The Three Times Rent Rule

This is called the Three Times Monthly Rent rule. Total gross income should be about three times the rent. Although the 30 percent and Three-Times-Rent rules are popular, they have inherent issues. One of the primary ones is that it does not account well for debt or expenses.

What is a good credit score to rent an apartment?

It's simply a business decision. Most individuals or companies renting an apartment want credit scores from applicants to be 620 or higher. People with credit scores lower than 620 may indicate a high risk of default on rent owed.

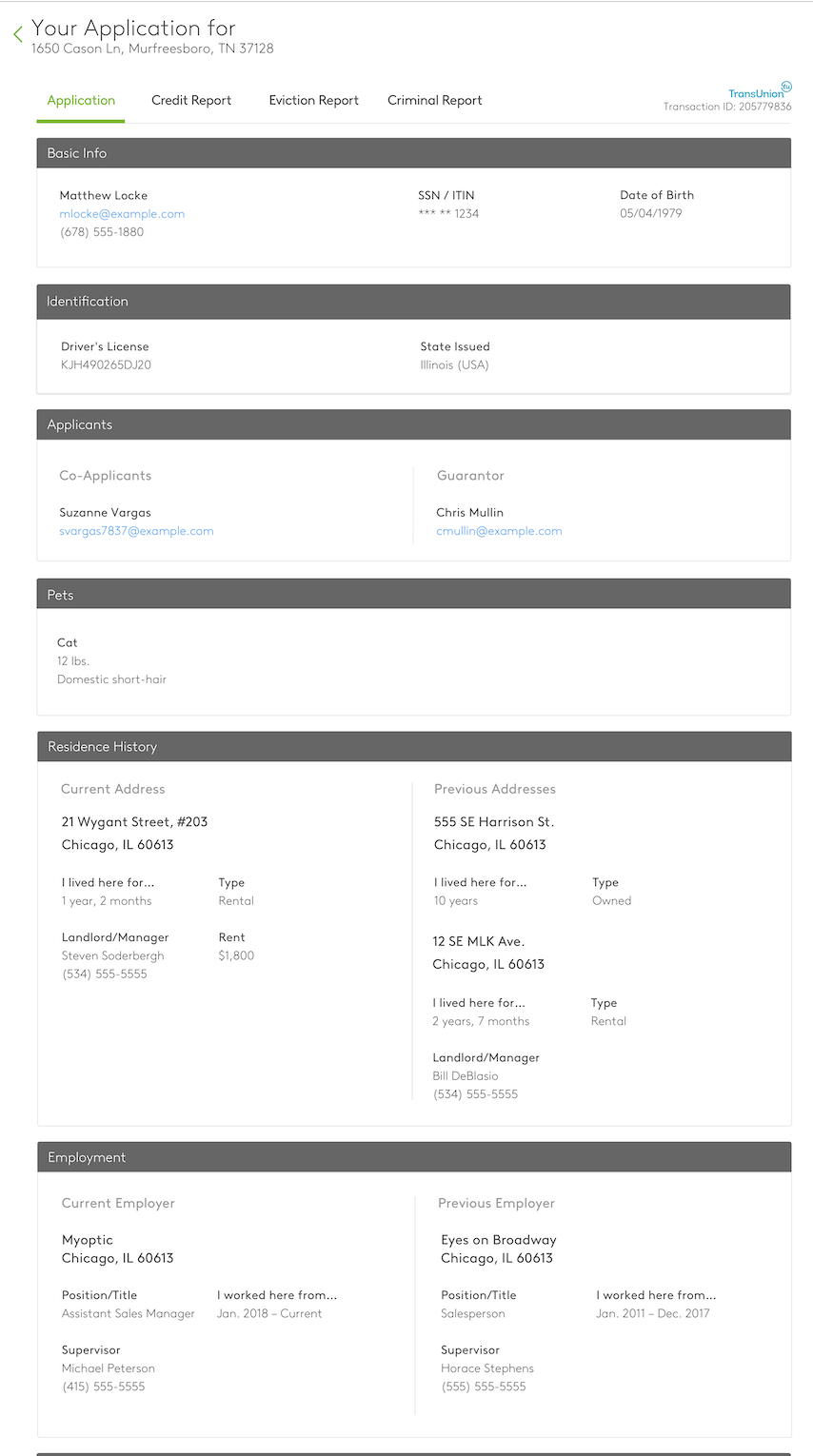

What do most apartments check for approval?

8 Things to Look Out For When Screening Rental Applications

- Credit Score.

- Background and Eviction Checks.

- Employment History.

- Current Income.

- Landlord References.

- Reason for Leaving Previous Residence.

- Tenant Demeanor.

- Lifestyle Choices.

How much of your paycheck should go to rent?

Use the 30% Rule

The 30% rule states that you should try to spend no more than 30% of your gross monthly income on rent.

What is the best income to rent?

