Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

How do you calculate cost basis for selling a rental property?

How Do I Calculate Cost Basis for Real Estate?

- Start with the original investment in the property.

- Add the cost of major improvements.

- Subtract the amount of allowable depreciation and casualty and theft losses.

How do you calculate the sales price of an investment property?

Looking at the sales prices of comparable properties and dividing that value by the generated gross annual income produces the average multiplier for the region. This type of valuation approach is similar to using comparable transactions or multiples to value a stock.

How do you calculate tax on selling price?

What is the sales tax formula?

- Sales tax rate = Sales tax percent / 100.

- Sales tax = List price x Sales tax rate.

What is the capital gains tax on $200 000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

How do I avoid paying taxes on profit from selling a house?

Sale of your principal residence. We conform to the IRS rules and allow you to exclude, up to a certain amount, the gain you make on the sale of your home. You may take an exclusion if you owned and used the home for at least 2 out of 5 years. In addition, you may only have one home at a time.

The 25K is for concession taxed contributions. You can put in larger amounts not concession taxed at your marginal rate. Recently provision was made for rolling in proceeds of home sale. But the big $$ is probably fortuituous (very !) investment returns on original contributions

— Andrew Murray Ph.D (oncewasarnold.bsky.social) (@Once_Was_Arnold) February 25, 2023

How do you calculate capital gains tax on the sale of a home?

Capital gain calculation in four steps

- Determine your basis.

- Determine your realized amount.

- Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference.

- Review the descriptions in the section below to know which tax rate may apply to your capital gains.

Frequently Asked Questions

What should I do with large lump sum of money after sale of house?

Depending on your financial circumstances, it might make sense to pay down debt, invest for growth, or supplement your retirement. You might also consider purchasing products to protect yourself and your loved ones, including annuities, life insurance, or long-term care coverage.

Do I pay taxes to the IRS when I sell my house?

If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. Your gain is usually the difference between what you paid for your home and the sale amount. Use Selling Your Home (IRS Publication 523) to: Determine if you have a gain or loss on the sale of your home.

How much capital gains tax on $200,000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

How long to own a house before selling to avoid capital gains?

The 121 home sale exclusion comes with specific restrictions: Eligibility: To be eligible for the exclusion, you must have owned and used the property as your primary residence for at least 2 of the 5 years preceding the sale.

How do I claim capital gains exclusion?

To claim the exclusion, you must meet the ownership and use tests. This means that during the 5-year period ending on the date of the sale, you must have: Owned the home for at least two years (the ownership test) Lived in the home as your main home for at least two years (the use test)

How do I claim Section 121 exclusion?

The Ownership and Use Test for Section 121 Exclusions

This requires that the taxpayer has owned the home and used it as a primary residence for at least 24 months out of the previous 60 months. The 60-month period ends on the date the home is sold. The 24 months do not have to be consecutive.

What is the code section for exclusion of gain on sale of primary residence?

Section 121(a) generally provides, with certain limitations and exceptions, that gross income does not include gain from the sale or exchange of property if, during the 5-year period ending on the date of the sale or exchange, the taxpayer has owned and Page 8 8 used the property as the taxpayer's principal residence

FAQ

- What is the 250 000 exclusion on the sale of a main home?

- Here's the most important thing you need to know: To qualify for the $250,000/$500,000 home sale exclusion, you must own and occupy the home as your principal residence for at least two years before you sell it. Your home can be a house, apartment, condominium, stock-cooperative, or mobile home fixed to land.

- What is the exclusion of gain on the sale of a home?

- If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.

