual day-to-day business operations. |

| Why is loss on sale of assets added in the cash flow statement? | The company reports a loss from sale of a long-term business assets as part of its net income because it represents money spent that the business didn't recoup. The difference amount between loss and book value is reported under investing activities. |

- Is cash sale of land an operating activity?

- The land sale for cash is considered the investing activity because investing activities are related to the purchase or sale of the non-current assets as property, securities, etc. This transaction is bringing cash inflow under investing activities.

- Why do you subtract a gain on sale from net income?

Answer and Explanation: A gain increases net income but cash is not received so it must be subtracted out of net income when converting to a cash basis from operating activities. A loss reduces net income but actual cash is not paid out so this must be added back to net income.

- How does gain on sale affect net income?

Since the gain on the sale is included in the net income, the gain is shown as a deduction from the net income reported in the operating activities section of the cash flow statement (under the indirect method).

- Does gain on sale of land go on income statement?

- The gain on sale of land is usually reported as a separate item in the income statement under other income or gains. It's considered an unusual or infrequent item because selling land isn't part of the company's usual day-to-day business operations.

- Is capital gains tax based on gross or net proceeds?

Key Takeaways

Capital gains taxes must be paid on the net proceeds of a sale, not the gross proceeds.