The rent-to-income ratio is the percentage of income a tenant will need for the monthly rent. A good rent-to-income ratio is around 30% of gross income, and most landlords will require that as a maximum percentage – the higher the percentage, the more likely it is that a tenant could not afford the rent long term.

What real estate markets are depressed?

San Francisco, California: -10.4% Sacramento, California: -6% San Jose, California: -5.6% Los Angeles, California: -5.4%

Did you know most NYC apartments have income requirements for renters? Here, we break down the 40x rent rule. https://t.co/hbml3QnjU2 (via @CNBCMakeIt) pic.twitter.com/BryIcG1vwH

— CNBC (@CNBC) March 29, 2023

Where in us are housing prices dropping?

Home prices decreased across the board in Washington and Oregon. Some cities – like Kirkland, Bellevue, Redmond, and Sammamish – saw prices drop 11% to 12%. In Seattle, prices dropped by 8%. Home prices also declined across Oregon, including in Bend, Portland, Beaverton, Hillsboro, Eugene, Gresham, Salem and Medford.

Where are housing prices dropping the fastest?

Prices in Western States Decrease the Most

- Idaho: -8%

- Washington: -7.5%

- Nevada: -5.6%

- Montana: -5.3%

- Utah: -4.3%

- Arizona: -4.2%

- California: -3.5%

- Oregon: -3.1%

What is the fastest way to make money in real estate?

- 7 Fastest Ways to Make Money in Real Estate.

- Renovation Flipping.

- Airbnb and Vacation Rentals.

- Long-Term Rentals.

- Contract Flipping.

- Lease to Buy.

- Commercial Property Rentals.

- Buying Land.

How can I make $100,000 this year?

How to make $100k a year

- Choose the right industry. The first step in earning at least $100,000 in salary is to choose a career in a more lucrative industry.

- Pursue a high-paying career.

- Consider your expenses.

- Move to a high-paying city.

- Invest in education.

- Add revenue streams.

- Negotiate your salary.

What rights do tenants have when landlord sells property in Wisconsin?

Since the tenant's agreement is tied to the property, they have the right to stay there after the property is sold. If no arrangements are made for the lease to terminate legally, the new landlord must honor the lease until it expires.

What are my rights if my landlord decides to sell in NJ?

Tenants are entitled to two-months notice before being required to vacate (if the buyer intends to personally occupy) or there may be no legal grounds to force the tenant to remove (if the prospective buyer does not intend to occupy the property).

What rights do tenants have when the house is being sold in Texas?

After the Sale

Under this Act, most tenants with a lease can stay in the home until their lease expires. However, if the new owner intends to move into the home, this will not apply. In those circumstances, the new owner must give the tenant at least 90 days' notice of their intent to terminate the lease.

Can you evict tenants after purchasing property in Wisconsin?

Tenant Rights

1 The takeaway: The lease that's in place before you buy the property remains in effect even after you close on it, so you cannot legally raise the rent, modify the clauses or agreements or kick a tenant out before the end of a lease term just because you're the new owner.

Why would an appraiser depreciate the value of buildings?

Physical depreciation is a loss of value due to aging as well as wear and tear on a home. Homes suffer from physical deterioration at different rates depending on how well the home is maintained and improved.

What does depreciation mean in appraisal?

A loss in value

Fundamentally speaking, depreciation is a loss in value due to any cause. It's the difference between the market value of a structural improvement or piece of equipment, and it's reproduction or replacement cost as of the date of the valuation.

What are the reasons for depreciation of property?

Property generally depreciates in three ways namely, physical obsolescence, external obsolescence, and functional obsolescence. Physical obsolescence mainly relates to deteriorations like fading paint and functional depreciation is defined by market standards that decrease the value of a property.

How do appraisers determine depreciation?

Age- life method- this is the most common method for calculating depreciation. The effective age of the home (which can be more or less than the actual age depending on the amount of wear and tear and upkeep) is divided by the total economic life to determine the percentage of depreciation.

Is depreciation based on appraised value?

The appraisal method of depreciation is a simplified method used to evaluate the economic loss in value of an asset from the beginning to the end of a reporting period. The difference between the appraised values constitutes the amount of depreciation that can be recorded.

How do you modify a listing agreement?

Any amendment should be explained in-full so that all parties are in agreement.

- Discuss the Amendment. The broker and owner should meet and discuss the changes to the listing agreement.

- Write the Amendment. Once a verbal agreement is made, the amendment should be written.

- Sign and Attach to Listing Agreement.

Which document is used to make changes to a listing contract agreement?

An addendum can be used to change, add to, or update the information found in the original contract. They're usually dated and signed, and refer back to specific parts of the contract.

What are the three types of listing agreements?

A listing agreement is a contract between a property owner and a real estate broker that authorizes the broker to represent the seller and find a buyer for the property. The three types of real estate listing agreements are open listing, exclusive agency listing, and exclusive right-to-sell listing.

Does a listing agreement must include a legal description or other unambiguous description of the property?