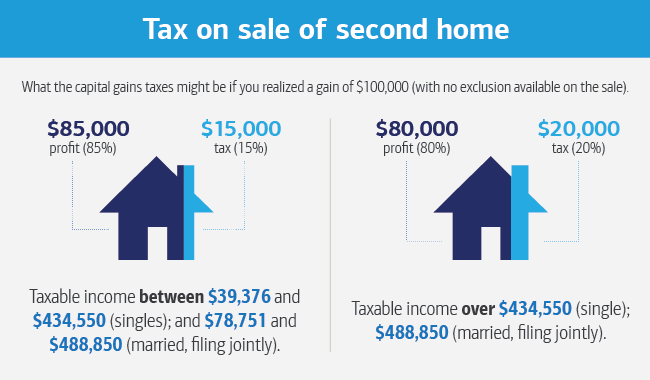

- How much does the IRS take when you sell a house?

- Long-term capital gains tax rates typically apply if you owned the asset for more than a year. The rates are much less onerous; many people qualify for a 0% tax rate. Everybody else pays either 15% or 20%. It depends on your filing status and income.

- Do I need to report the sale of my home to the IRS?

- Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

- Does selling a house hurt your tax return?

- You are required to include any gains that result from the sale of your home in your taxable income. But if the gain is from your primary home, you may exclude up to $250,000 from your income if you're a single filer or up to $500,000 if you're a married filing jointly provided you meet certain requirements.

- How much does IRS take from selling a house?

- Long-term capital gains tax rates typically apply if you owned the asset for more than a year. The rates are much less onerous; many people qualify for a 0% tax rate. Everybody else pays either 15% or 20%. It depends on your filing status and income.

- What is the long-term capital gains tax rate for 2023?

- Long-term capital gains tax rates for the 2023 tax year For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

How are proceeds from the sale of a home taxed

| How is capital gains calculated on sale of real estate? | Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain. If you sold your assets for less than you paid, you have a capital loss. |

| How do I avoid long-term capital gains tax on real estate? | Fortunately, the IRS gives homeowners and real estate investors ways to save big. You can avoid capital gains tax by buying another house and using the 121 home sale exclusion. In addition, the 1031 like-kind exchange allows investors to defer taxes. |

| What are long-term capital gains rates for estates? | For trusts, there are three long-term capital gains brackets:

|

| What is the long-term capital gains tax rate for 2024? | Capital gains tax For individuals with taxable income of more than $1 million, the budget proposes that capital gains be taxed at ordinary rates, with 37% (or 40.8% with the NIIT) generally being the highest rate — or 39.6% (or 43.4% with the NIIT) if the top tax rate is raised. |

| How do you calculate long term capital gains on a house? | It is calculated by subtracting the asset's original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price. Special rates apply for long-term capital gains on assets owned for over a year. |

| How do I avoid long term capital gains tax on real estate? | A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes. |

| When must taxable income from the sale of real estate be reported to the IRS? | You may be able to exclude from income all or a portion of the gain on your home sale. If you can exclude all of the gain, you don't need to report the sale on your tax return, unless you received a Form 1099-S, Proceeds From Real Estate Transactions. |

- Is the sale of a house considered taxable income?

- Capital gains taxes can apply to the profit made from the sale of homes and residential real estate. The Section 121 exclusion, however, allows many homeowners to exclude up to $500,000 of the gain from their taxable income. Homeowners must meet certain ownership and home use criteria to qualify for the exemption.

- Does the IRS know I sold my house?

- That's simply how the law works in California and across the United States. With the help of real estate settlement agents, the IRS has thorough reporting on the sale of your home, including all associated financial transactions.

- How can I avoid paying taxes on my home equity?

- Home equity can be taxed when you sell your property. If you're selling your primary residence, you may be able to exclude up to $500,000 of the gain when you sell your house. Home equity loans, home equity lines of credit (HELOCs), and refinancing all allow you to access your equity without needing to pay taxes.

- Is home equity considered capital gains?

- The short answer to your question is that the home equity line of credit is unrelated to the potential capital gain or loss on the sale of your home. To calculate the gain or loss on the sale of your property, you take the gross sales price less your selling expenses to calculate the total amount realized.

- How long do I have to buy another house to avoid capital gains?

- Within 180 days How Long Do I Have to Buy Another House to Avoid Capital Gains? You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

- Is home equity taxable when sold?

- It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.