A listing agreement must include a legal description or other unambiguous description of the property. The most common form in which a broker is compensated is through a commission that is fixed dollar amount. Commissions are usually expressed as a percentage of the sales price.

How the agreement can be altered or updated?

A contract amendment allows the parties to make a mutually agreed-upon change to an existing contract. An amendment can add to an existing contract, delete from it, or change parts of it. The original contract remains in place, only with some terms altered by way of the amendment.

What do you call a person who pays rent?

What is a tenant? A tenant is someone who pays rent to live in a property (house, apartment, condominium, townhouse) that belongs to someone else.

Who rents out his house?

A landlord is the owner of a house, apartment, condominium, land, or real estate which is rented or leased to an individual or business, who is called a tenant (also a lessee or renter). When a juristic person is in this position, the term landlord is used. Other terms include lessor, housing provider, and owner.

What do you call a person who rents a room?

A tenant is someone who lives in a house or room and pays rent to the person who owns it.

Who is called a tenant?

: one who has the occupation or temporary possession of lands or tenements of another. specifically : one who rents or leases a dwelling (such as a house) from a landlord. b. : one who holds or possesses real estate or sometimes personal property (such as a security) by any kind of right.

What is another name for renter?

On this page you'll find 16 synonyms, antonyms, and words related to renter, such as: occupant, boarder, leaseholder, lessee, roomer, and rentee.

How long does it take to get a 1099 form?

The IRS requires organizations to supply 1099 forms by January 31 of the year following the reported income earned. Expect to receive a 1099 by late January or early February at the latest. This timeframe helps ensure you have plenty of time to collect the documents you need to file your taxes and make any corrections.

How do I get an estate tax closing letter from the IRS?

For those who wish to continue to receive estate tax closing letters, estates and their authorized representatives may call the IRS at (866) 699-4083 to request an estate tax closing letter no earlier than four months after the filing of the estate tax return.

How do I know if the IRS received my form?

- If you are receiving a tax refund, check its status using the IRS Where's My Refund tool. You can view the status of your refund for the past 3 tax years.

- If you owe money or are receiving a refund, you can check your return status by signing in to view your IRS online account information.

Which IRS form is the form for an estate tax return?

Form 1041

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts.

What happens if I didn’t receive my 1099 form?

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

What are the advantages of hiring a broker?

What Are the Advantages of Working with a Broker?

- Knowledgeable. A broker brings their extent of knowledge to you.

- Negotiation. Brokers work with numerous insurance companies that's why they aren't tied to one company.

- Customization. Brokers ask a lot of questions to understand your needs fully.

- Supportive.

- Renewals.

What exactly does a broker do?

A broker is an intermediary between those who want to make trades and invest and the exchange in which those trades are processed. You need a broker because stock exchanges require that those who execute trades on the exchange be licensed.

Why a broker is better than an agent?

The main difference between an agent and broker is the number of responsibilities they're able to take on. A broker can do everything an agent can do, but they have the added responsibility of making sure all real estate transactions are lawful, all paperwork is accurately completed and all finances are accounted for.

What is the difference between a broker and an agent?

Differences between agents and brokers

Because brokers represent their clients, they have a duty to provide impartial advice and act in the buyers' best interest. Agents, on the other hand, are motivated to sell the products that the insurers they represent offer.

Is it smart to hire a broker?

Deciding between hiring a stock broker or learning to invest on your own depends on your time, expertise, goals, and preferences: Hiring a Stock Broker: Suitable if you lack time or expertise, want professional advice, and value convenience. Brokers offer diversification, research tools, and personalized guidance.

How long do I need to live in the house on a conventional loan?

In general, you'll need to move into the property within 60 days of closing. Additionally, you'll need to live in the property for at least 12 months to qualify as an owner occupant with most lenders. In contrast, you could obtain financing as an absentee owner.

Can I Airbnb my house if I have a mortgage?

Listing a property on Airbnb that has a residential mortgage is possible. However, landlords must be aware of the terms and conditions of their residential mortgage agreement before embarking on the project. Most residential mortgage agreements won't specifically rule out the use of the property as an Airbnb.

How much do you have to put down on a conventional loan?

Home buyers can make a conventional down payment anywhere between 3% and 20% (or more) depending on the lender, the loan program, and the price and location of the home. Keep in mind that when you put down less than 20% on a conventional loan, you are required to pay private mortgage insurance (PMI).

What is the 90 day rule on conventional loans?

Lenders check with the local municipality to confirm that the property's last recorded deed is not within 90 days of the new purchase contract date. If within the 90-day window, lenders will deny the loan and force buyers to wait until 91 days to sign a new contract.

How long is the waiting period for conventional loan?

Conventional loans aren't backed by the federal government and typically require a minimum 620 credit score and a 3% down payment to qualify. The conventional loan foreclosure waiting period is typically seven years, though it may be shortened to two to three years in extenuating circumstances.